- Israel

- /

- Food and Staples Retail

- /

- TASE:YHNF

M.Yochananof and Sons (1988) Ltd's (TLV:YHNF) Popularity With Investors Is Under Threat From Overpricing

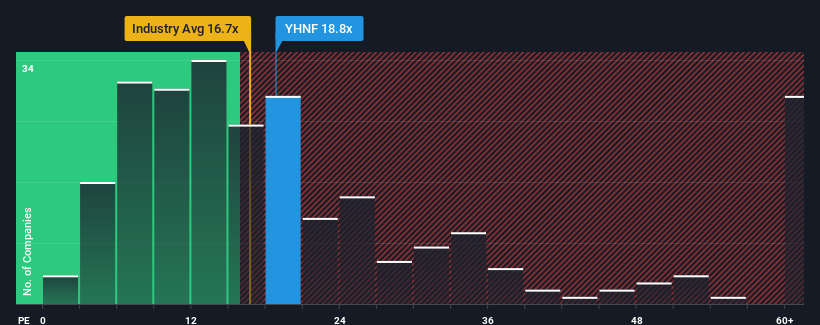

When close to half the companies in Israel have price-to-earnings ratios (or "P/E's") below 11x, you may consider M.Yochananof and Sons (1988) Ltd (TLV:YHNF) as a stock to avoid entirely with its 18.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at M.Yochananof and Sons (1988) over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for M.Yochananof and Sons (1988)

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, M.Yochananof and Sons (1988) would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 10%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 22% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 22% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that M.Yochananof and Sons (1988)'s P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that M.Yochananof and Sons (1988) currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for M.Yochananof and Sons (1988) with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than M.Yochananof and Sons (1988). So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:YHNF

M.Yochananof and Sons (1988)

Engages in the marketing and retail trade in the food and related products in Israel.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.