- Israel

- /

- Food and Staples Retail

- /

- TASE:YHNF

Is M.Yochananof and Sons (1988) (TLV:YHNF) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, M.Yochananof and Sons (1988) Ltd (TLV:YHNF) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for M.Yochananof and Sons (1988)

What Is M.Yochananof and Sons (1988)'s Net Debt?

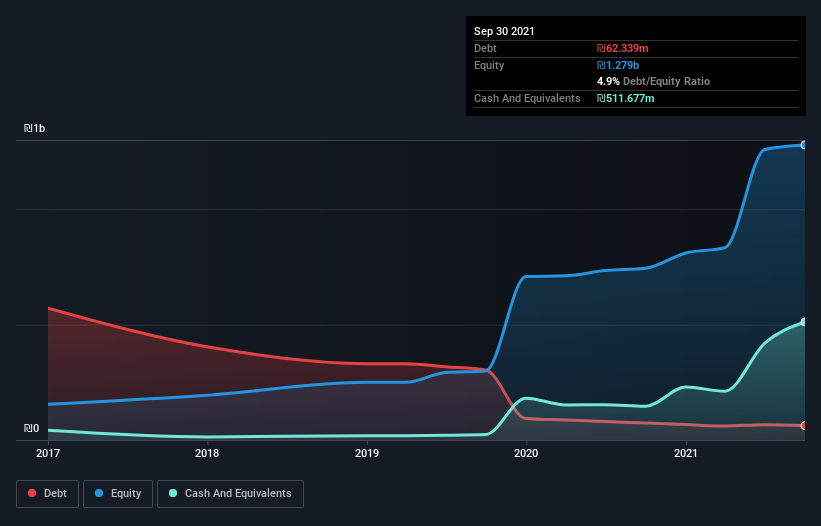

You can click the graphic below for the historical numbers, but it shows that M.Yochananof and Sons (1988) had ₪62.3m of debt in September 2021, down from ₪73.5m, one year before. But it also has ₪511.7m in cash to offset that, meaning it has ₪449.3m net cash.

How Strong Is M.Yochananof and Sons (1988)'s Balance Sheet?

The latest balance sheet data shows that M.Yochananof and Sons (1988) had liabilities of ₪747.6m due within a year, and liabilities of ₪1.29b falling due after that. Offsetting this, it had ₪511.7m in cash and ₪324.4m in receivables that were due within 12 months. So its liabilities total ₪1.20b more than the combination of its cash and short-term receivables.

M.Yochananof and Sons (1988) has a market capitalization of ₪3.49b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, M.Yochananof and Sons (1988) boasts net cash, so it's fair to say it does not have a heavy debt load!

It is well worth noting that M.Yochananof and Sons (1988)'s EBIT shot up like bamboo after rain, gaining 52% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since M.Yochananof and Sons (1988) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. M.Yochananof and Sons (1988) may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, M.Yochananof and Sons (1988) recorded free cash flow worth 50% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

Although M.Yochananof and Sons (1988)'s balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of ₪449.3m. And it impressed us with its EBIT growth of 52% over the last year. So we don't have any problem with M.Yochananof and Sons (1988)'s use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - M.Yochananof and Sons (1988) has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:YHNF

M.Yochananof and Sons (1988)

Engages in the marketing and retail trade in the food and related products in Israel.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.