- Israel

- /

- Food and Staples Retail

- /

- TASE:RMLI

Shareholders May Be More Conservative With Rami Levi Chain Stores Hashikma Marketing 2006 Ltd's (TLV:RMLI) CEO Compensation For Now

Key Insights

- Rami Levi Chain Stores Hashikma Marketing 2006's Annual General Meeting to take place on 4th of December

- CEO Rami Levy's total compensation includes salary of ₪1.14m

- The overall pay is 482% above the industry average

- Rami Levi Chain Stores Hashikma Marketing 2006's EPS grew by 0.2% over the past three years while total shareholder return over the past three years was 17%

CEO Rami Levy has done a decent job of delivering relatively good performance at Rami Levi Chain Stores Hashikma Marketing 2006 Ltd (TLV:RMLI) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 4th of December. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Rami Levi Chain Stores Hashikma Marketing 2006

How Does Total Compensation For Rami Levy Compare With Other Companies In The Industry?

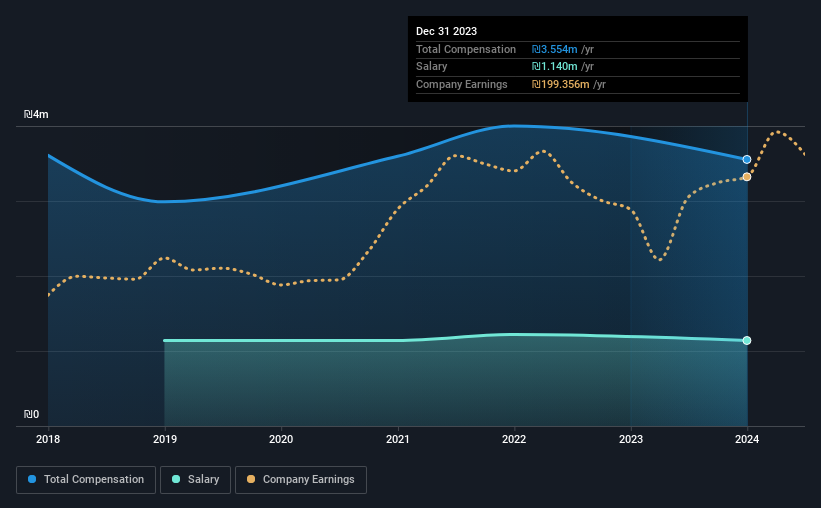

At the time of writing, our data shows that Rami Levi Chain Stores Hashikma Marketing 2006 Ltd has a market capitalization of ₪3.2b, and reported total annual CEO compensation of ₪3.6m for the year to December 2023. That's a notable decrease of 11% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₪1.1m.

For comparison, other companies in the Israel Consumer Retailing industry with market capitalizations ranging between ₪1.5b and ₪5.9b had a median total CEO compensation of ₪611k. Accordingly, our analysis reveals that Rami Levi Chain Stores Hashikma Marketing 2006 Ltd pays Rami Levy north of the industry median. Furthermore, Rami Levy directly owns ₪1.3b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2021 | Proportion (2023) |

| Salary | ₪1.1m | ₪1.2m | 32% |

| Other | ₪2.4m | ₪2.8m | 68% |

| Total Compensation | ₪3.6m | ₪4.0m | 100% |

Talking in terms of the industry, salary represented approximately 60% of total compensation out of all the companies we analyzed, while other remuneration made up 40% of the pie. Rami Levi Chain Stores Hashikma Marketing 2006 sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Rami Levi Chain Stores Hashikma Marketing 2006 Ltd's Growth

Rami Levi Chain Stores Hashikma Marketing 2006 Ltd saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is up 3.0%.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Rami Levi Chain Stores Hashikma Marketing 2006 Ltd Been A Good Investment?

Rami Levi Chain Stores Hashikma Marketing 2006 Ltd has generated a total shareholder return of 17% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Rami Levi Chain Stores Hashikma Marketing 2006 that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:RMLI

Rami Levi Chain Stores Hashikma Marketing 2006

Operates a chain of discount format retail stores in Israel.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026