Loss-making Sonovia (TLV:SONO) has seen earnings and shareholder returns follow the same downward trajectory over past -24%

While not a mind-blowing move, it is good to see that the Sonovia Ltd. (TLV:SONO) share price has gained 21% in the last three months. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 24% in a year, falling short of the returns you could get by investing in an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Sonovia

Given that Sonovia didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Sonovia increased its revenue by 682%. That's well above most other pre-profit companies. The share price drop of 24% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

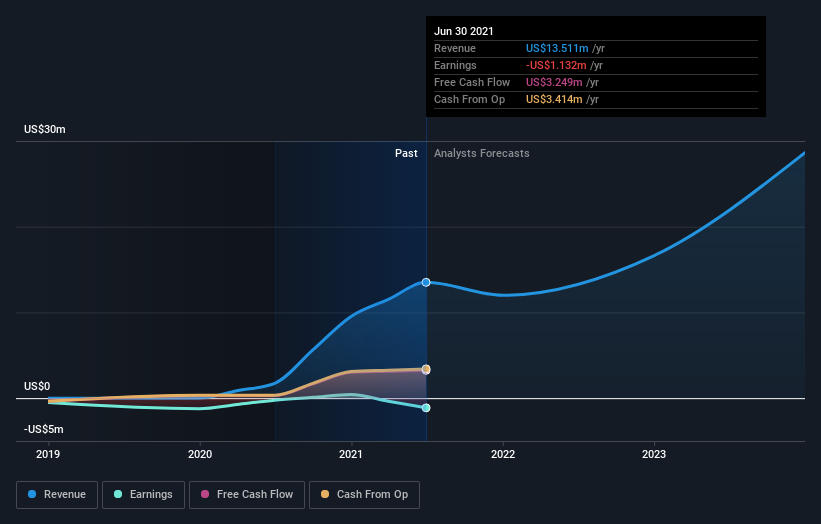

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Sonovia stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 42% in the last year, Sonovia shareholders might be miffed that they lost 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 21%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Sonovia better, we need to consider many other factors. Take risks, for example - Sonovia has 1 warning sign we think you should be aware of.

Of course Sonovia may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SONO

Sonovia

Engages in the development and production of anti-bacterial textile products in Israel.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives