- Israel

- /

- Consumer Durables

- /

- TASE:DNYA

Exploring Undiscovered Gems in the Middle East April 2025

Reviewed by Simply Wall St

As the Middle East's financial landscape navigates mixed outcomes from Gulf bourses amid ongoing trade war concerns, investors are keenly observing how regional indices respond to global economic tensions. In this climate, identifying promising stocks requires a focus on companies with resilient business models and strategic growth opportunities that can withstand external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Malam - Team | 91.23% | 12.11% | -6.38% | ★★★★★☆ |

| Y.D. More Investments | 72.96% | 29.63% | 29.48% | ★★★★★☆ |

| C. Mer Industries | 114.92% | 13.32% | 73.44% | ★★★★☆☆ |

| Polyram Plastic Industries | 41.71% | 10.42% | 9.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Riyadh Cement (SASE:3092)

Simply Wall St Value Rating: ★★★★★★

Overview: Riyadh Cement Company engages in the production and sale of cement across several Middle Eastern countries, including Saudi Arabia, Bahrain, Jordan, Kuwait, Qatar, and Oman, with a market capitalization of SAR4.21 billion.

Operations: Riyadh Cement generates revenue primarily from its cement manufacturing segment, which amounted to SAR789.40 million. The company operates in multiple Middle Eastern markets, contributing to its diverse revenue streams.

Riyadh Cement, a smaller player in the Middle East cement sector, has demonstrated impressive financial performance. The company reported sales of SAR 789.4 million for 2024, up from SAR 643.38 million the previous year, with net income jumping to SAR 310.44 million from SAR 188.77 million. Its earnings per share rose to SAR 2.59 from SAR 1.57, reflecting robust growth and profitability without any debt burden since its debt-to-equity ratio was once at 2.4%. With a price-to-earnings ratio of just 13.6x compared to the SA market's average of 22.4x, Riyadh Cement appears attractively valued relative to its peers and industry standards.

- Take a closer look at Riyadh Cement's potential here in our health report.

Gain insights into Riyadh Cement's past trends and performance with our Past report.

National Agricultural Development (SASE:6010)

Simply Wall St Value Rating: ★★★★★★

Overview: The National Agricultural Development Company operates in the production of agricultural and livestock products both domestically in Saudi Arabia and internationally, with a market capitalization of SAR6.96 billion.

Operations: The company's revenue primarily comes from its Dairy and Food segment, generating SAR3.02 billion, followed by Agriculture at SAR136.32 million and Protein Bars at SAR180.29 million. The net profit margin is a key financial metric to consider when evaluating the company's profitability trends over time.

The National Agricultural Development Company (NADEC) is making waves with its impressive financial performance and strategic moves. In 2024, NADEC's net income surged to SAR 774.63 million from SAR 302.07 million the previous year, marking a remarkable earnings growth of 156.4%, outpacing the industry average of 14.8%. This growth was partly influenced by a significant one-off gain of SAR296.9 million. Additionally, NADEC's debt-to-equity ratio has dramatically improved over five years from 113.6% to just 4.8%, showcasing effective debt management strategies while maintaining an attractive P/E ratio of 9x compared to the SA market average of 22x.

Danya Cebus (TASE:DNYA)

Simply Wall St Value Rating: ★★★★★★

Overview: Danya Cebus Ltd. is a construction and infrastructure company operating in Israel and internationally, with a market capitalization of ₪3.39 billion.

Operations: Danya Cebus generates revenue primarily from Non-Residential Construction Work (₪2.29 billion) and Residential Development and Construction (₪2.34 billion), with additional contributions from Infrastructure (₪1.34 billion).

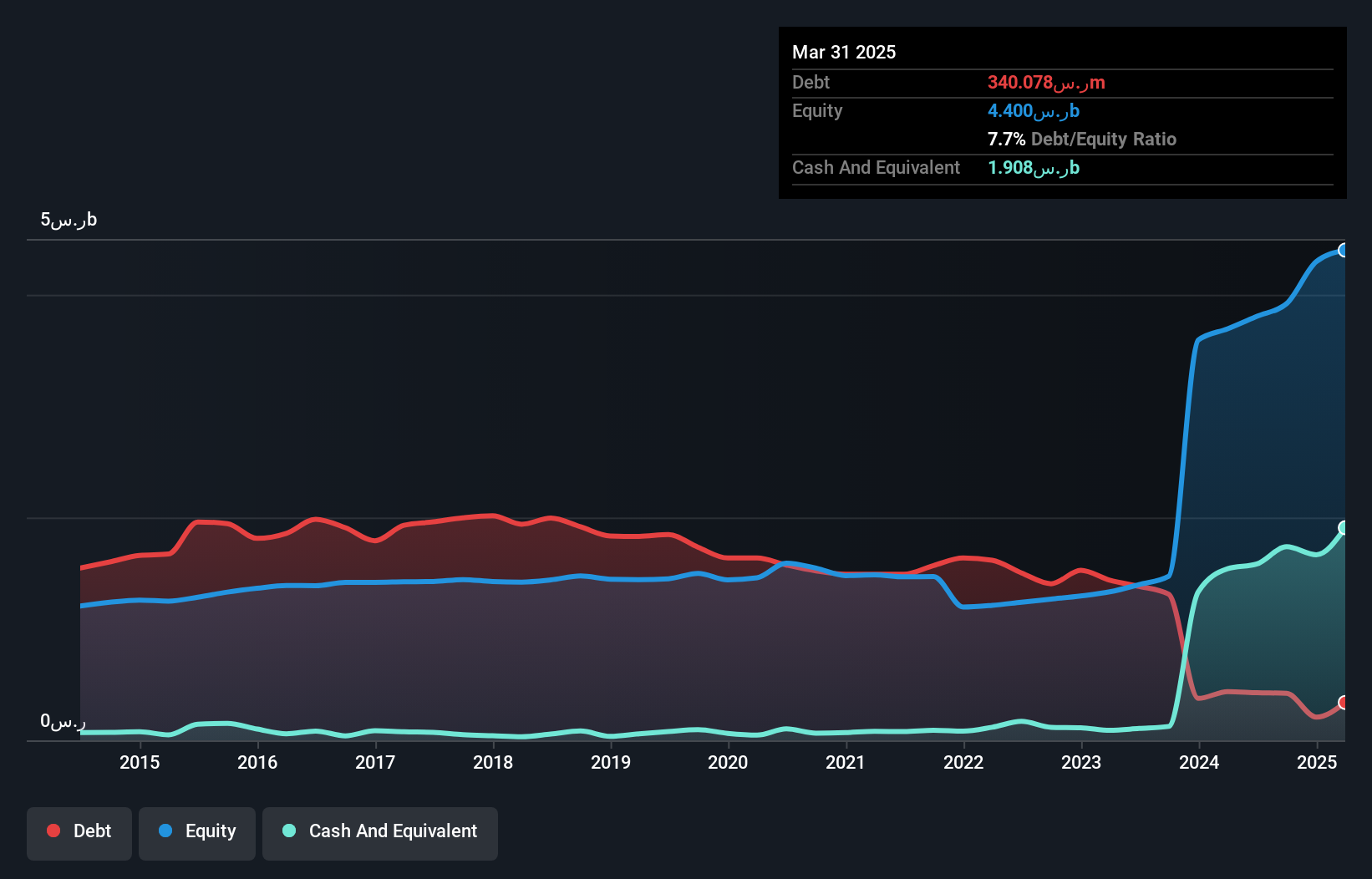

Danya Cebus, a notable player in the Middle East construction sector, showcases a robust financial stance with cash exceeding its total debt and a significantly reduced debt-to-equity ratio from 213.3% to 1.3% over five years. Despite facing an earnings growth setback of -11.4% last year against the industry’s 6.9%, it maintains high-quality earnings and offers good value with a P/E ratio of 19.5x, slightly below the industry average of 19.7x. Recent results show sales rising to ILS 6 billion from ILS 5.4 billion, though net income dipped to ILS 173 million from ILS 196 million previously.

Make It Happen

- Click this link to deep-dive into the 243 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DNYA

Danya Cebus

Operates as a construction and infrastructure company in Israel and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives