Brill Shoe Industries Ltd. (TLV:BRIL) Shares Fly 26% But Investors Aren't Buying For Growth

The Brill Shoe Industries Ltd. (TLV:BRIL) share price has done very well over the last month, posting an excellent gain of 26%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

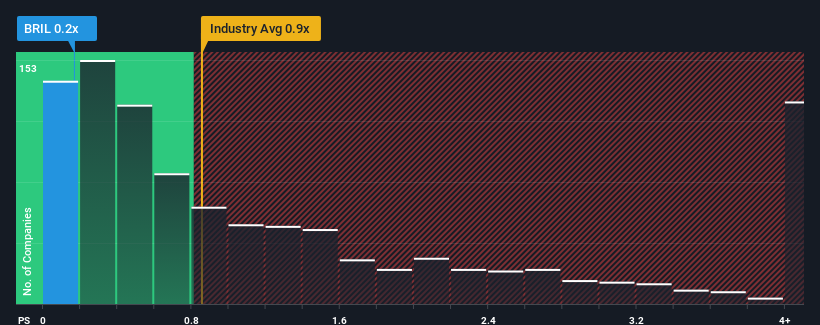

In spite of the firm bounce in price, Brill Shoe Industries' price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Luxury industry in Israel, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Brill Shoe Industries

How Brill Shoe Industries Has Been Performing

As an illustration, revenue has deteriorated at Brill Shoe Industries over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Brill Shoe Industries will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Brill Shoe Industries' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.9%. Regardless, revenue has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 12% shows it's noticeably less attractive.

In light of this, it's understandable that Brill Shoe Industries' P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Brill Shoe Industries' P/S?

Despite Brill Shoe Industries' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Brill Shoe Industries revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Brill Shoe Industries that you should be aware of.

If these risks are making you reconsider your opinion on Brill Shoe Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Brill Shoe Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BRIL

Brill Shoe Industries

Designs, manufactures, imports, procures, markets, and sells footwear and clothing products, and fashion accessories in Israel.

Good value with adequate balance sheet.

Market Insights

Community Narratives