- Israel

- /

- Commercial Services

- /

- TASE:ARAN

Aran Research & Development (1982) Ltd.'s (TLV:ARAN) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

Most readers would already be aware that Aran Research & Development (1982)'s (TLV:ARAN) stock increased significantly by 19% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. In this article, we decided to focus on Aran Research & Development (1982)'s ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Aran Research & Development (1982)

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Aran Research & Development (1982) is:

5.1% = ₪3.0m ÷ ₪59m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every ₪1 worth of equity, the company was able to earn ₪0.05 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Aran Research & Development (1982)'s Earnings Growth And 5.1% ROE

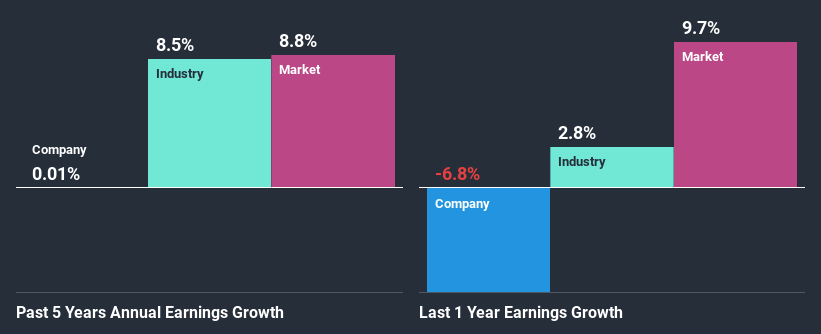

On the face of it, Aran Research & Development (1982)'s ROE is not much to talk about. Next, when compared to the average industry ROE of 8.2%, the company's ROE leaves us feeling even less enthusiastic. As a result, Aran Research & Development (1982)'s flat net income growth over the past five years doesn't come as a surprise given its lower ROE.

As a next step, we compared Aran Research & Development (1982)'s net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 2.5% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Aran Research & Development (1982)'s's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Aran Research & Development (1982) Efficiently Re-investing Its Profits?

While the company did pay out a portion of its dividend in the past, it currently doesn't pay a dividend. We infer that the company has been reinvesting all of its profits to grow its business.

Conclusion

On the whole, we feel that the performance shown by Aran Research & Development (1982) can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Aran Research & Development (1982) and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you decide to trade Aran Research & Development (1982), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ARAN

Aran Research & Development (1982)

Engages in the product design and development, and equipment manufacturing businesses for plastics industry in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026