Middle Eastern Market Highlights: Hub Girisim Sermayesi Yatirim Ortakligi Among 3 Prominent Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown a mixed performance, with most Gulf markets gaining due to easing trade tensions, while the Saudi index faced declines amid weak earnings and falling oil prices. Despite the fluctuating market conditions, penny stocks remain an intriguing investment area for those seeking affordable entry points into potentially high-growth companies. Although often associated with smaller or newer firms, these stocks can still offer significant value and growth potential when backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.99 | SAR1.59B | ✅ 2 ⚠️ 1 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.987 | ₪123.66M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.54 | ₪172.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.912 | ₪2.81B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.13 | ₪158.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.714 | AED434.9M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.50 | AED425.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.31 | AED9.78B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates as a venture capital investment company with a market capitalization of TRY476 million.

Operations: Hub Girisim Sermayesi Yatirim Ortakligi A.S. does not have any reported revenue segments.

Market Cap: TRY476M

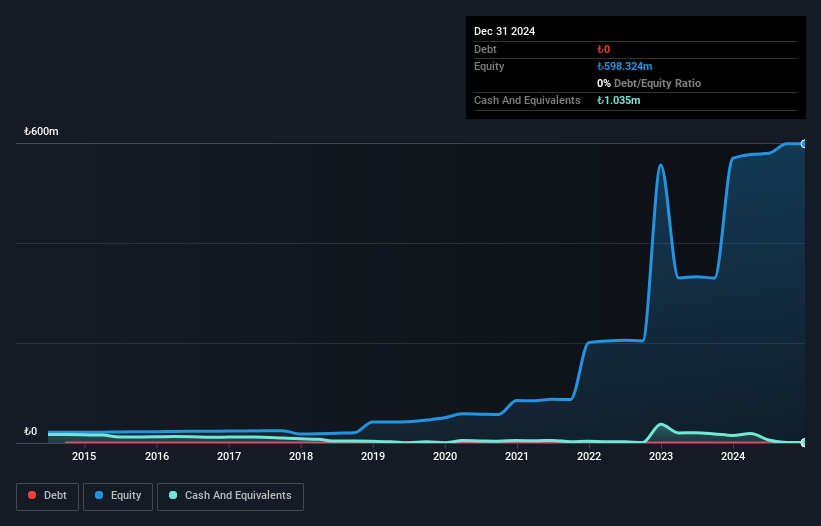

Hub Girisim Sermayesi Yatirim Ortakligi A.S., with a market cap of TRY476 million, is currently pre-revenue and unprofitable, reporting a net loss of TRY222.19 million for 2024. Despite this, the company has no debt and maintains sufficient short-term assets (TRY17.5M) to cover both its short-term (TRY8.8M) and long-term liabilities (TRY266.6K). The firm benefits from a cash runway exceeding three years due to positive free cash flow growth. While earnings have declined over the past five years by 23.6% annually, shareholders have not faced significant dilution recently, indicating financial stability in certain aspects despite ongoing challenges.

- Navigate through the intricacies of Hub Girisim Sermayesi Yatirim Ortakligi with our comprehensive balance sheet health report here.

- Examine Hub Girisim Sermayesi Yatirim Ortakligi's past performance report to understand how it has performed in prior years.

Big Tech 50 R&D-Limited Partnership (TASE:BIGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Tech 50 R&D-Limited Partnership focuses on investing in technology companies in Israel and has a market cap of ₪17.42 million.

Operations: The company's revenue segments include Blank Checks with a revenue of -$5.22 million.

Market Cap: ₪17.42M

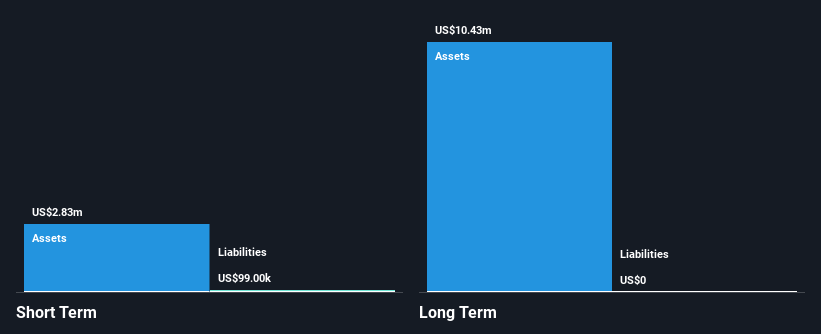

Big Tech 50 R&D-Limited Partnership, with a market cap of ₪17.42 million, is pre-revenue and reported a net loss of US$5.67 million for 2024. The company has no long-term liabilities or debt and maintains sufficient short-term assets (US$2.8M) to cover its short-term liabilities (US$99K). Despite an increase in losses over the past five years at a rate of 50.4% annually, the firm benefits from a cash runway exceeding three years due to stable free cash flow, offering some financial resilience amid high share price volatility and increased weekly volatility from 8% to 14%.

- Click here to discover the nuances of Big Tech 50 R&D-Limited Partnership with our detailed analytical financial health report.

- Assess Big Tech 50 R&D-Limited Partnership's previous results with our detailed historical performance reports.

SavorEat (TASE:SVRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SavorEat Ltd. specializes in cellulose-based meat substitutes that aim to replicate the eating experience of real meat, with a market cap of ₪8.84 million.

Operations: SavorEat Ltd. has not reported any specific revenue segments at this time.

Market Cap: ₪8.84M

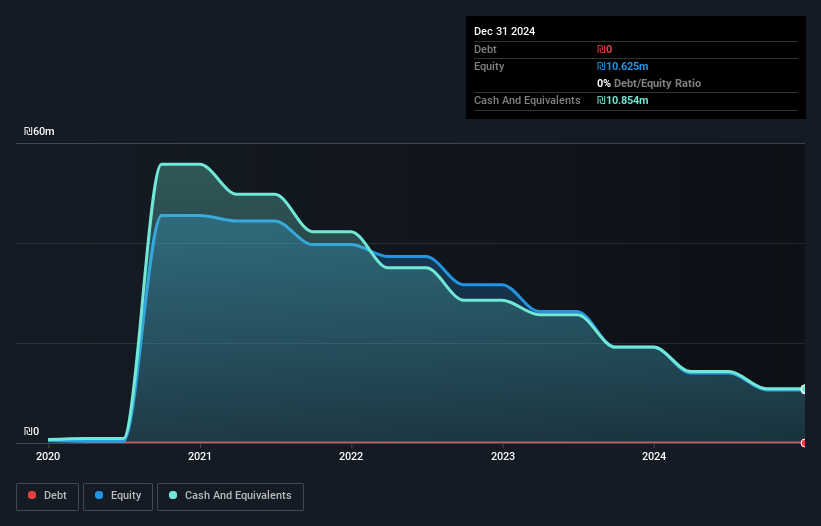

SavorEat Ltd., with a market cap of ₪8.84 million, remains pre-revenue and unprofitable, with a net loss of ₪10.7 million in 2024. Despite having no long-term liabilities and sufficient short-term assets (₪11.3M) to cover its short-term liabilities (₪1.2M), the company faces significant challenges, including high share price volatility and increased weekly volatility from 18% to 30%. While it has a cash runway exceeding one year, its auditor expressed doubts about its ability to continue as a going concern due to ongoing losses and declining earnings over the past five years at an annual rate of 15.2%.

- Click to explore a detailed breakdown of our findings in SavorEat's financial health report.

- Learn about SavorEat's historical performance here.

Key Takeaways

- Navigate through the entire inventory of 96 Middle Eastern Penny Stocks here.

- Curious About Other Options? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SVRT

SavorEat

A cellulose-based meat substitute, provides identical eating experience to that of meat.

Flawless balance sheet slight.

Market Insights

Community Narratives