- Israel

- /

- Construction

- /

- TASE:SKBN

Shikun & Binui (TASE:SKBN) Net Income Drops 39% Despite Revenue Growth, Challenging Profit Turnaround Hopes

Reviewed by Simply Wall St

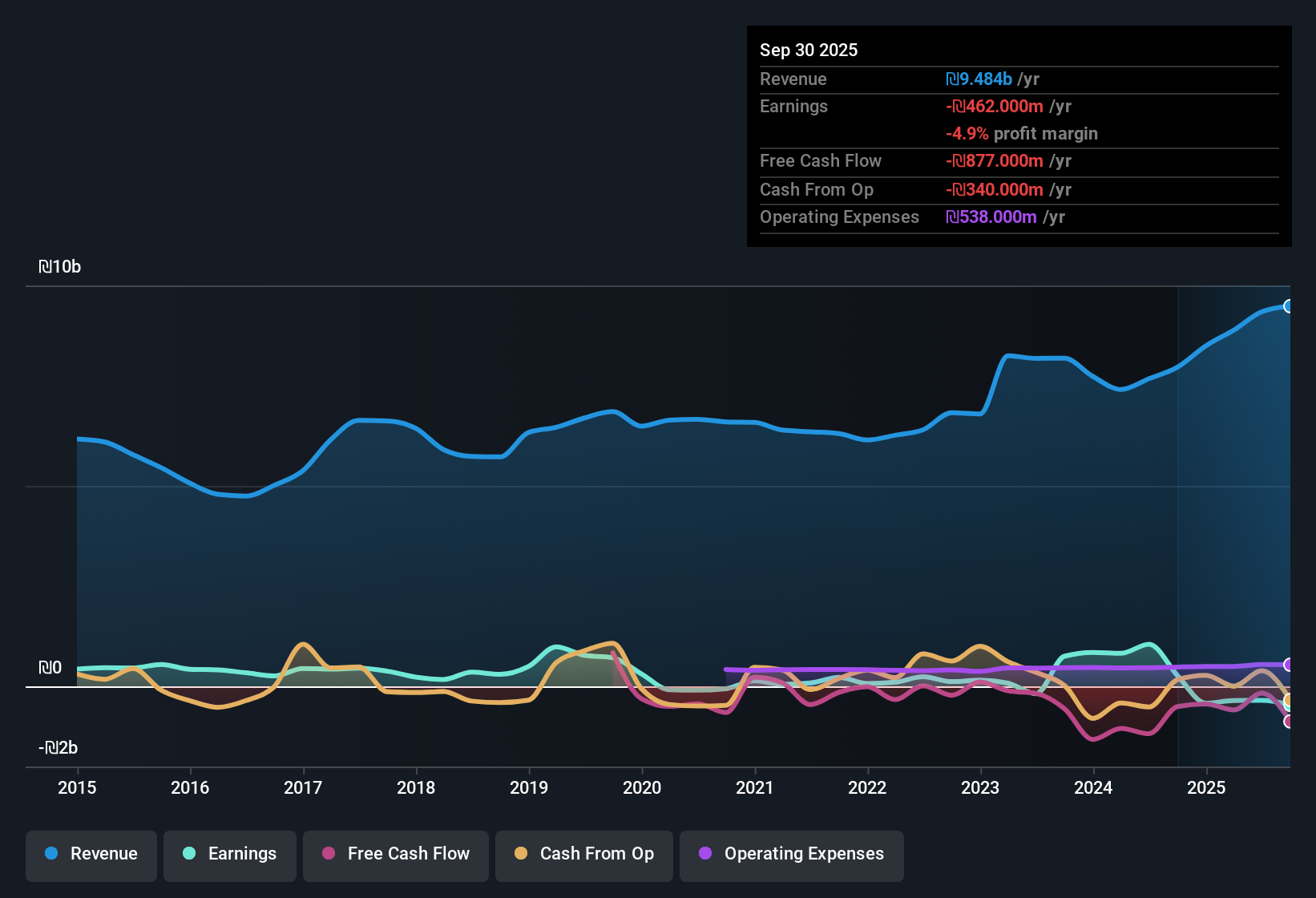

Shikun & Binui (TASE:SKBN) has just reported its Q2 2025 results, posting revenue of ₪2.4 billion and basic EPS of ₪0.16. Looking back, the company saw revenue range from ₪1.8 billion to ₪2.5 billion per quarter over the past six periods, while EPS fluctuated between -₪1.26 and ₪0.26. Despite these headline figures, margins remain under pressure and profitability continues to be elusive for investors keeping an eye on earnings season developments.

See our full analysis for Shikun & Binui.Next up, we will compare these latest numbers with current market narratives to see which expectations hold up and which may need to be reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Income Swings Despite Slightly Higher Revenue

- Net income from ongoing operations came in at 75 million ILS for Q2 2025, but this is a drop from 123 million ILS last quarter, despite revenue rising from 2.21 billion ILS to 2.40 billion ILS.

- The latest analysis notes that Shikun & Binui's ability to narrow its net loss over the trailing twelve months, now at -352 million ILS compared to -422 million ILS in the same period last year, heavily supports the market view that gradual operational improvement is possible even without a clear profit trend.

- Consensus narrative emphasizes how these turbulent swings in quarterly net income challenge any bullish expectation for quick profitability.

- The modest pace of loss reduction, just 3.7% annually over the past five years, underscores continued caution among investors looking for a turnaround.

Price-To-Sales Premium Raises Questions

- Shikun & Binui trades at a Price-To-Sales Ratio of 1.1x, higher than the Israeli construction industry average of 0.9x and roughly in line with peer companies.

- Market observers highlight that this premium valuation stands in contrast to ongoing unprofitability and slow progress in shrinking operating losses over the past year.

- Peer-average pricing may signal that investors are giving the company the benefit of the doubt, but a clear path to sustained profit is still missing in the figures.

- Without any evidence of rising margins or positive EPS over the trailing twelve months, the higher Price-To-Sales Ratio looks difficult to justify unless major operational improvements are achieved soon.

Debt Coverage Remains a Top Risk

- The company's debt is not well covered by operating cash flow, according to the latest risk data, meaning that leverage adds notable vulnerability for equity holders.

- This situation reinforces cautious sentiment, as the combination of weak cash flow coverage, continued net losses, and above-average price volatility raises red flags for those focused on financial resilience.

- Analysts repeatedly point out that, over the last twelve months, Shikun & Binui’s losses and financing pressures increase the importance of tracking balance sheet risks alongside any operational gains.

- The share price, which has been more volatile than the broader Israeli market, signals that investors remain wary about near-term stability unless the company can better manage its debt load.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shikun & Binui's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shikun & Binui’s persistent net losses, weak debt coverage, and volatile share price highlight ongoing concerns about financial resilience and stability.

If you’re searching for companies with stronger financial footing and less risk from high debt, check out our solid balance sheet and fundamentals stocks screener (1938 results) to find stocks built for greater balance sheet strength and lasting performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SKBN

Shikun & Binui

Operates as an infrastructure and real estate company in Israel and internationally.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.