- Israel

- /

- Aerospace & Defense

- /

- TASE:RSEL

Does RSL Electronics (TLV:RSEL) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in RSL Electronics (TLV:RSEL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

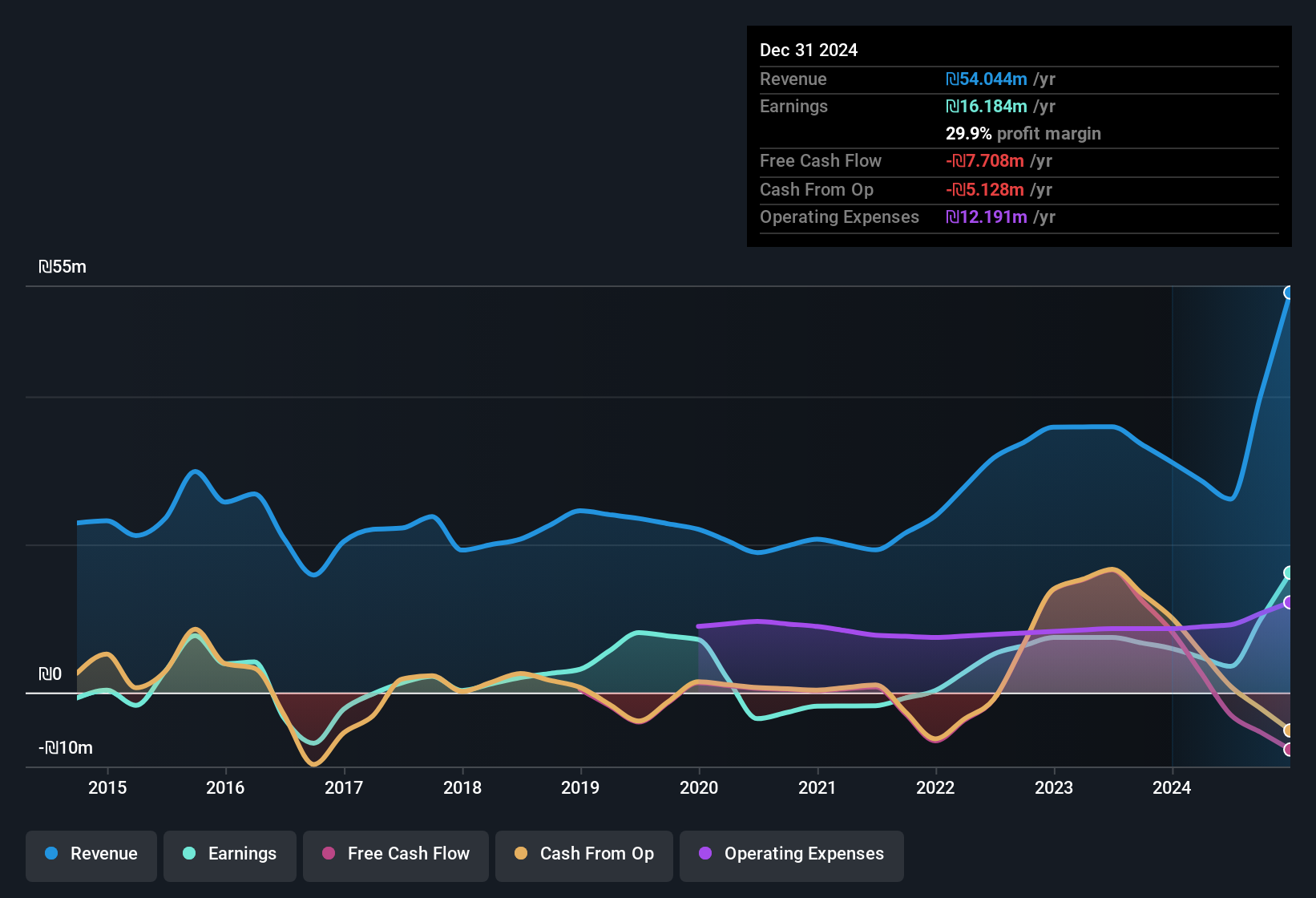

RSL Electronics' Improving Profits

In the last three years RSL Electronics' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, RSL Electronics' EPS grew from ₪0.59 to ₪1.60, over the previous 12 months. It's not often a company can achieve year-on-year growth of 172%. The best case scenario? That the business has hit a true inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that RSL Electronics is growing revenues, and EBIT margins improved by 10.4 percentage points to 31%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for RSL Electronics

RSL Electronics isn't a huge company, given its market capitalisation of ₪147m. That makes it extra important to check on its balance sheet strength.

Are RSL Electronics Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that RSL Electronics insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 55%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. In terms of absolute value, insiders have ₪81m invested in the business, at the current share price. So there's plenty there to keep them focused!

Is RSL Electronics Worth Keeping An Eye On?

RSL Electronics' earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching RSL Electronics very closely. What about risks? Every company has them, and we've spotted 4 warning signs for RSL Electronics (of which 3 are a bit concerning!) you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IL with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:RSEL

RSL Electronics

Develops, manufactures, and sells control systems, utilities, health monitoring, and diagnostics and prognostics systems for aerospace, railroad, energy, and defense sectors in Israel and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives