Shareholders May Be Wary Of Increasing RoboGroup T.E.K. Ltd.'s (TLV:ROBO) CEO Compensation Package

Key Insights

- RoboGroup T.E.K will host its Annual General Meeting on 25th of September

- Salary of US$292.0k is part of CEO Yoram Deutsch's total remuneration

- Total compensation is similar to the industry average

- RoboGroup T.E.K's three-year loss to shareholders was 61% while its EPS was down 14% over the past three years

RoboGroup T.E.K. Ltd. (TLV:ROBO) has not performed well recently and CEO Yoram Deutsch will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 25th of September. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for RoboGroup T.E.K

Comparing RoboGroup T.E.K. Ltd.'s CEO Compensation With The Industry

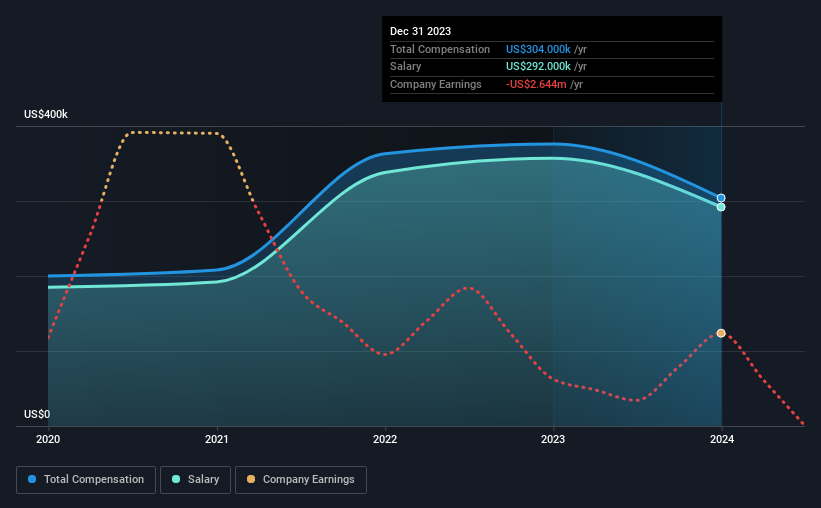

According to our data, RoboGroup T.E.K. Ltd. has a market capitalization of ₪51m, and paid its CEO total annual compensation worth US$304k over the year to December 2023. Notably, that's a decrease of 19% over the year before. Notably, the salary which is US$292.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the Israel Machinery industry with market capitalizations below ₪757m, we found that the median total CEO compensation was US$285k. This suggests that RoboGroup T.E.K remunerates its CEO largely in line with the industry average.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$292k | US$357k | 96% |

| Other | US$12k | US$19k | 4% |

| Total Compensation | US$304k | US$376k | 100% |

On an industry level, roughly 80% of total compensation represents salary and 20% is other remuneration. Investors will find it interesting that RoboGroup T.E.K pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at RoboGroup T.E.K. Ltd.'s Growth Numbers

Over the last three years, RoboGroup T.E.K. Ltd. has shrunk its earnings per share by 14% per year. Its revenue is down 20% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has RoboGroup T.E.K. Ltd. Been A Good Investment?

With a total shareholder return of -61% over three years, RoboGroup T.E.K. Ltd. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Yoram receives almost all of their compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 5 warning signs for RoboGroup T.E.K you should be aware of, and 3 of them are a bit concerning.

Important note: RoboGroup T.E.K is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ROBO

RoboGroup T.E.K

Engages in the robotics, motion control, and technology education business in Israel.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion