- Israel

- /

- Oil and Gas

- /

- TASE:TMRP

Middle East's Undiscovered Gems Featuring 3 Promising Stocks

Reviewed by Simply Wall St

The Middle East's stock markets have recently experienced fluctuations, with most Gulf markets easing due to falling oil prices and investor caution surrounding global trade developments. Despite these challenges, certain sectors in the region continue to show resilience, supported by strong economic fundamentals and growth in the non-oil private sector. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate robust financial health and potential for growth amidst broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 17.77% | -1.63% | -0.93% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Tukas Gida Sanayi ve Ticaret (IBSE:TUKAS)

Simply Wall St Value Rating: ★★★★★★

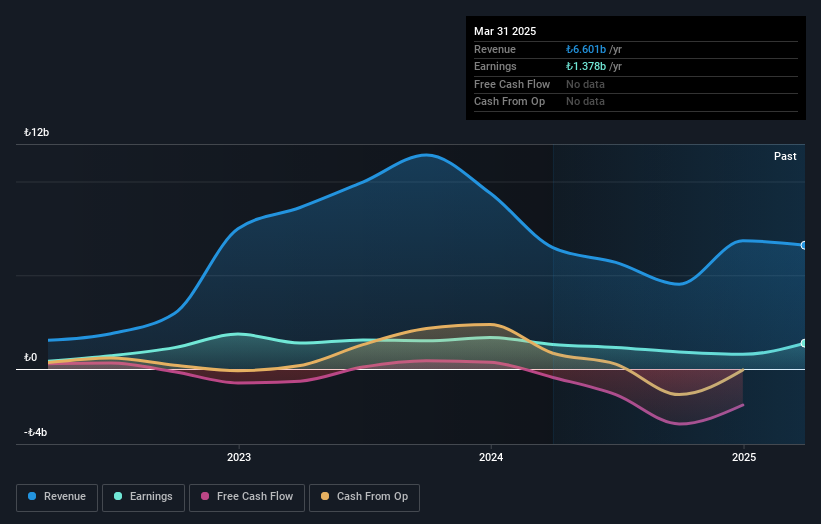

Overview: Tukas Gida Sanayi ve Ticaret A.S., along with its subsidiaries, is involved in the production and distribution of food products both within Turkey and internationally, with a market capitalization of TRY12.15 billion.

Operations: Tukas generates revenue primarily through the manufacture and sale of food products. The company's financial performance is highlighted by its market capitalization of TRY12.15 billion, reflecting its significant presence in both domestic and international markets.

Tukas Gida Sanayi ve Ticaret, a nimble player in the food industry, showcases an attractive price-to-earnings ratio of 8.8x, well below the broader Turkish market's 17.6x. Despite sales dipping to TRY 2 billion from TRY 2.24 billion year-on-year in Q1 2025, net income surged to TRY 488 million from a previous loss of TRY 109 million. The company boasts high-quality earnings and zero debt compared to five years ago when its debt-to-equity was at a hefty 113.6%. However, free cash flow remains negative despite exceeding industry growth with a recent earnings increase of 5.1%.

Orbit Technologies (TASE:ORBI)

Simply Wall St Value Rating: ★★★★★★

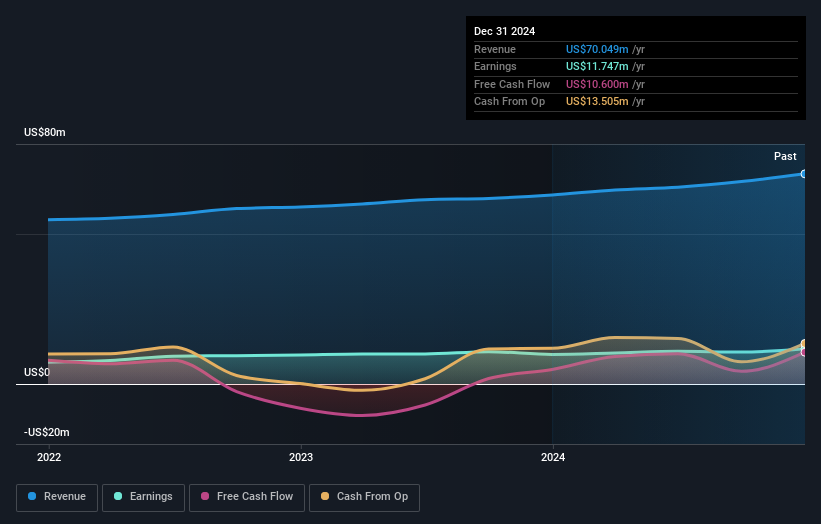

Overview: Orbit Technologies Ltd is engaged in the development, manufacturing, and sale of communication products globally with a market capitalization of ₪949.93 million.

Operations: Orbit Technologies generates revenue primarily from the development, marketing, and creation of advanced communication systems, totaling $70.05 million.

Orbit Technologies, a nimble player in the Aerospace & Defense sector, showcases robust financial health with high-quality earnings and zero debt. Over the past five years, its earnings have grown at a solid 26.7% annually. Despite not outpacing industry growth last year, Orbit's P/E ratio of 22.4x remains attractive compared to the industry average of 32.7x. Recent innovations like the OrBeam MIL ESA antenna and MPT30Ka SATCOM system highlight Orbit's commitment to cutting-edge technology and adaptability in dynamic environments, enhancing its market position as it continues to deliver reliable satellite communication solutions across various platforms globally.

- Click here and access our complete health analysis report to understand the dynamics of Orbit Technologies.

Explore historical data to track Orbit Technologies' performance over time in our Past section.

Tamar Petroleum (TASE:TMRP)

Simply Wall St Value Rating: ★★★★☆☆

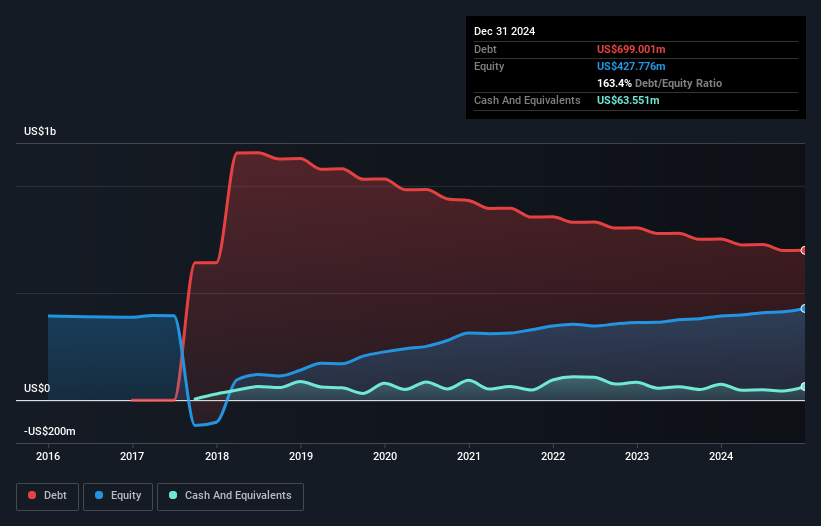

Overview: Tamar Petroleum Ltd is involved in the exploration, development, production, marketing, and transmission of natural gas and condensate in Israel with a market capitalization of ₪3.12 billion.

Operations: Tamar Petroleum generates revenue primarily from its oil and gas exploration and production segment, amounting to $263.38 million. The company's financial performance is influenced by various factors, including market conditions and operational costs.

Tamar Petroleum stands out with a notable earnings growth of 18.3% over the past year, surpassing the Oil and Gas industry average of 9.6%. Despite this positive trend, the company carries a high net debt to equity ratio at 148.5%, though it has significantly reduced from 458.5% five years ago. Trading at a substantial discount of 43.2% below its estimated fair value, Tamar's interest payments are well covered by EBIT at 3.4 times coverage, indicating solid financial management despite its high debt level and consistent free cash flow generation in recent years.

- Get an in-depth perspective on Tamar Petroleum's performance by reading our health report here.

Examine Tamar Petroleum's past performance report to understand how it has performed in the past.

Next Steps

- Dive into all 249 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tamar Petroleum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TMRP

Tamar Petroleum

Engages in the exploration, development, production, marketing, and transmission of natural gas and condensate in Israel.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives