ADNH Catering Leads 3 Undiscovered Gems with Strong Financial Foundations

Reviewed by Simply Wall St

As Gulf markets navigate mixed outcomes amid hopes for Federal Reserve easing and the impact of soft oil prices, investor sentiment remains cautious yet hopeful for a broader recovery. In this environment, stocks with strong financial foundations and resilience become particularly attractive, as they are well-positioned to withstand market fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Mackolik Internet Hizmetleri Ticaret | 14.04% | 29.58% | 34.64% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

We'll examine a selection from our screener results.

ADNH Catering (ADX:ADNHC)

Simply Wall St Value Rating: ★★★★★★

Overview: ADNH Catering PLC provides catering and support services in the United Arab Emirates, with a market capitalization of AED1.81 billion.

Operations: ADNH Catering generates revenue primarily through its catering and support services in the UAE. The company's market capitalization is AED1.81 billion.

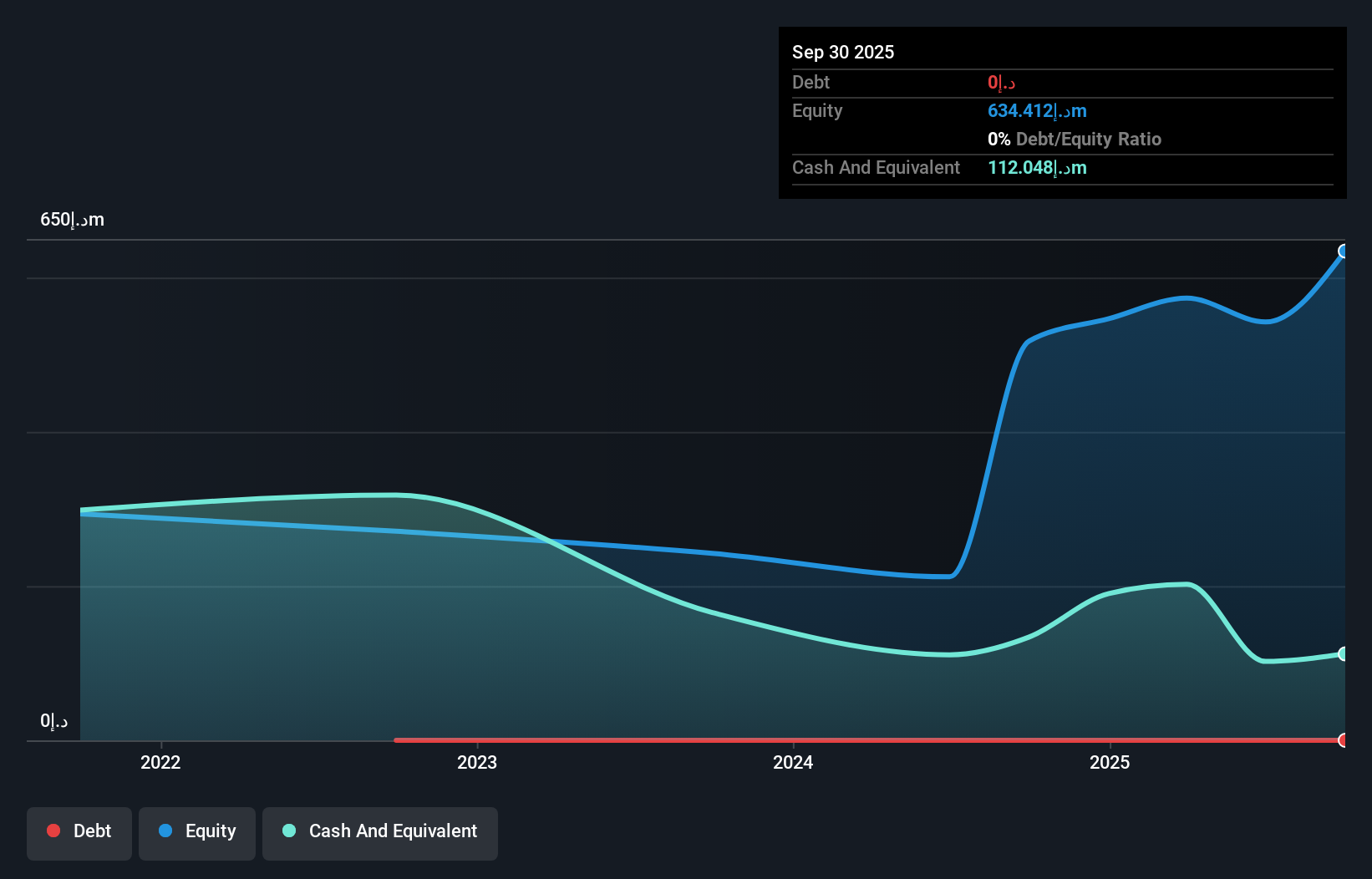

ADNH Catering, a compact player in the Middle East hospitality sector, showcases resilience with its debt-free status and high-quality earnings. Over the past year, earnings surged by 16.7%, outpacing the industry average of 3.5%. Despite a historical annual decline of 17.3% over five years, revenue is projected to climb by nearly 12% annually moving forward. The company maintains a favorable price-to-earnings ratio at 11.1x compared to the AE market's 11.7x, suggesting good value potential. Recent guidance indicates an anticipated revenue growth between 8% and 10%, while dividends are set at AED180 million for full-year distribution in two installments.

- Delve into the full analysis health report here for a deeper understanding of ADNH Catering.

Assess ADNH Catering's past performance with our detailed historical performance reports.

Europen Endustri Insaat Sanayi ve Ticaret (IBSE:EUREN)

Simply Wall St Value Rating: ★★★★★★

Overview: Europen Endustri Insaat Sanayi ve Ticaret A.S. is a company engaged in the manufacturing of construction materials, with a market capitalization of TRY13.42 billion.

Operations: Europen Endustri generates revenue primarily from Door and Window (Including Double Glass) at TRY2.41 billion, followed by Glass at TRY1.83 billion and Profile (PVC) at TRY473.69 million. The company has a notable net profit margin trend, which reflects its efficiency in converting sales into actual profit after expenses are deducted.

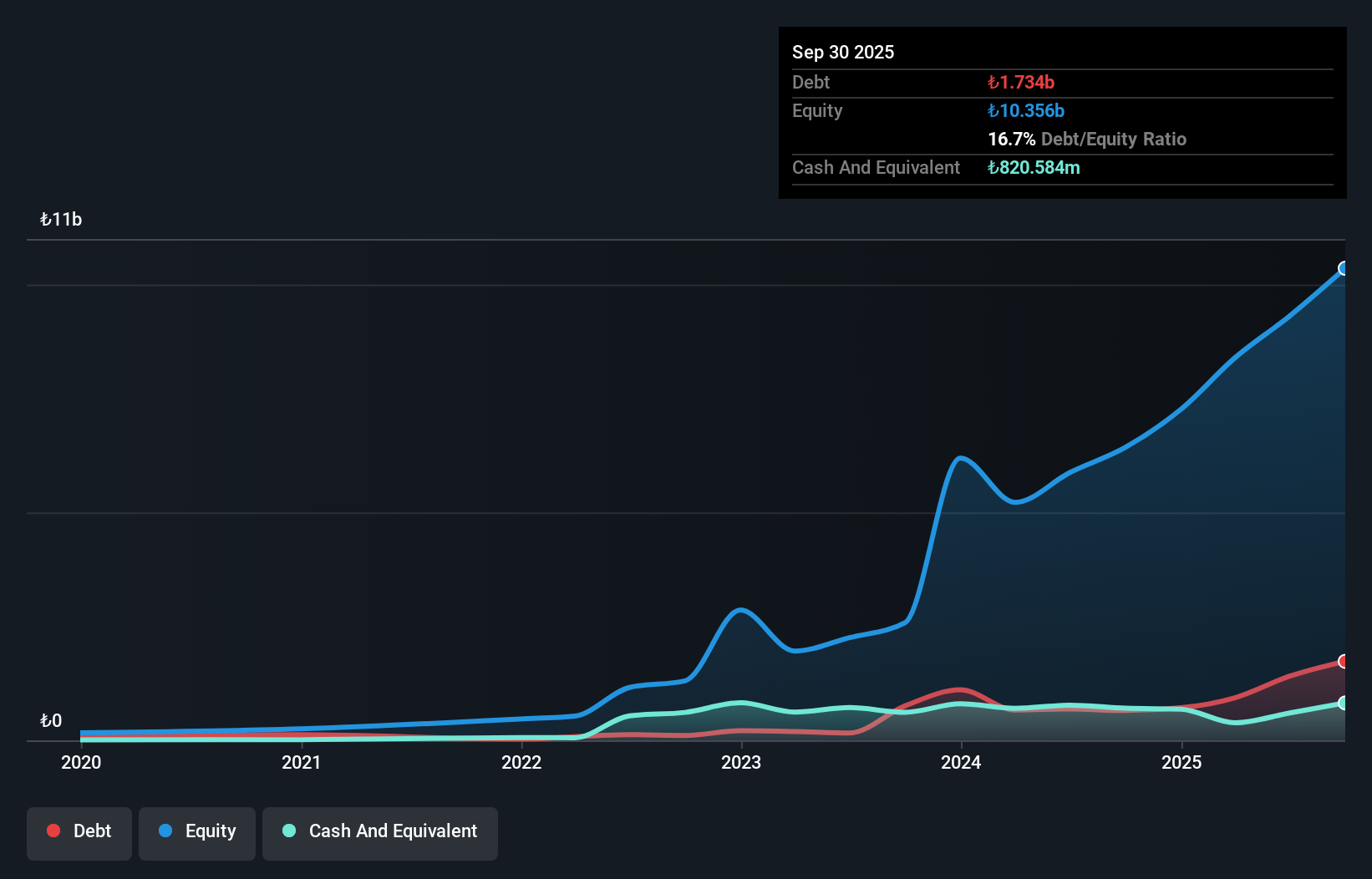

Europen Endustri Insaat Sanayi ve Ticaret has shown impressive growth, with earnings surging 57% over the past year, outpacing the building industry significantly. The company's net debt to equity ratio stands at a satisfactory 8.8%, reflecting solid financial health. Despite recent volatility in its share price, Europen is trading at 7.7% below its estimated fair value, suggesting potential undervaluation. Recent results indicate robust performance with third-quarter sales reaching TRY 1,951 million and net income jumping to TRY 345 million from TRY 39 million last year. Earnings per share also saw a notable increase to TRY 0.1644 from TRY 0.0185 a year ago.

Orbit Technologies (TASE:ORBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Orbit Technologies Ltd is a global developer, manufacturer, and seller of communication products with a market cap of ₪1.05 billion.

Operations: Orbit Technologies generates revenue primarily through the sale of communication products. The company's financial performance is highlighted by a gross profit margin of 35%, indicating its efficiency in managing production and operational costs relative to sales.

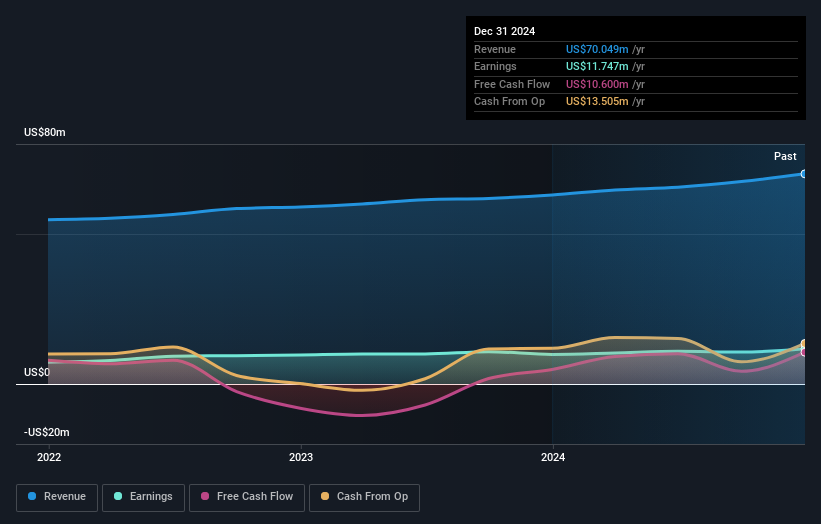

Orbit Technologies, with a price-to-earnings ratio of 24.8x, offers intriguing value compared to the Aerospace & Defense industry average of 32.7x. The company has shown consistent earnings growth at 19.5% annually over the past five years, although its recent earnings growth of 21.7% lagged behind the industry's impressive 57%. Notably debt-free for five years, Orbit's financial health is underscored by a positive free cash flow of US$10.6 million in late 2024 and robust non-cash earnings performance. Recent developments include an acquisition agreement by Kratos Defense valued at approximately $360 million and its addition to the S&P Global BMI Index.

- Dive into the specifics of Orbit Technologies here with our thorough health report.

Evaluate Orbit Technologies' historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 182 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Europen Endustri Insaat Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EUREN

Europen Endustri Insaat Sanayi ve Ticaret

Europen Endustri Insaat Sanayi ve Ticaret A.S.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.