The Middle Eastern stock markets have shown mixed performances recently, with Dubai's index logging gains for two consecutive sessions and Abu Dhabi rebounding after a brief decline. Amidst this backdrop, penny stocks—often associated with smaller or newer companies—continue to capture the interest of investors seeking growth opportunities at lower price points. While the term 'penny stocks' may seem outdated, these investments can still offer significant potential when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.70 | TRY1.83B | ✅ 2 ⚠️ 2 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.94 | SAR1.58B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.557 | ₪179.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Terminal X Online (TASE:TRX) | ₪4.314 | ₪547.9M | ✅ 2 ⚠️ 0 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.311 | ₪171.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.725 | AED440.98M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.13 | AED361.51M | ✅ 2 ⚠️ 5 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.18 | AED2.34B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.41 | AED10.29B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 94 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance (Salama) PJSC, along with its subsidiaries, offers various general, family, health, and auto takaful solutions across Africa and Asia with a market cap of AED356.18 million.

Operations: The company's revenue is derived from Family Takaful at AED228.53 million and General Takaful at AED802.73 million.

Market Cap: AED356.18M

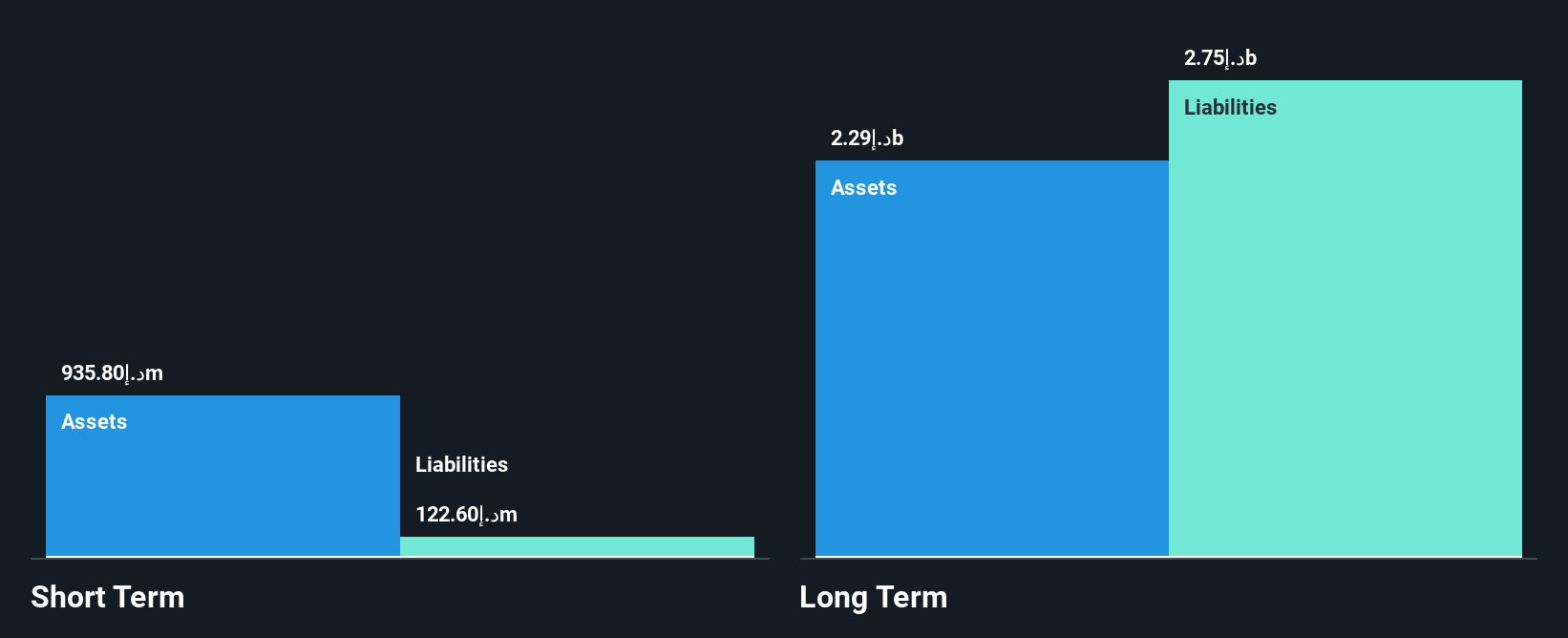

Islamic Arab Insurance (Salama) PJSC, with a market cap of AED356.18 million, has transitioned to profitability over the past year despite facing challenges such as a recent net loss of AED0.974 million for Q1 2025. The company benefits from strong short-term asset coverage but struggles with long-term liabilities exceeding its assets by AED1.42 billion. Salama's debt-free status is advantageous, though its Return on Equity remains low at 2.2%. Recent leadership changes and board inexperience may impact strategic direction, yet the company's stable weekly volatility suggests some resilience in navigating market fluctuations.

- Click to explore a detailed breakdown of our findings in Islamic Arab Insurance (Salama) PJSC's financial health report.

- Evaluate Islamic Arab Insurance (Salama) PJSC's historical performance by accessing our past performance report.

Elbit Medical Technologies (TASE:EMTC-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elbit Medical Technologies Ltd is an investment holding company focused on the research, development, production, and marketing of therapeutic medical systems globally, with a market cap of ₪17.24 million.

Operations: Elbit Medical Technologies Ltd has not reported any specific revenue segments.

Market Cap: ₪17.24M

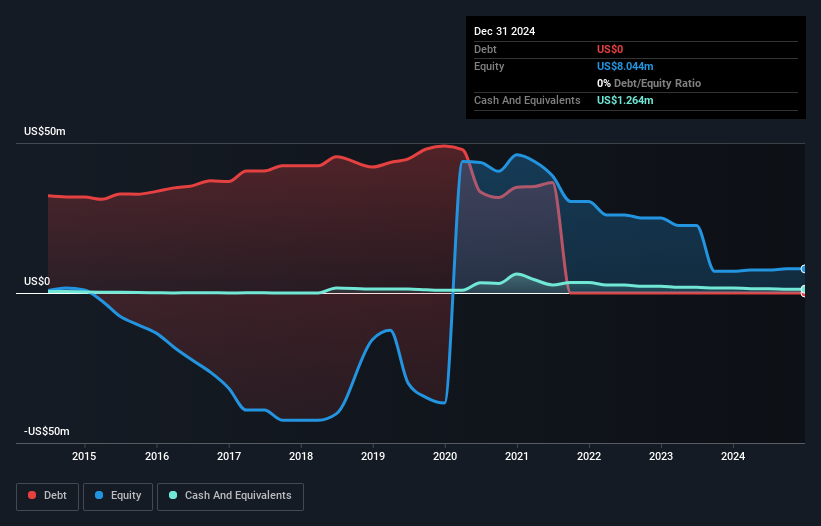

Elbit Medical Technologies Ltd, with a market cap of ₪17.24 million, has recently become profitable, reporting a net income of US$0.827 million for 2024 compared to a significant loss the previous year. Despite being pre-revenue with less than US$1 million in revenue historically, the company reported an increase to US$1.33 million last year. Its debt-free status and strong short-term asset coverage are positive indicators, but its low Return on Equity at 10.3% and high non-cash earnings suggest caution. The stock's high volatility may present risks for investors seeking stability in penny stocks within the region.

- Get an in-depth perspective on Elbit Medical Technologies' performance by reading our balance sheet health report here.

- Explore historical data to track Elbit Medical Technologies' performance over time in our past results report.

Massivit 3D Printing Technologies (TASE:MSVT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Massivit 3D Printing Technologies Ltd is a company that provides industrial 3D printing systems both in Italy and internationally, with a market cap of ₪23.42 million.

Operations: The company's revenue is generated from selling printers and related consumables, amounting to $4.89 million.

Market Cap: ₪23.42M

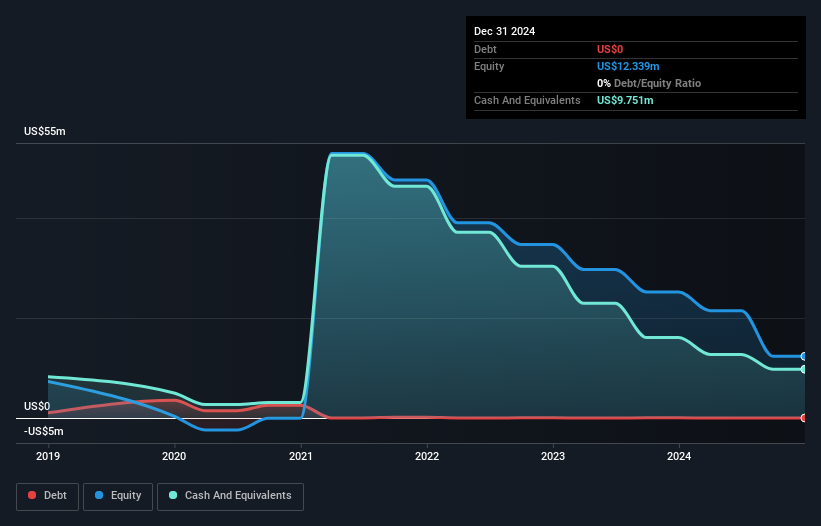

Massivit 3D Printing Technologies Ltd, with a market cap of ₪23.42 million, faces challenges as it reported declining sales of US$4.89 million for 2024 compared to US$12.62 million the previous year and a net loss of US$16.16 million. Despite reducing its debt-to-equity ratio significantly over five years, the company remains unprofitable with negative Return on Equity at -130.98%. Its short-term assets exceed liabilities, providing some financial cushion; however, less than a year of cash runway and high share price volatility could pose risks for investors in penny stocks seeking stability in the Middle East market.

- Dive into the specifics of Massivit 3D Printing Technologies here with our thorough balance sheet health report.

- Examine Massivit 3D Printing Technologies' past performance report to understand how it has performed in prior years.

Where To Now?

- Take a closer look at our Middle Eastern Penny Stocks list of 94 companies by clicking here.

- Contemplating Other Strategies? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MSVT

Massivit 3D Printing Technologies

Operates as a provider of industrial 3D printing systems in Italy and internationally.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives