- Israel

- /

- Construction

- /

- TASE:LUZN

Union Insurance Company P.J.S.C Leads 3 Promising Middle Eastern Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced mixed outcomes, influenced by declining oil prices and weaker-than-expected U.S. economic data. For investors seeking opportunities in smaller or newer companies, penny stocks can still offer surprising value despite the term's somewhat outdated feel. In this article, we explore three promising Middle Eastern penny stocks that demonstrate financial strength and potential for long-term growth.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.99 | SAR1.61B | ✅ 2 ⚠️ 1 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.987 | ₪121.56M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.54 | ₪177.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.912 | ₪2.84B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.13 | ₪158.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.715 | AED434.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.50 | AED425.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.16B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.30 | AED9.86B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Union Insurance Company P.J.S.C (ADX:UNION)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Union Insurance Company P.J.S.C. underwrites insurance products in the United Arab Emirates, Gulf Cooperation Council, and internationally, with a market cap of AED198.89 million.

Operations: The company's revenue is derived from two primary segments: Life Insurance, contributing AED18.32 million, and General Insurance, accounting for AED248.95 million.

Market Cap: AED198.89M

Union Insurance Company P.J.S.C., with a market cap of AED198.89 million, has recently transitioned to profitability, reporting a net income of AED38.31 million for 2024 compared to a loss the previous year. The company operates without debt, providing financial stability and flexibility in its operations. Despite having high non-cash earnings and an attractive price-to-earnings ratio of 5.2x compared to the broader AE market, its dividend yield of 8.32% is not well covered by free cash flows. Recent amendments to the Articles of Association indicate ongoing corporate governance updates aimed at strengthening operational frameworks.

- Unlock comprehensive insights into our analysis of Union Insurance Company P.J.S.C stock in this financial health report.

- Examine Union Insurance Company P.J.S.C's past performance report to understand how it has performed in prior years.

A1 Capital Yatirim Menkul Degerler (IBSE:A1CAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: A1 Capital Yatirim Menkul Degerler A.S. operates as a brokerage company with a market capitalization of TRY3.21 billion.

Operations: The company generates revenue of TRY40.09 billion from its brokerage services segment.

Market Cap: TRY3.21B

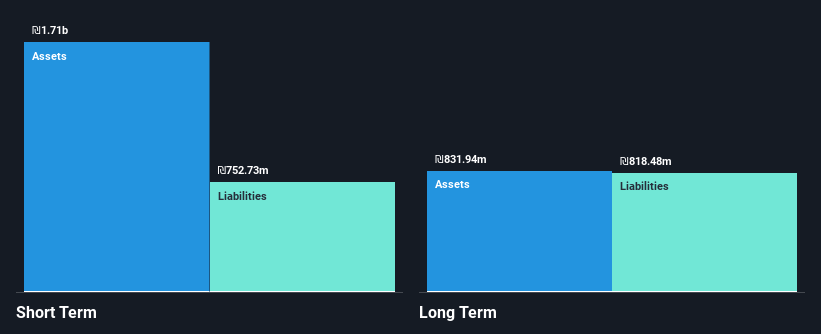

A1 Capital Yatirim Menkul Degerler A.S. has recently turned profitable, reporting a net income of TRY369.89 million for 2024, contrasting with a loss the previous year. The company’s financial health is underscored by its short-term assets exceeding both short and long-term liabilities, and it holds more cash than total debt. Despite having a low return on equity at 9.1%, A1CAP's price-to-earnings ratio of 8.7x suggests it may be undervalued compared to the TR market average. Additionally, its earnings are considered high quality, with no significant shareholder dilution observed over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of A1 Capital Yatirim Menkul Degerler.

- Explore historical data to track A1 Capital Yatirim Menkul Degerler's performance over time in our past results report.

Amos Luzon Development and Energy Group (TASE:LUZN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Amos Luzon Development and Energy Group Ltd, along with its subsidiaries, operates in real estate development and construction both in Israel and internationally, with a market cap of ₪1.10 billion.

Operations: The company generates revenue through its Ronson activity, which contributes ₪358.75 million, and its Rom Group activity, which adds ₪484.27 million.

Market Cap: ₪1.1B

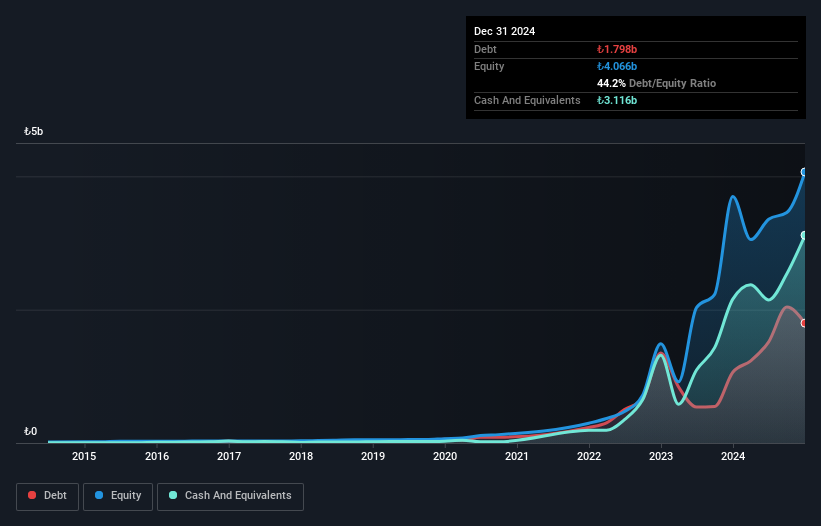

Amos Luzon Development and Energy Group Ltd's financial position reveals a mix of strengths and challenges. The company has reduced its debt to equity ratio significantly over five years, now standing at a satisfactory 101.9%, supported by short-term assets exceeding liabilities. However, its operating cash flow remains negative, impacting debt coverage. Recent earnings have declined sharply, with net income dropping from ₪106.1 million to ₪2.21 million year-over-year, reflecting lower profit margins at 0.3%. Despite stable weekly volatility and an experienced board with an average tenure of 8.7 years, the low return on equity of 1.8% indicates room for improvement in profitability metrics.

- Dive into the specifics of Amos Luzon Development and Energy Group here with our thorough balance sheet health report.

- Understand Amos Luzon Development and Energy Group's track record by examining our performance history report.

Key Takeaways

- Discover the full array of 96 Middle Eastern Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:LUZN

Amos Luzon Development and Energy Group

Engages in the real estate development and construction business in Israel and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives