Golan Plastic Products (TLV:GLPL) Hasn't Managed To Accelerate Its Returns

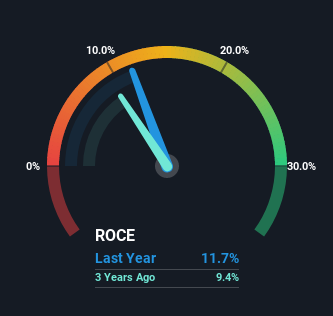

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, the ROCE of Golan Plastic Products (TLV:GLPL) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Golan Plastic Products, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = ₪46m ÷ (₪515m - ₪121m) (Based on the trailing twelve months to March 2023).

So, Golan Plastic Products has an ROCE of 12%. That's a relatively normal return on capital, and it's around the 11% generated by the Building industry.

View our latest analysis for Golan Plastic Products

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Golan Plastic Products has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

SWOT Analysis for Golan Plastic Products

- Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Dividend is low compared to the top 25% of dividend payers in the Building market.

- Current share price is above our estimate of fair value.

- GLPL's financial characteristics indicate limited near-term opportunities for shareholders.

- Lack of analyst coverage makes it difficult to determine GLPL's earnings prospects.

- Dividends are not covered by cash flow.

The Trend Of ROCE

While the current returns on capital are decent, they haven't changed much. The company has consistently earned 12% for the last five years, and the capital employed within the business has risen 71% in that time. 12% is a pretty standard return, and it provides some comfort knowing that Golan Plastic Products has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

The Bottom Line

The main thing to remember is that Golan Plastic Products has proven its ability to continually reinvest at respectable rates of return. And long term investors would be thrilled with the 120% return they've received over the last five years. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

On a separate note, we've found 1 warning sign for Golan Plastic Products you'll probably want to know about.

While Golan Plastic Products isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:GRIN

Golan Renewable Industries

Develops, manufactures, sells, and distributes cross-linked polyethylene pipe systems in Israel, Europe, Latin America, Scandinavia, North and South America, and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026