Does Golan Plastic Products (TLV:GLPL) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Golan Plastic Products Ltd. (TLV:GLPL) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Golan Plastic Products

How Much Debt Does Golan Plastic Products Carry?

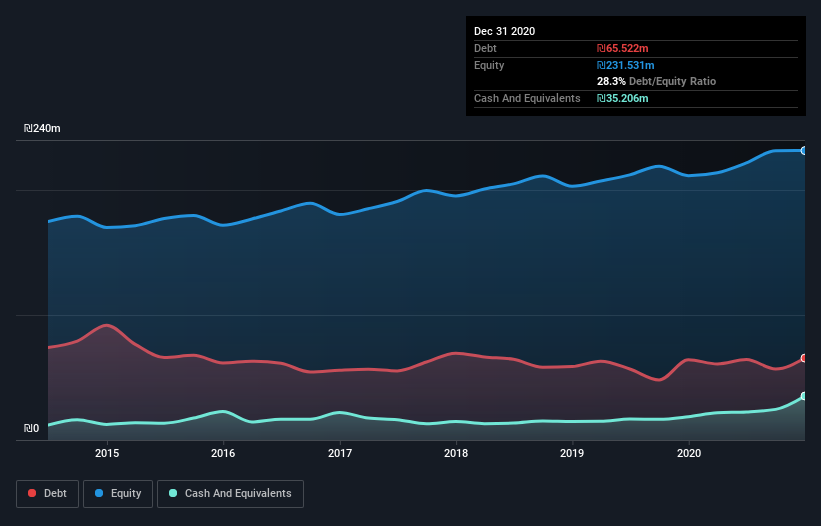

The chart below, which you can click on for greater detail, shows that Golan Plastic Products had ₪65.5m in debt in December 2020; about the same as the year before. However, it does have ₪35.2m in cash offsetting this, leading to net debt of about ₪30.3m.

A Look At Golan Plastic Products' Liabilities

The latest balance sheet data shows that Golan Plastic Products had liabilities of ₪108.8m due within a year, and liabilities of ₪105.9m falling due after that. Offsetting this, it had ₪35.2m in cash and ₪136.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪42.5m.

Given Golan Plastic Products has a market capitalization of ₪315.5m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Golan Plastic Products has a low net debt to EBITDA ratio of only 0.61. And its EBIT covers its interest expense a whopping 11.7 times over. So we're pretty relaxed about its super-conservative use of debt. Another good sign is that Golan Plastic Products has been able to increase its EBIT by 20% in twelve months, making it easier to pay down debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Golan Plastic Products will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Golan Plastic Products recorded free cash flow worth 63% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Golan Plastic Products's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its net debt to EBITDA also supports that impression! Zooming out, Golan Plastic Products seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Golan Plastic Products has 2 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:GRIN

Golan Renewable Industries

Develops, manufactures, sells, and distributes cross-linked polyethylene pipe systems in Israel, Europe, Latin America, Scandinavia, North and South America, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives