- Israel

- /

- Aerospace & Defense

- /

- TASE:ESLT

Spain Cancels €700 Million Deal Could Be a Game Changer for Elbit Systems (TASE:ESLT)

Reviewed by Simply Wall St

- The Spanish Ministry of Defense recently canceled its €700 million procurement deal for Elbit Systems' PULS artillery system, citing aims to reduce technological dependence on Israel amid the ongoing Gaza conflict.

- This decision comes as Spain moves to source alternative defense equipment from US suppliers, highlighting shifting international supply chain dynamics for the sector.

- We'll examine how the loss of this major contract may influence Elbit Systems' investment narrative and reshape its international prospects.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Elbit Systems' Investment Narrative?

The big picture for Elbit Systems has always rested on the belief in its ability to win large-scale international defense contracts and sustain profit growth, thanks to cutting-edge products and deep relationships in the global defense sector. The cancellation of the €700 million Spanish deal, driven by geopolitical concerns, inserts a new short-term risk into the story. It underscores how international contracts can hinge on political pressures, not just capability or price. While the company’s pipeline remains strong, with recent successes like billion-dollar European orders and new product launches, the Spanish decision may prompt investors to watch for wider shifts in demand or procurement preferences, particularly from NATO-aligned countries. Short-term catalysts like contract wins and robust quarterly results remain intact for now, and the share price’s 4.9% recent decline suggests that, while this headline is meaningful, the broader positive trend has not been fundamentally disrupted yet. Over the longer term, however, the risk of further contract losses linked to geopolitics rises, and that’s something shareholders can’t afford to ignore.

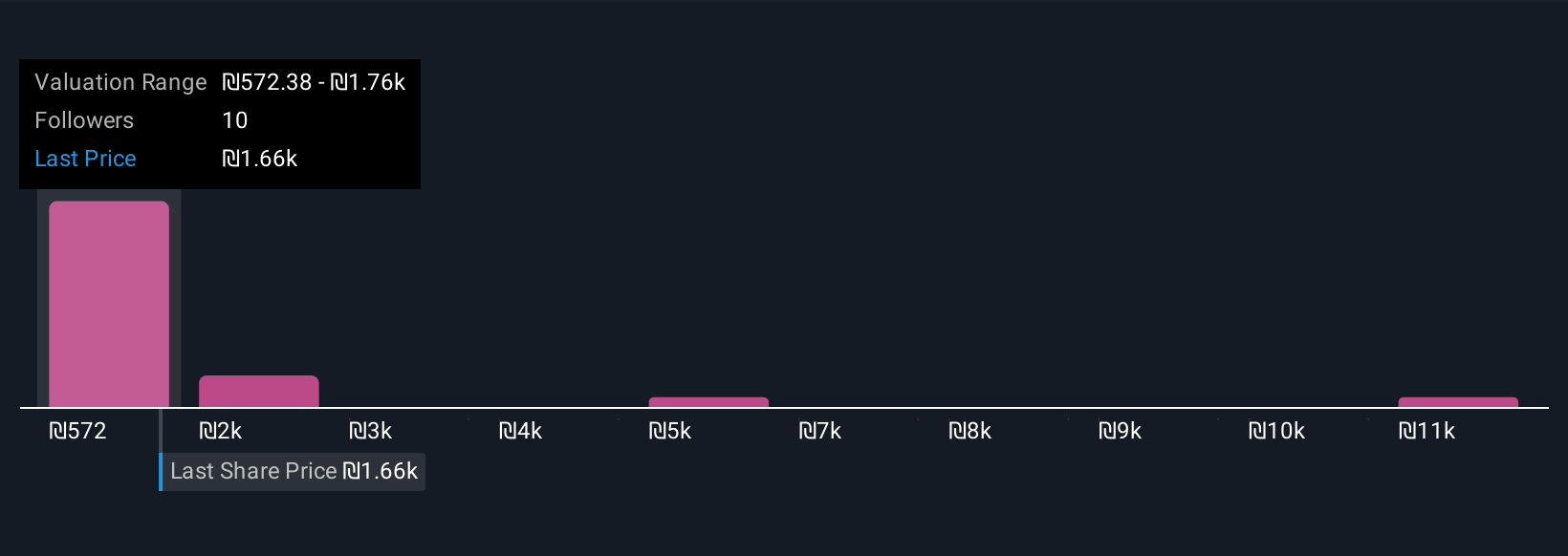

But if international politics start to impact more contracts, the long-term outlook may need a rethink. Elbit Systems' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 7 other fair value estimates on Elbit Systems - why the stock might be worth over 7x more than the current price!

Build Your Own Elbit Systems Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elbit Systems research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Elbit Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elbit Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ESLT

Elbit Systems

Develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications in Israel, North America, Europe, the Asia-Pacific, Latin America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives