Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Electra Limited (TLV:ELTR) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Electra

What Is Electra's Net Debt?

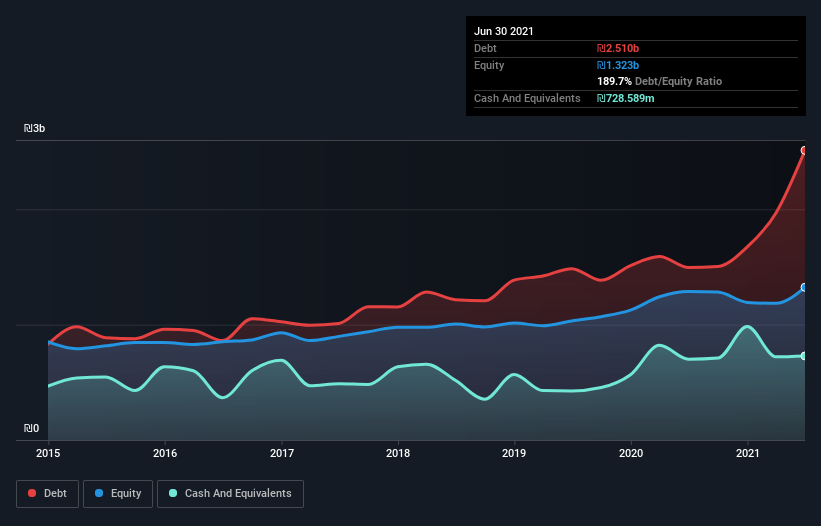

The image below, which you can click on for greater detail, shows that at June 2021 Electra had debt of ₪2.51b, up from ₪1.49b in one year. However, it also had ₪728.6m in cash, and so its net debt is ₪1.78b.

How Strong Is Electra's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Electra had liabilities of ₪3.60b due within 12 months and liabilities of ₪2.72b due beyond that. Offsetting this, it had ₪728.6m in cash and ₪3.05b in receivables that were due within 12 months. So it has liabilities totalling ₪2.53b more than its cash and near-term receivables, combined.

Electra has a market capitalization of ₪8.45b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Electra has a debt to EBITDA ratio of 3.2, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 12.4 is very high, suggesting that the interest expense on the debt is currently quite low. Importantly, Electra grew its EBIT by 34% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Electra will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Electra recorded free cash flow of 20% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Both Electra's ability to to cover its interest expense with its EBIT and its EBIT growth rate gave us comfort that it can handle its debt. Having said that, its conversion of EBIT to free cash flow somewhat sensitizes us to potential future risks to the balance sheet. When we consider all the elements mentioned above, it seems to us that Electra is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Electra that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Electra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ELTR

Electra

Through its subsidiaries, engages in the contracting, construction, infrastructure, and electromechanical system businesses in Israel and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives