- Israel

- /

- Construction

- /

- TASE:CMER

C. Mer Industries Ltd. (TLV:CMER) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Despite an already strong run, C. Mer Industries Ltd. (TLV:CMER) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 256% in the last year.

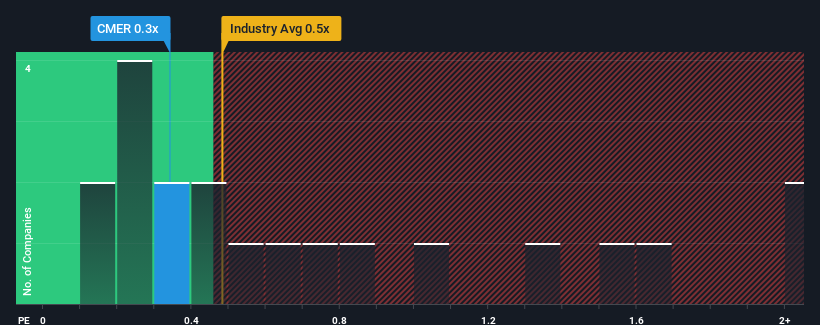

In spite of the firm bounce in price, there still wouldn't be many who think C. Mer Industries' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Israel's Construction industry is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for C. Mer Industries

What Does C. Mer Industries' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, C. Mer Industries has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for C. Mer Industries, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is C. Mer Industries' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like C. Mer Industries' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The latest three year period has also seen an excellent 61% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why C. Mer Industries is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What Does C. Mer Industries' P/S Mean For Investors?

C. Mer Industries' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, C. Mer Industries' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 4 warning signs for C. Mer Industries (2 don't sit too well with us!) that you should be aware of.

If you're unsure about the strength of C. Mer Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:CMER

C. Mer Industries

Provides solutions in the areas of homeland security (HLS), communication infrastructure, and defense technologies.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives