- Israel

- /

- Aerospace & Defense

- /

- TASE:BSEN

Bet Shemesh (TASE:BSEN) Net Margin Drops to 13.5%, Challenging Growth Narrative

Reviewed by Simply Wall St

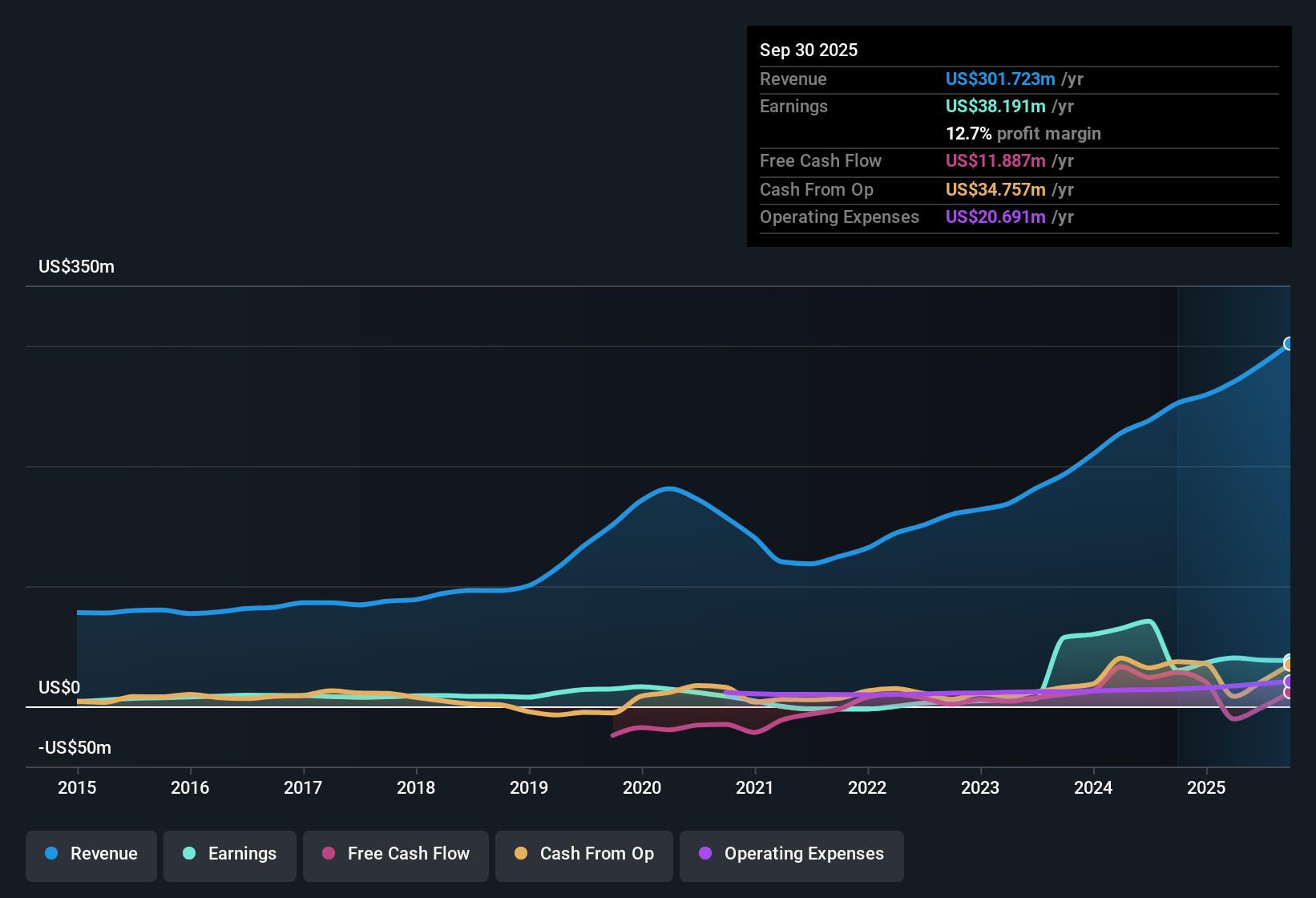

Bet Shemesh Engines Holdings (1997) (TASE:BSEN) just posted its Q3 2025 results, reporting total revenue of $76.9 million and basic EPS of $0.83. Looking at the numbers over the past year, quarterly revenue has climbed from $63.1 million in Q1 2024 to the current level, while EPS has moved from $0.81 up to $1.24 in Q1 2025 before coming in at $0.83 this quarter. Margins remain a focal point, with recent results showing more modest profitability compared with some of the prior quarters.

See our full analysis for Bet Shemesh Engines Holdings (1997).The next step is to put these headline numbers in context by weighing them against the bigger-picture narratives that drive investor sentiment. We will look at how the data supports or challenges prevailing market views about Bet Shemesh’s future.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dramatic Margin Compression: 13.5% vs. 29.8% Last Year

- Net profit margin fell to 13.5% in the last twelve months, a stark drop from 29.8% the previous year. Reported net income over the trailing twelve months stood at $38.5 million.

- Recent margin pressures contrast with the strong 58% annualized earnings growth over the past five years.

- While historical growth rates set high expectations, the most current twelve-month period saw earnings growth turn negative. Recent performance diverged sharply from the longer-term trend.

- As a result, the narrative shifts from a reliable growth story to a situation where investors must weigh falling profitability against perceived business quality.

Premium Valuation vs. DCF Fair Value

- Bet Shemesh shares are trading at ₪617.60, substantially higher than their DCF fair value estimate of ₪49.01. The 43.2x P/E ratio also exceeds the peer average of 38.5x.

- The consensus is that the market is pricing in strong future growth, but there is a considerable gap between reported margins and the DCF fair value. This challenges the rationale for paying such a premium.

- Investors may accept this valuation premium due to the company’s history of quality earnings, but recent sharp margin decline and negative earnings growth test this confidence.

- This disconnect could increase pressure on management to improve profitability in order to justify both the share price multiple and the elevated price relative to intrinsic value benchmarks.

Despite the market’s optimism, the results suggest investors need to be alert to further changes in profit margins and monitor valuation signals that might shift quickly. Stay updated when valuation signals shift by adding Bet Shemesh Engines Holdings (1997) to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Dividend Coverage Concerns Intensify

- The 2.82% dividend yield is currently not covered by either earnings or free cash flow, raising questions about sustainability.

- Some critics note that while earnings quality over the last year is rated high, the lack of dividend coverage directly challenges the assumption that profits are robust enough to support both reinvestment and shareholder payouts.

- The reported $38.5 million trailing twelve-month net income indicates solid bottom-line delivery, but dividend sustainability depends on translating that into cash flow. Recent trends indicate this is under strain.

- Even supporters of the business model must consider how long current dividend levels can be maintained if profit margins do not recover.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bet Shemesh Engines Holdings (1997)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bet Shemesh faces challenges with sharply compressed margins, negative recent earnings growth, and a share price far above its estimated fair value.

Prefer to avoid paying too much for fragile profits? Use these 920 undervalued stocks based on cash flows to uncover companies where market value truly aligns with fundamentals and upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bet Shemesh Engines Holdings (1997) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BSEN

Bet Shemesh Engines Holdings (1997)

Engages in the production of jet engine parts in Israel.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.