- Israel

- /

- Aerospace & Defense

- /

- TASE:ARYT

Should You Worry About Aryt Industries Ltd.'s (TLV:ARYT) CEO Pay?

Yoav Tuvia became the CEO of Aryt Industries Ltd. (TLV:ARYT) in 2013. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Aryt Industries

How Does Yoav Tuvia's Compensation Compare With Similar Sized Companies?

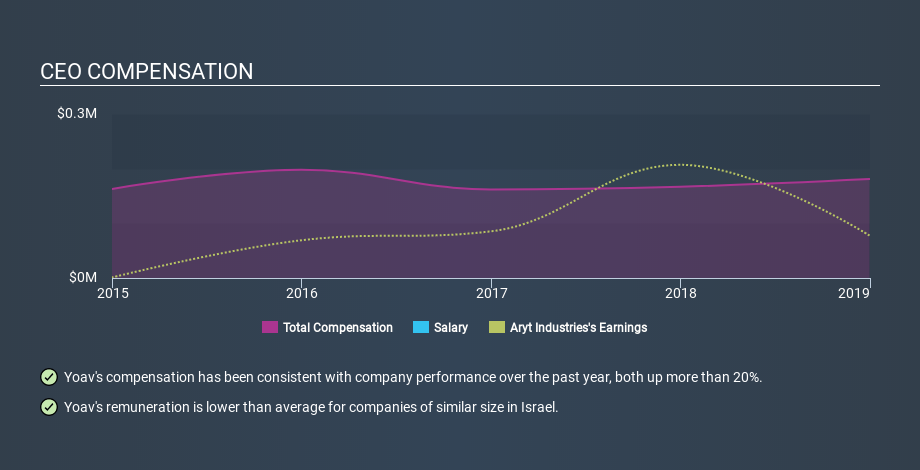

At the time of writing, our data says that Aryt Industries Ltd. has a market cap of ₪106m, and reported total annual CEO compensation of ₪181k for the year to December 2018. We took a group of companies with market capitalizations below ₪721m, and calculated the median CEO total compensation to be ₪1.4m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Aryt Industries stands. On a sector level, around 63% of total compensation represents salary and 37% is other remuneration. Readers will want to know that Aryt Industries pays a modest slice of remuneration through salary, as compared to the wider sector.

Most shareholders would consider it a positive that Yoav Tuvia takes less total compensation than the CEOs of most similar size companies, leaving more for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance. You can see a visual representation of the CEO compensation at Aryt Industries, below.

Is Aryt Industries Ltd. Growing?

Over the last three years Aryt Industries Ltd. has shrunk its earnings per share by an average of 8.7% per year (measured with a line of best fit). In the last year, its revenue is down 22%.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Aryt Industries Ltd. Been A Good Investment?

With a three year total loss of 21%, Aryt Industries Ltd. would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

It appears that Aryt Industries Ltd. remunerates its CEO below most similar sized companies.

Yoav Tuvia is paid less than CEOs of similar size companies, but the company isn't growing and total shareholder returns have been disappointing. We would not call the pay too generous, but nor would we claim the CEO is underpaid, given lacklustre business performance. On another note, Aryt Industries has 5 warning signs (and 1 which is potentially serious) we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TASE:ARYT

Aryt Industries

Through its subsidiaries, develops, produces, and markets electronic fuses for the defense market in Israel.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026