In July 2025, major Gulf markets have shown resilience and growth, buoyed by progress in U.S. trade deals and strategic moves within the region's key sectors. As indices like Saudi Arabia's benchmark index and Dubai's main share index continue to edge higher, identifying promising stocks becomes crucial for investors looking to capitalize on this momentum. In this context, a good stock is often characterized by strong fundamentals, strategic partnerships, and an ability to leverage regional economic developments effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Altinay Savunma Teknolojileri Anonim Sirketi (IBSE:ALTNY)

Simply Wall St Value Rating: ★★★★☆☆

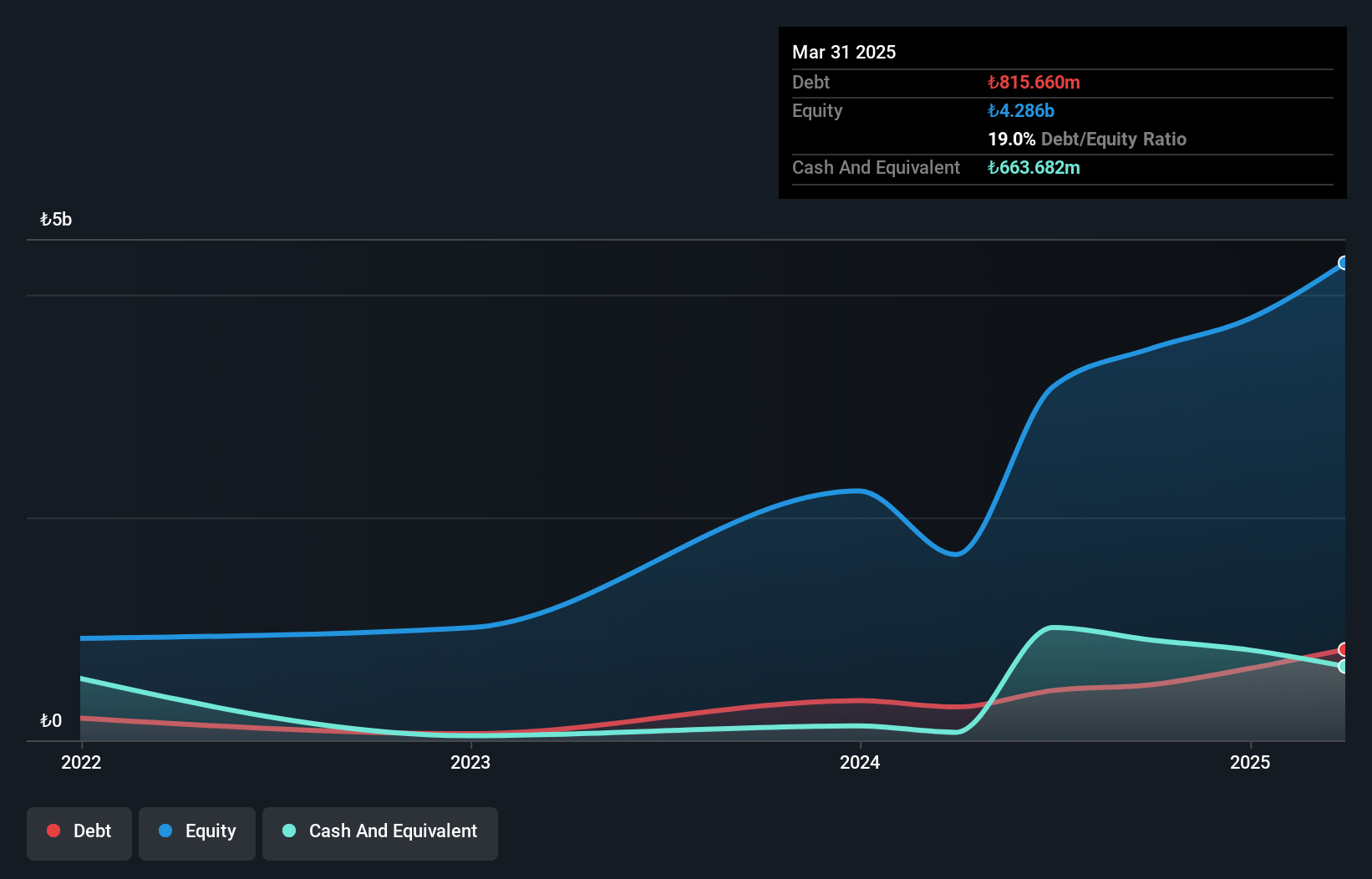

Overview: Altinay Savunma Teknolojileri Anonim Sirketi specializes in motion control, unmanned systems, stealth technology, weaponry, ammunition destruction, and production systems with a market cap of TRY20.02 billion.

Operations: Altinay's primary revenue stream is from its Defense Industry Systems, generating TRY1.96 billion. The company's net profit margin is 15%, reflecting its profitability within the sector.

Altinay Savunma Teknolojileri, a promising player in the Aerospace & Defense sector, reported robust earnings growth of 86.7% over the past year, outpacing the industry average of 9.6%. With a Price-To-Earnings ratio at 28.1x, it offers good value compared to the industry's 55.2x average. The company turned around its financials with TRY 637 million in sales and a net income of TRY 62 million for Q1 2025 from last year's net loss of TRY 160 million. Despite not being free cash flow positive recently, its satisfactory net debt to equity ratio at 3.5% suggests manageable debt levels.

Kayseri Seker Fabrikasi Anonim Sirketi (IBSE:KAYSE)

Simply Wall St Value Rating: ★★★★★☆

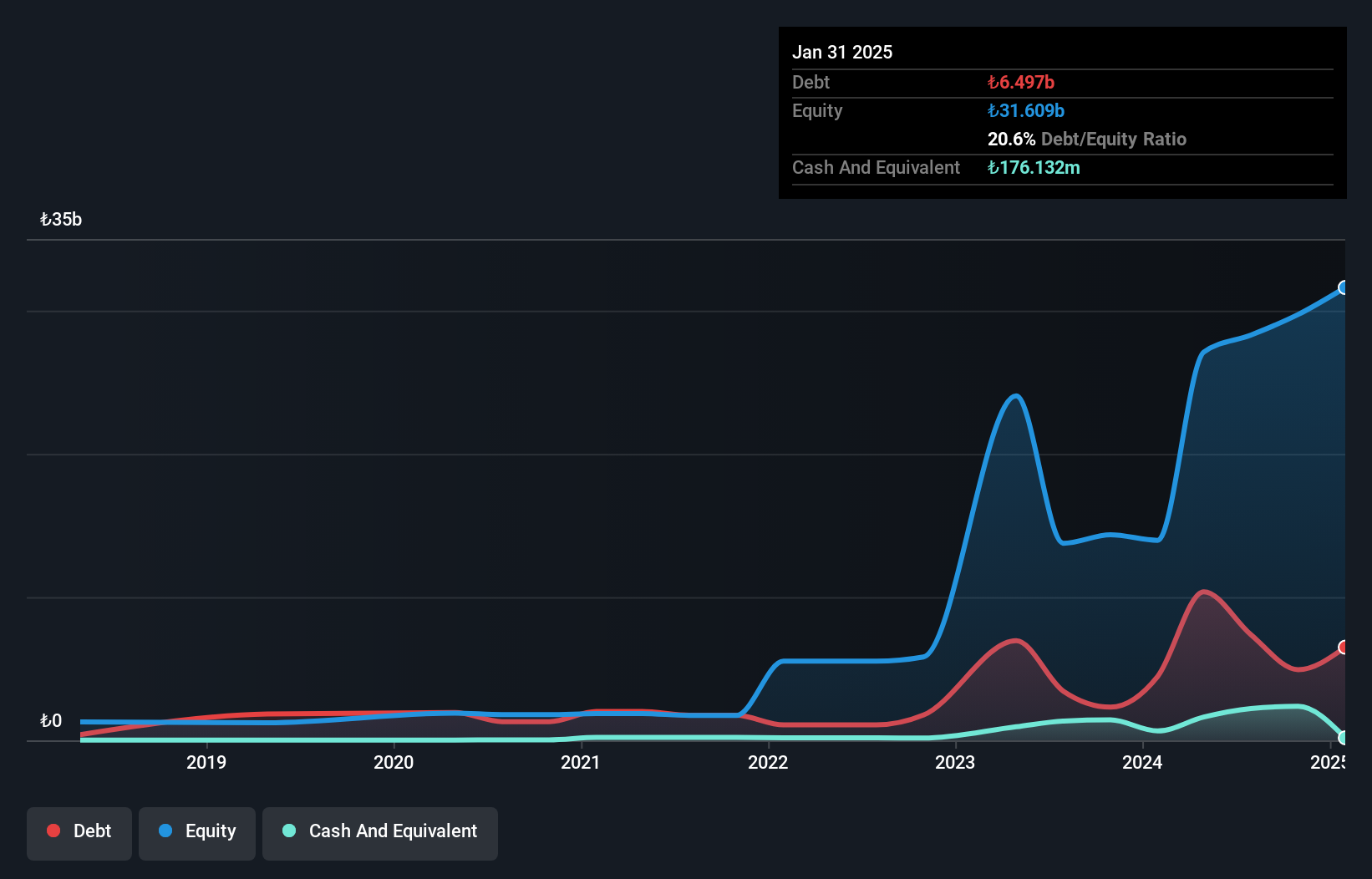

Overview: Kayseri Seker Fabrikasi Anonim Sirketi is engaged in the manufacturing and sale of sugar both within Turkey and internationally, with a market capitalization of TRY13.45 billion.

Operations: Kayseri Seker generates revenue primarily from sugar production activities, amounting to TRY16.39 billion. The company also engages in other activities contributing TRY2.97 billion to its revenue stream.

Kayseri Seker Fabrikasi showcases a compelling financial transformation with its debt to equity ratio dropping from 110.1% to 20.6% over five years, indicating improved financial health. The company outpaced the food industry with a modest earnings growth of 1.8%, compared to the industry's -6.8%. Despite trading at a significant discount of 96.3% below estimated fair value, KAYSE's earnings are influenced by large one-off gains of TRY1.5 billion in the past year, affecting profitability metrics like EBIT which currently doesn't cover interest payments effectively (0x coverage). These factors suggest potential yet highlight areas needing attention for sustainable growth.

- Dive into the specifics of Kayseri Seker Fabrikasi Anonim Sirketi here with our thorough health report.

Understand Kayseri Seker Fabrikasi Anonim Sirketi's track record by examining our Past report.

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★☆

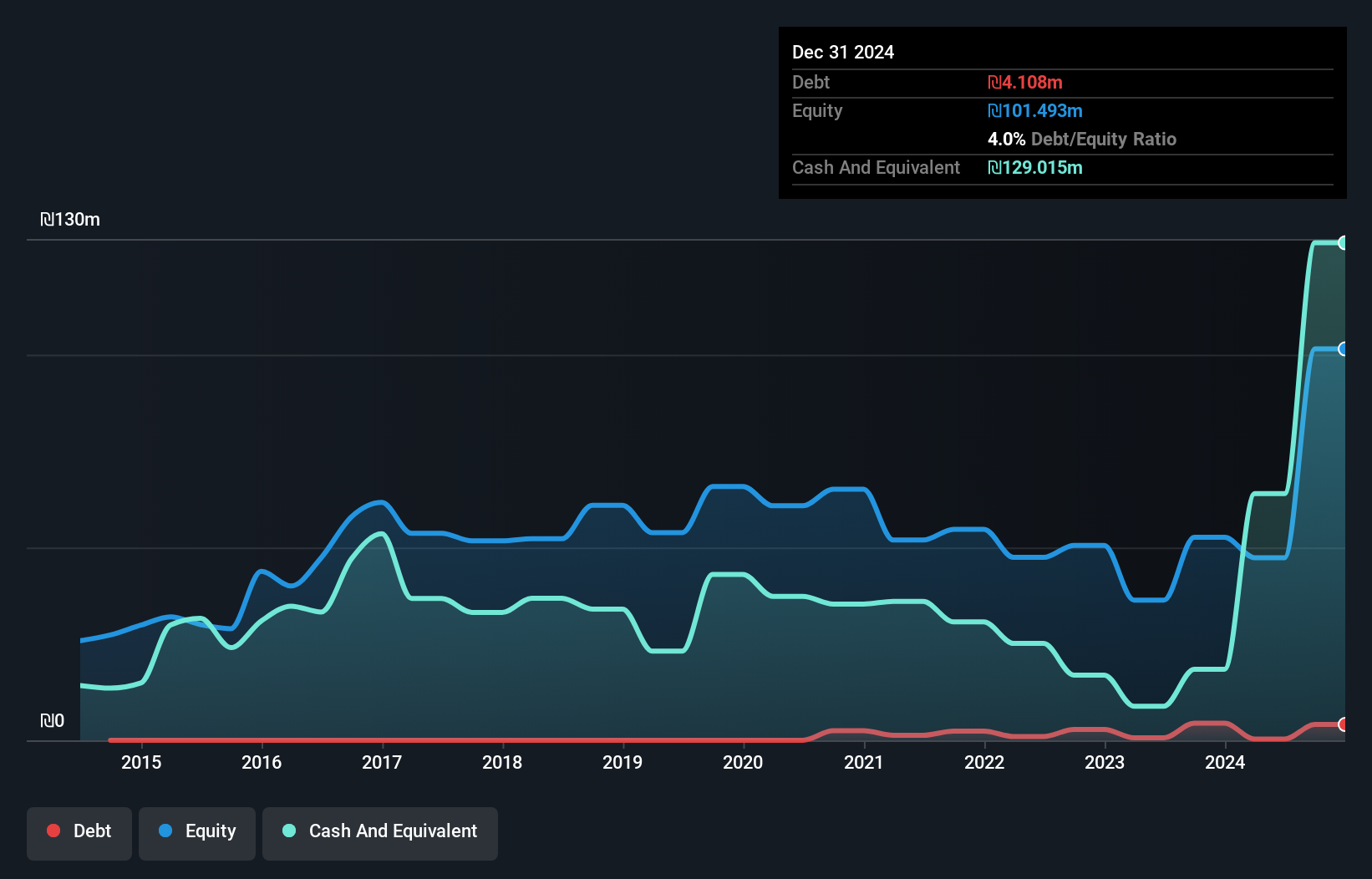

Overview: Aryt Industries Ltd. engages in the development, production, and marketing of electronic thunderbolts for the defense market in Israel, with a market cap of ₪2.14 billion.

Operations: Aryt Industries generates revenue primarily from its detonators segment, which brought in ₪126.54 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Aryt Industries, a relatively small player in the Aerospace & Defense sector, has shown impressive financial resilience. Over the past year, its earnings skyrocketed by 459%, outpacing industry growth of 46%. Despite a modest rise in its debt to equity ratio from 0% to 4% over five years, Aryt maintains more cash than total debt. Trading at an attractive valuation—88% below estimated fair value—it boasts high-quality earnings and positive free cash flow. Recently added to the TA-125 Index, Aryt's volatile share price suggests market interest but also potential risks for investors.

- Delve into the full analysis health report here for a deeper understanding of Aryt Industries.

Gain insights into Aryt Industries' past trends and performance with our Past report.

Taking Advantage

- Reveal the 219 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kayseri Seker Fabrikasi Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KAYSE

Kayseri Seker Fabrikasi Anonim Sirketi

Manufactures and sells sugar in Turkey and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion