Declining Stock and Solid Fundamentals: Is The Market Wrong About Arad Investment & Industrial Development Ltd. (TLV:ARAD)?

With its stock down 6.6% over the past month, it is easy to disregard Arad Investment & Industrial Development (TLV:ARAD). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Specifically, we decided to study Arad Investment & Industrial Development's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Arad Investment & Industrial Development

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Arad Investment & Industrial Development is:

15% = ₪626m ÷ ₪4.1b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every ₪1 worth of equity, the company was able to earn ₪0.15 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Arad Investment & Industrial Development's Earnings Growth And 15% ROE

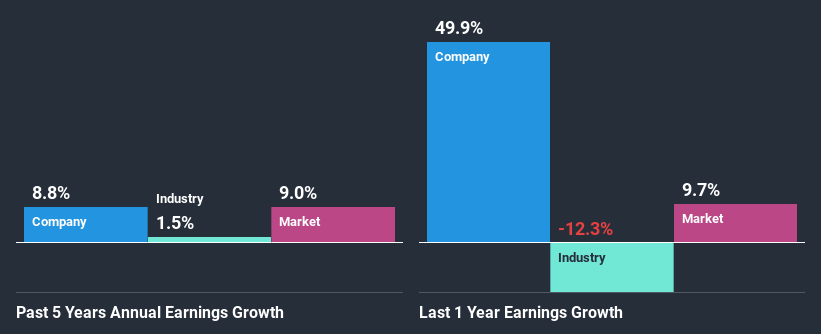

To begin with, Arad Investment & Industrial Development seems to have a respectable ROE. Especially when compared to the industry average of 7.0% the company's ROE looks pretty impressive. This certainly adds some context to Arad Investment & Industrial Development's decent 8.8% net income growth seen over the past five years.

Next, on comparing with the industry net income growth, we found that Arad Investment & Industrial Development's growth is quite high when compared to the industry average growth of 2.6% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. What is ARAD worth today? The intrinsic value infographic in our free research report helps visualize whether ARAD is currently mispriced by the market.

Is Arad Investment & Industrial Development Using Its Retained Earnings Effectively?

Arad Investment & Industrial Development's three-year median payout ratio to shareholders is 6.8% (implying that it retains 93% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

Moreover, Arad Investment & Industrial Development is determined to keep sharing its profits with shareholders which we infer from its long history of seven years of paying a dividend.

Conclusion

In total, we are pretty happy with Arad Investment & Industrial Development's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. You can see the 2 risks we have identified for Arad Investment & Industrial Development by visiting our risks dashboard for free on our platform here.

If you decide to trade Arad Investment & Industrial Development, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:MLTH

Malam-Team Holdings

Provides computer services in the field of information technology in Israel.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026