- Israel

- /

- Construction

- /

- TASE:AFHL

Afcon Holdings (TASE:AFHL) Net Margin Jumps to 3.9%, Defies Prevailing Bearish Narratives

Reviewed by Simply Wall St

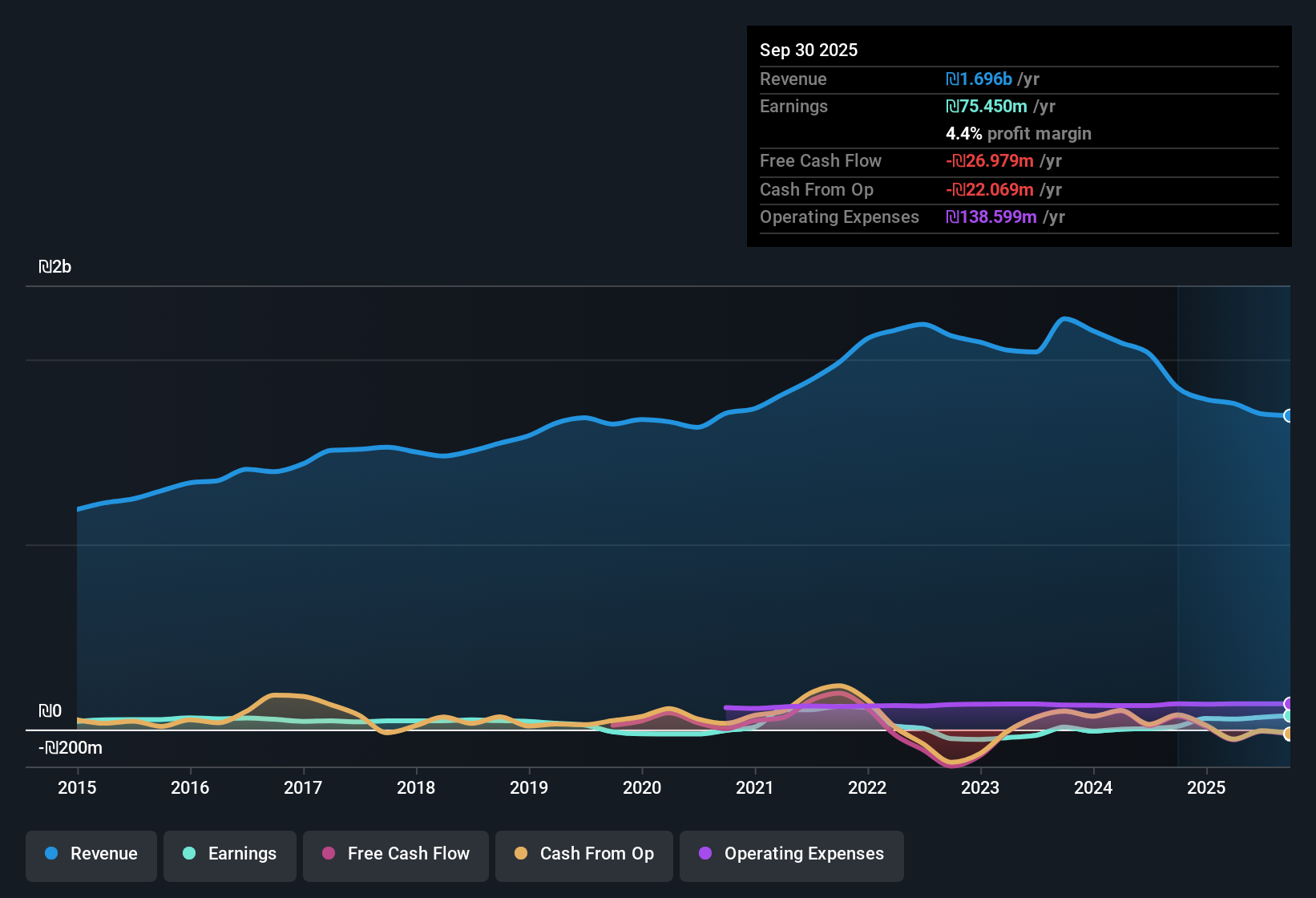

Afcon Holdings (TASE:AFHL) just posted its Q3 2025 numbers, reporting revenue of 392.3 million ILS and basic EPS of 3.2 ILS for the quarter. Looking at recent trends, the company’s trailing twelve-month revenue moved from 2.1 billion ILS one year ago to 1.7 billion ILS this quarter. EPS climbed from 0.27 ILS to 12.5 ILS over the same span. Against this backdrop, margins have held up and set the stage for a lively investor debate over what is powering the results.

See our full analysis for Afcon Holdings.Let’s see how these earnings stack up against the prevailing narratives. The numbers may reinforce some long-held views, while throwing others into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Climb to 3.9% After Multi-Year Slump

- Net profit margin jumped to 3.9% for the trailing twelve months, a notable acceleration compared to the 0.3% margin seen previously. This highlights a pronounced turnaround after several years of averaging a 14.7% annual decline in earnings.

- What stands out is that the margin expansion heavily supports the view that Afcon has moved past its earnings dip, with:

- A surge in annual net income to 66.3 million ILS, far exceeding prior periods of sub-17 million ILS in quarterly net income

- Quality of earnings marked as high, which counters past worries about profitability consistency

Share Price Premium Over DCF Fair Value

- Shares are trading at 289.10 ILS, which is substantially higher than the latest DCF fair value estimate of 36.16 ILS per share. This spotlights a marked valuation premium.

- Critics highlight that current valuation is hard to justify against intrinsic estimates, especially when:

- The Price-to-Earnings ratio at 22.8x sits above the Asian Construction sector average of 14.9x, but below the Construction industry average of 33x

- This gap between price and DCF fair value challenges the argument that recent performance fully warrants the current market price

Debt Coverage Weakness Raises Red Flags

- Operating cash flow currently does not cover debt, underlining an ongoing vulnerability in the company’s financial structure that was specifically flagged in the risk summary.

- Bears argue that this debt coverage shortfall is a key concern because:

- Improved margins and profits have not translated into greater financial flexibility or lower leverage risk

- A sustained inability to cover debt out of operations could dampen future investment or resilience if market conditions shift

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Afcon Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Afcon’s rising margins have not resolved the persistent challenge of weak debt coverage and limited financial flexibility, even as profits improved.

If you want to invest in companies that sidestep these balance sheet concerns, check out solid balance sheet and fundamentals stocks screener (1938 results) built to weather financial stress more reliably.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AFHL

Afcon Holdings

Develops and executes construction projects in Israel and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.