What Mizrahi Tefahot Bank (TASE:MZTF)'s Net Income Growth Signals for Shareholders After Q3 Earnings

Reviewed by Sasha Jovanovic

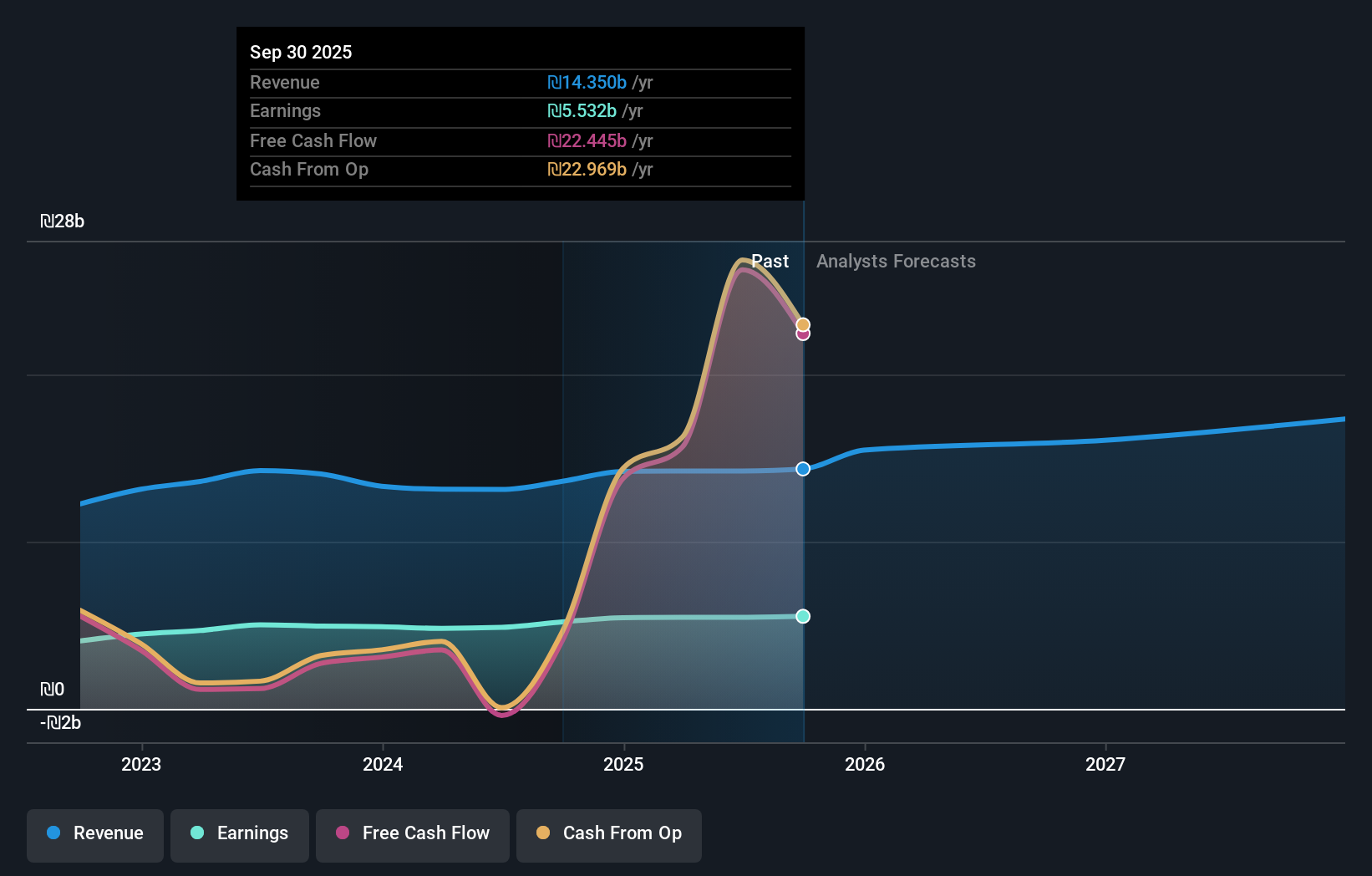

- Mizrahi Tefahot Bank Ltd. announced third quarter 2025 earnings on November 18, reporting net interest income of ILS 3.15 billion and net income of ILS 1.48 billion, both compared to the same period last year.

- While net interest income remained stable, the year-on-year increase in net income highlights the bank’s underlying operating momentum.

- We'll explore how continued growth in net income shapes Mizrahi Tefahot Bank's investment narrative following the latest quarterly results.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Mizrahi Tefahot Bank's Investment Narrative?

Owning shares in Mizrahi Tefahot Bank often comes down to believing in its ability to deliver consistent profit growth and maintain high-quality earnings, even as revenue expansion flattens. The latest quarterly report showing net income rising despite essentially flat net interest income suggests the bank’s core operations remain resilient and efficient, supporting shareholder confidence. With short-term catalysts like sustained margin strength and the potential for further operational improvements, the new results may slightly improve the near-term outlook compared to the prior quarter. However, the unchanged pattern in board independence and slower-than-market revenue forecasts continue to temper the company’s risk profile. In this context, the recent earnings news is supportive but not game-changing, and the bigger picture remains a balance between reliable profit and structural challenges. But strong profits don't erase underlying governance concerns investors should keep in mind.

Mizrahi Tefahot Bank's shares are on the way up, but they could be overextended by 6%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Mizrahi Tefahot Bank - why the stock might be worth 5% less than the current price!

Build Your Own Mizrahi Tefahot Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mizrahi Tefahot Bank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mizrahi Tefahot Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mizrahi Tefahot Bank's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MZTF

Mizrahi Tefahot Bank

Provides a range of international, commercial, domestic, and personal banking services to individuals and businesses in Israel and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives