Ryanair (ISE:RYA) Valuation Spotlight After Strong Q2 Results and Upgraded Traffic Outlook

Reviewed by Simply Wall St

Ryanair Holdings (ISE:RYA) just posted results showing impressive jumps in both revenue and net income for the second quarter and first half of fiscal 2026, outpacing last year's figures. In addition, management has upped its full-year traffic guidance, citing faster aircraft deliveries and solid demand.

See our latest analysis for Ryanair Holdings.

Ryanair’s upbeat second-quarter results arrived as the stock continues to build momentum, notching a 1-month share price return of 8% and bringing its year-to-date gain to over 42%. Over the past year, shareholders have enjoyed a 48% total return, and long-term holders have seen gains of more than 125% across three years. This reflects optimism about Ryanair’s growth prospects and its ability to sustain strong traffic trends.

If strong showings from market leaders have you curious what else might be outperforming, this is a perfect moment to discover fast growing stocks with high insider ownership

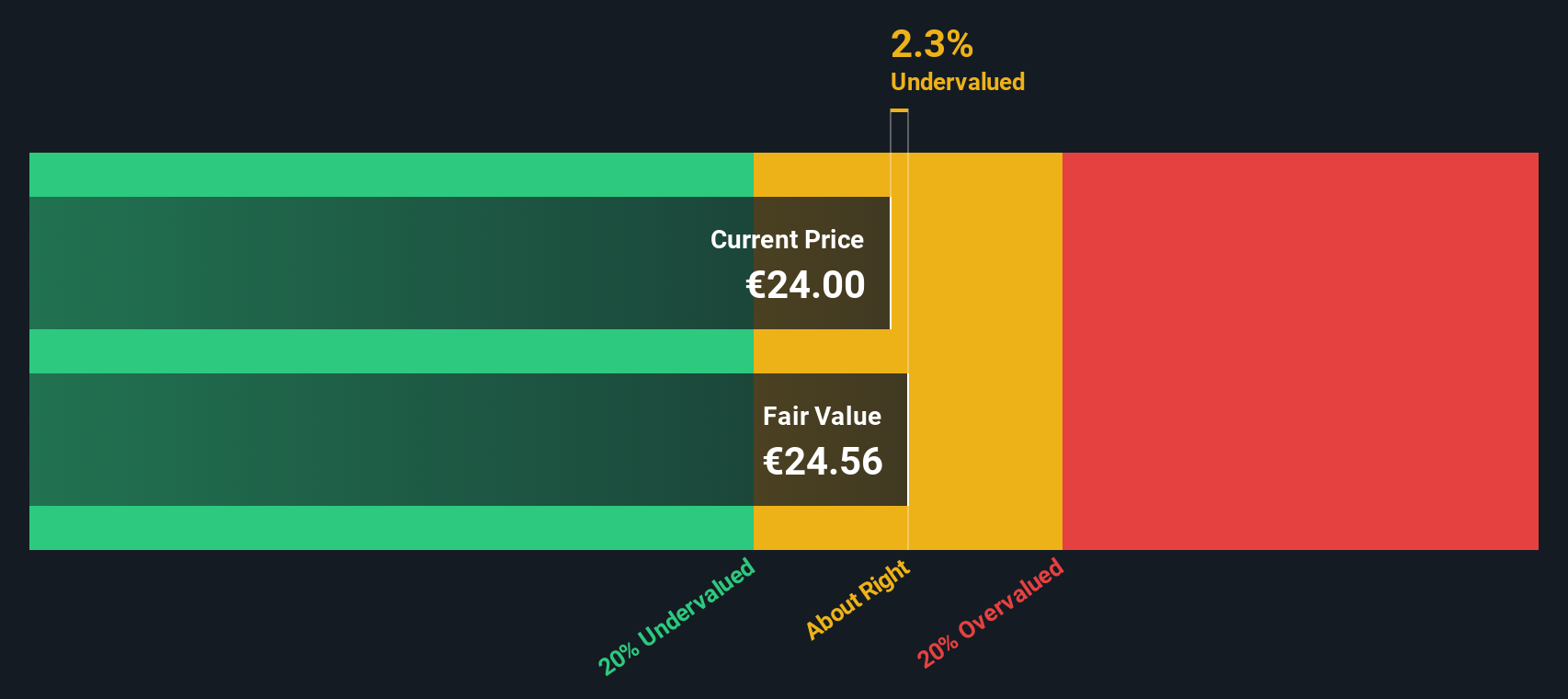

But with shares rallying so strongly, the key question now is whether Ryanair is still trading below its true value or if the market has already factored in all of the company’s impressive growth and future prospects.

Price-to-Earnings of 12.2x: Is it justified?

Ryanair trades at a price-to-earnings (P/E) ratio of 12.2x, which is notably lower than the average of its peer group at 17.4x and just below the broader Irish market’s P/E of 12.7x. This relative discount suggests that investors are not fully pricing in Ryanair’s recent momentum or profitability gains compared to its domestic competitors.

The price-to-earnings ratio is a popular yardstick reflecting what the market is willing to pay for each euro of earnings. For an airline like Ryanair, known for operational efficiency and consistent bottom-line growth, a lower-than-peer P/E may indicate an undervaluation relative to earnings power.

This discount could mean the market is underestimating Ryanair’s ability to grow or maintain its high profit margins. It could also reflect concerns about industry-specific risks, but the strong earnings performance and robust returns suggest there may be room for upward revision if positive trends continue.

Compared to global airlines, where the industry P/E sits at 9.2x, Ryanair’s valuation appears higher, which could reflect a quality or region-specific premium. However, its clear lead versus Irish competitors underscores its current value proposition.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.2x (UNDERVALUED)

However, rising fuel costs and potential disruptions to air travel could challenge Ryanair’s ability to maintain its current pace of growth and profitability.

Find out about the key risks to this Ryanair Holdings narrative.

Another Perspective: SWS DCF Model Suggests a Slight Overvaluation

While the earnings-based valuation points to Ryanair looking attractive versus peers, our DCF model provides a different angle. The SWS DCF model estimates Ryanair's fair value at €25.54, which is below its current trading price of €27.30. This suggests the shares might be a bit overvalued on a cash flows basis. Could this mean future growth is already priced in, or is the market expecting Ryanair to outperform its forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ryanair Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ryanair Holdings Narrative

If you see Ryanair’s story differently or want to explore your own numbers further, you can easily develop a personalized view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ryanair Holdings.

Looking for More Investment Ideas?

Smart investors seize every edge. Don’t limit your portfolio to just one opportunity. Tap into stocks with cash flow value, strong dividends, or blockchain innovation right now.

- Uncover hidden value by putting your money to work in these 870 undervalued stocks based on cash flows, where companies may be trading below their true worth.

- Grow your income with these 15 dividend stocks with yields > 3% and target reliable payers boasting yields above 3% for a steady stream of returns.

- Ride the next financial revolution by tapping into these 82 cryptocurrency and blockchain stocks, featuring stocks powering digital currencies and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:RYA

Ryanair Holdings

Provides scheduled-passenger airline services in Ireland, Italy, Spain, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives