- United States

- /

- Banks

- /

- NYSE:TFC

Ryanair Holdings And 2 Other Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets rebound from recent sell-offs and central banks adjust interest rates, investors are keenly watching for opportunities that may be trading below their estimated value. In this environment, identifying undervalued stocks can offer a strategic advantage, particularly when these companies show strong fundamentals and potential for growth despite current market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| QleanAir (OM:QAIR) | SEK25.50 | SEK50.79 | 49.8% |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.651 | £1.30 | 49.8% |

| Pasquarelli Auto (BIT:PSQ) | €0.90 | €1.80 | 49.9% |

| Tompkins Financial (NYSEAM:TMP) | US$61.75 | US$122.99 | 49.8% |

| Engtex Group Berhad (KLSE:ENGTEX) | MYR0.665 | MYR1.32 | 49.8% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | US$477.90 | US$954.88 | 50% |

| Open Lending (NasdaqGM:LPRO) | US$6.18 | US$12.34 | 49.9% |

| Tortilla Mexican Grill (AIM:MEX) | £0.505 | £1.01 | 49.9% |

| Sinch (OM:SINCH) | SEK32.32 | SEK64.40 | 49.8% |

| Distribuidora Internacional de Alimentación (BME:DIA) | €0.0128 | €0.026 | 50% |

Below we spotlight a couple of our favorites from our exclusive screener.

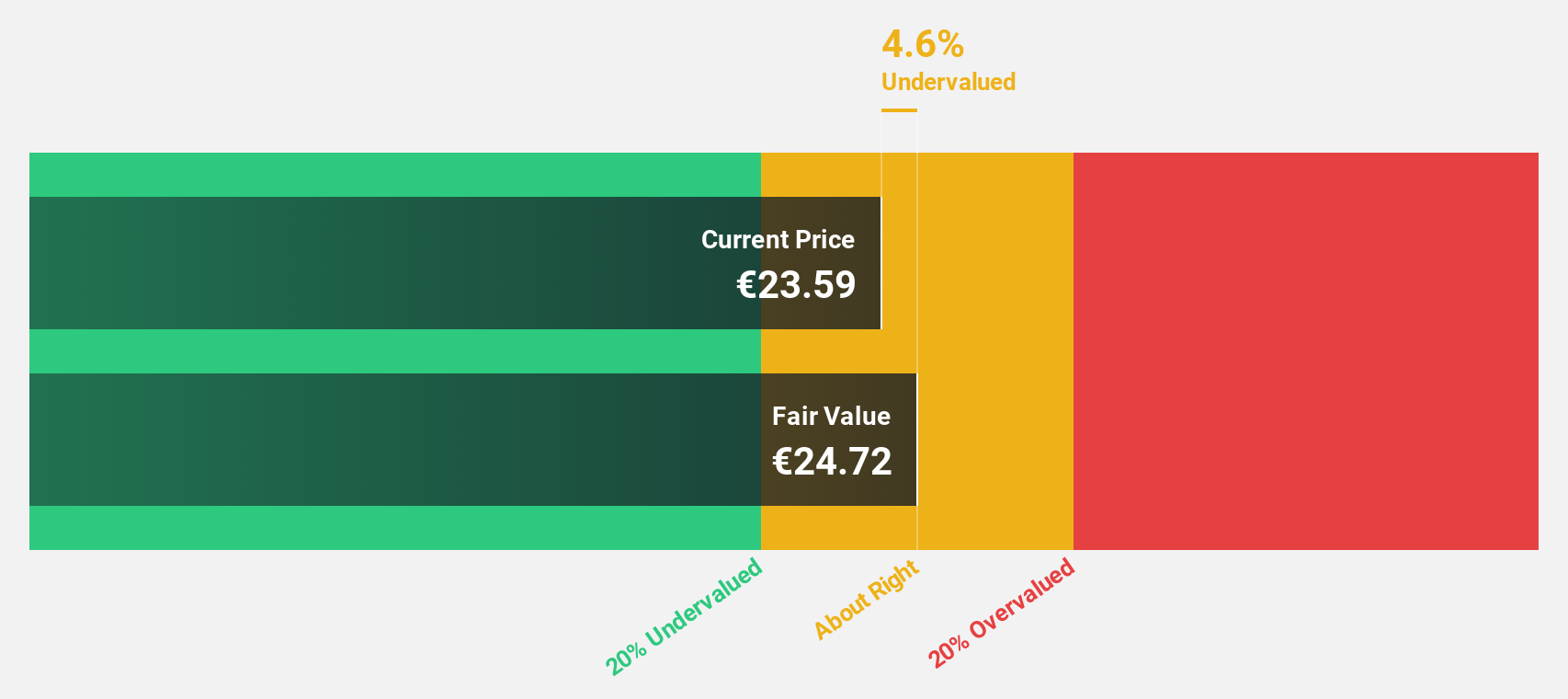

Ryanair Holdings (ISE:RYA)

Overview: Ryanair Holdings plc, with a market cap of approximately €18.39 billion, operates scheduled-passenger airline services across Ireland, the United Kingdom, Spain, Italy, and internationally through its subsidiaries.

Operations: Ryanair Holdings generates revenue primarily from Ryanair DAC (€14.06 billion) and Other Airlines (€1.51 billion).

Estimated Discount To Fair Value: 28.1%

Ryanair Holdings is trading 28.1% below its estimated fair value of €23.17, suggesting it is undervalued based on cash flows. Despite a volatile share price and an unstable dividend track record, the company shows strong revenue growth forecasts (6.3% annually) and earnings growth (10.3% annually), both outpacing the Irish market averages. Recent traffic results reveal continued operational strength with increased passenger numbers year-over-year, maintaining a high load factor of 94-96%.

- According our earnings growth report, there's an indication that Ryanair Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Ryanair Holdings stock in this financial health report.

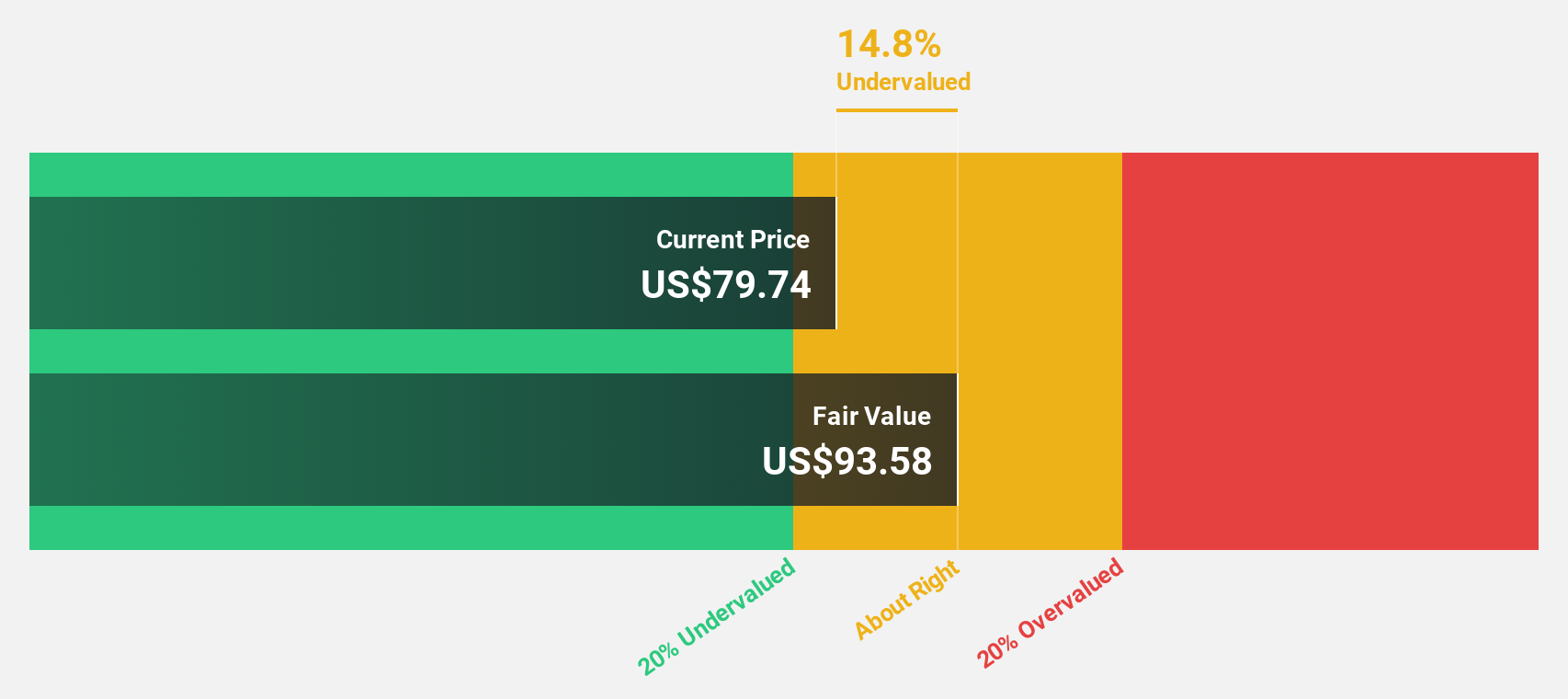

Coherent (NYSE:COHR)

Overview: Coherent Corp. develops, manufactures, and markets engineered materials, optoelectronic components and devices, as well as optical and laser systems for industrial, communications, electronics, and instrumentation markets worldwide with a market cap of approximately $12.41 billion.

Operations: Coherent's revenue segments include $1.40 billion from Lasers, $1.47 billion from Materials, and $2.34 billion from Networking.

Estimated Discount To Fair Value: 27.2%

Coherent Corp. is trading at US$86.06, significantly below its estimated fair value of US$118.14, indicating it may be undervalued based on cash flows. The company’s revenue is forecast to grow at 11.7% annually, outpacing the broader market's 8.7%. Coherent's recent product innovations, including uncooled dual-chip micro-pump lasers and L-band 800 Gbps transceivers, highlight its commitment to advancing data center and telecom technologies while aiming for profitability within three years.

- Our growth report here indicates Coherent may be poised for an improving outlook.

- Navigate through the intricacies of Coherent with our comprehensive financial health report here.

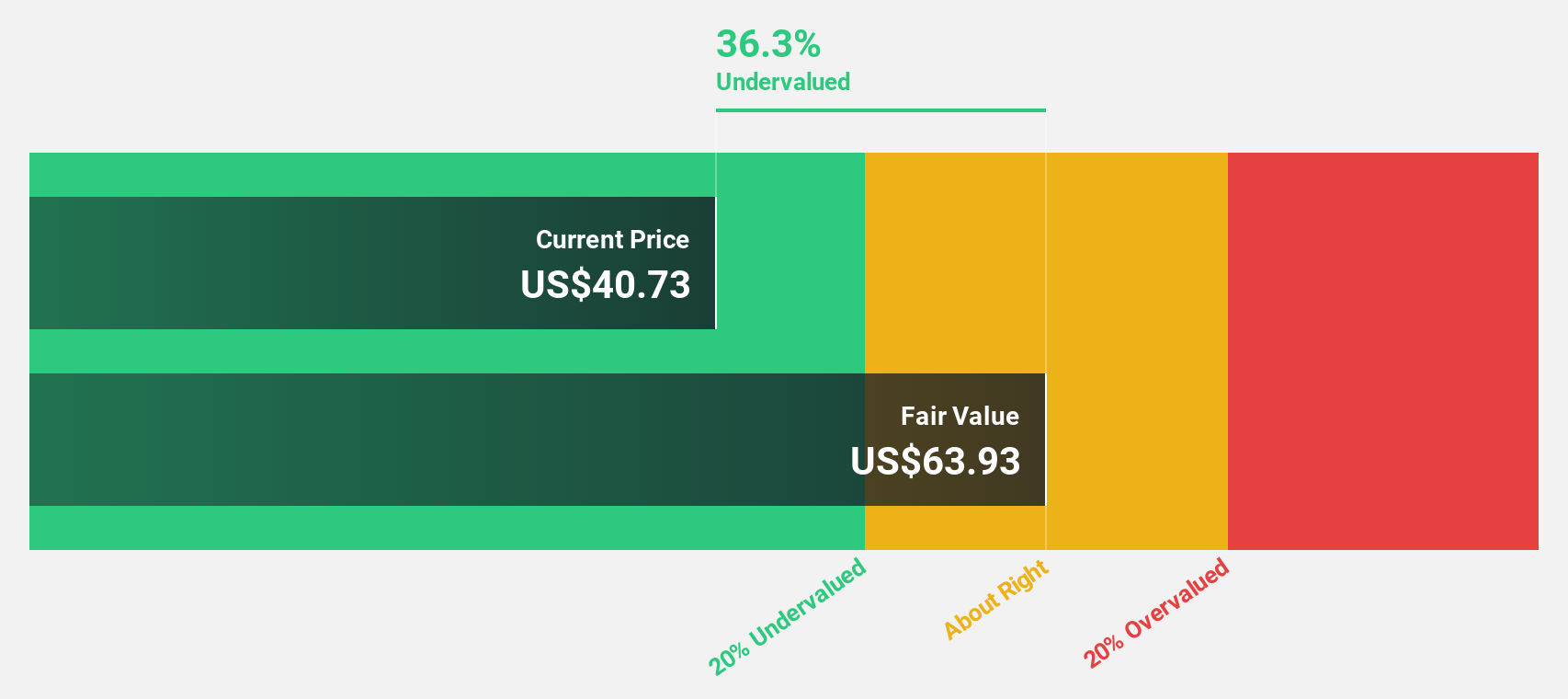

Truist Financial (NYSE:TFC)

Overview: Truist Financial Corporation is a financial services company offering banking and trust services in the Southeastern and Mid-Atlantic United States, with a market cap of approximately $56.27 billion.

Operations: Truist Financial's revenue segments include Segment Adjustment at $24.12 billion and Treasury & Corporate (Ot&C) at -$9.88 billion.

Estimated Discount To Fair Value: 42.6%

Truist Financial, trading at US$42.93, is significantly undervalued compared to its estimated fair value of US$74.80 based on discounted cash flows. Despite recent executive changes and a fixed-income offering of US$1 billion, the company faces challenges with earnings coverage for its 4.85% dividend yield. However, Truist's revenue is forecast to grow at 12.1% annually, outpacing the broader market's 8.7%, and it is expected to achieve profitability within three years with a notable annual profit growth forecast of 59%.

- In light of our recent growth report, it seems possible that Truist Financial's financial performance will exceed current levels.

- Click here to discover the nuances of Truist Financial with our detailed financial health report.

Key Takeaways

- Unlock our comprehensive list of 937 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet established dividend payer.