Evaluating Glanbia (ISE:GL9): Is the Stock Undervalued After Recent Share Price Shifts?

Reviewed by Kshitija Bhandaru

See our latest analysis for Glanbia.

Through the past year, Glanbia’s share price has seen modest shifts while long-term shareholders have fared somewhat better, with a five-year total shareholder return of nearly 78%. Recent price moves seem to reflect a mix of steady fundamentals and shifting sentiment, as investors weigh growth prospects and reassess valuation.

If all this has you wondering where the next opportunity lies, it could be the perfect time to discover fast growing stocks with high insider ownership.

But with Glanbia trading at a notable discount to analyst price targets and showing steady profit growth, should investors be eyeing a bargain, or is the market already factoring in all the company’s future potential?

Most Popular Narrative: 18% Undervalued

The most popular narrative values Glanbia materially higher than its last closing price, pointing to significant upside based on future earnings growth and operational transformation. Investors are watching closely to see which of the company's big moves could drive this valuation closer to reality.

Ongoing expansion and investment in Health & Nutrition and Dairy Nutrition divisions, supported by growing global demand for functional foods, supplements, and high-protein offerings (including plant-based), position Glanbia to capture rising revenue and achieve mid-single-digit volume-led growth, especially in international and emerging markets like Asia and Latin America. This is expected to positively impact top-line growth.

What’s behind this bullish case? There is a dramatic shift predicted in Glanbia’s profit margins and growth, underpinned by aggressive strategic bets on international markets. The foundation includes higher-value products, operational shakeups, and a set of financial projections that most investors would not expect from a traditional food company. Want to know the numbers that power this target? The full story reveals which assumptions turn Glanbia into a global contender.

Result: Fair Value of €16.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued high input costs and increased competition could quickly challenge Glanbia’s growth story and put pressure on future margins.

Find out about the key risks to this Glanbia narrative.

Another View: Earnings Ratios Paint a Less Optimistic Picture

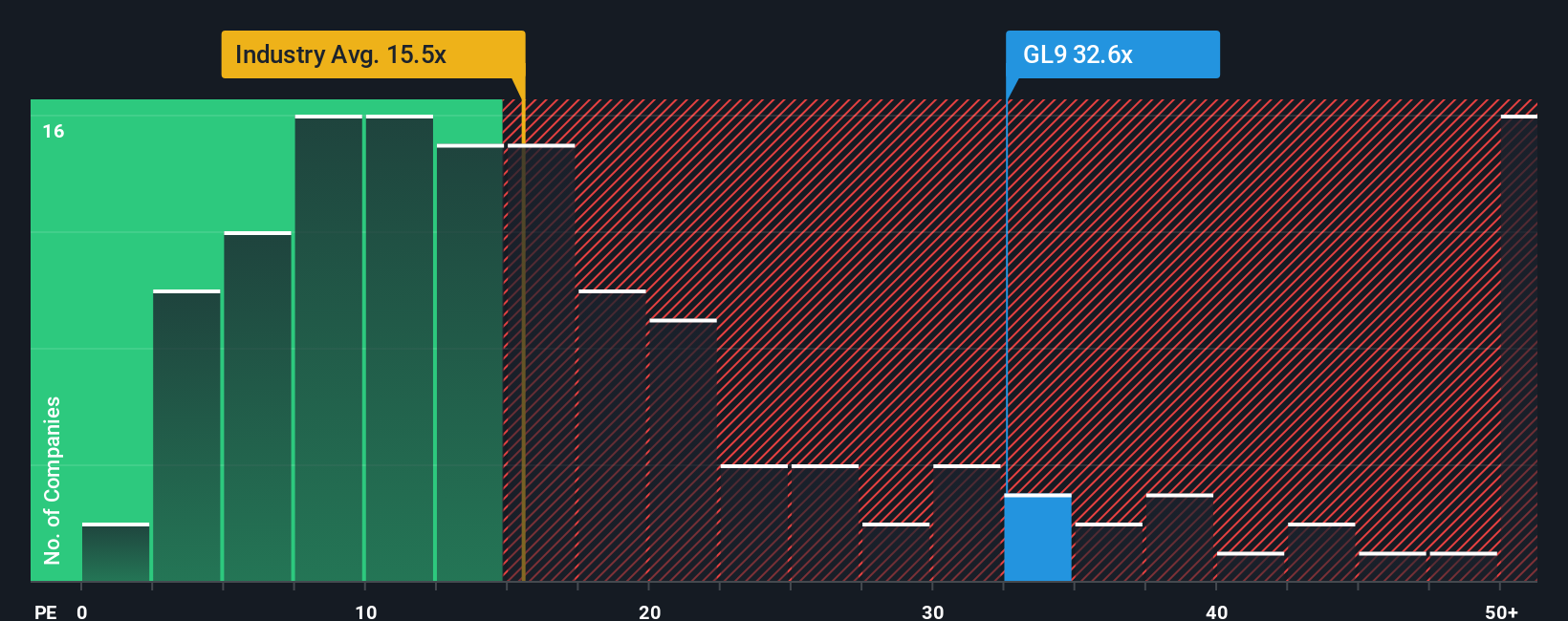

When looking at Glanbia’s valuation through the lens of earnings ratios, things appear far less attractive. The current price-to-earnings ratio stands at 32.4x, which is much higher than both the European Food industry average of 15.5x and the peer average of 15.6x. Even the fair ratio, estimated at 24x, is well below where Glanbia is trading now. This premium suggests investors may be taking on more valuation risk than they realize. Could the market be too optimistic about future growth? Is there potential for a shift back toward fair value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Glanbia Narrative

If you see things differently or want to dig deeper on your own terms, you can craft your own Glanbia analysis in under three minutes, so why not Do it your way.

A great starting point for your Glanbia research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just settle on one opportunity. Set yourself up to spot tomorrow’s winners by tapping into powerful screeners built for forward-thinking investors.

- Zero in on under-the-radar opportunities by checking out these 3563 penny stocks with strong financials with robust fundamentals and promising upside.

- Boost your portfolio’s future potential as you track these 24 AI penny stocks harnessing artificial intelligence for game-changing growth and industry disruption.

- Supercharge your income stream by searching through these 19 dividend stocks with yields > 3% that consistently deliver strong, reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GL9

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives