- Ireland

- /

- Hospitality

- /

- ISE:DHG

Dalata Hotel Group (ISE:DHG): Is the Current Valuation Justified Following Strong Multi-Year Gains?

Reviewed by Simply Wall St

If you have been keeping an eye on Dalata Hotel Group (ISE:DHG), you might be wondering what’s behind its recent share price action. While there is no single major event moving the stock right now, Dalata’s performance may still leave investors questioning whether the current trends signal a new direction for the group or if this is business as usual in a shifting travel landscape.

The company’s share price has ticked up an impressive 65% over the last year, with momentum building steadily since the start of the year, a period that also saw annual net income grow by 17% and continued, albeit modest, revenue growth. Although returns have been essentially flat over the past month, longer-term gains—up nearly 93% over three years and over 128% within five years—suggest investors continue to respond to Dalata’s track record of expansion and profitability, even without headline-making news driving movements in the short term.

With these strong gains baked into the current price, the real question is whether Dalata still offers value at today’s levels, or if investors are simply paying now for growth that might take years to fully materialize.

Price-to-Earnings of 21.5x: Is it justified?

Dalata Hotel Group is currently trading at a Price-To-Earnings (P/E) ratio of 21.5x, which is above the European Hospitality industry average of 18.5x. This means investors are paying a higher price for each euro of earnings than the typical industry peer.

The price-to-earnings multiple measures how much investors are willing to pay for a company’s earnings. In the hotel sector, it is a widely used yardstick for comparing value, since it reflects both growth prospects and profitability.

This above-average ratio suggests the market expects stronger future growth or superior quality from Dalata compared to competitors. However, whether such a premium is warranted depends on whether the company can deliver sustained earnings growth in the coming years.

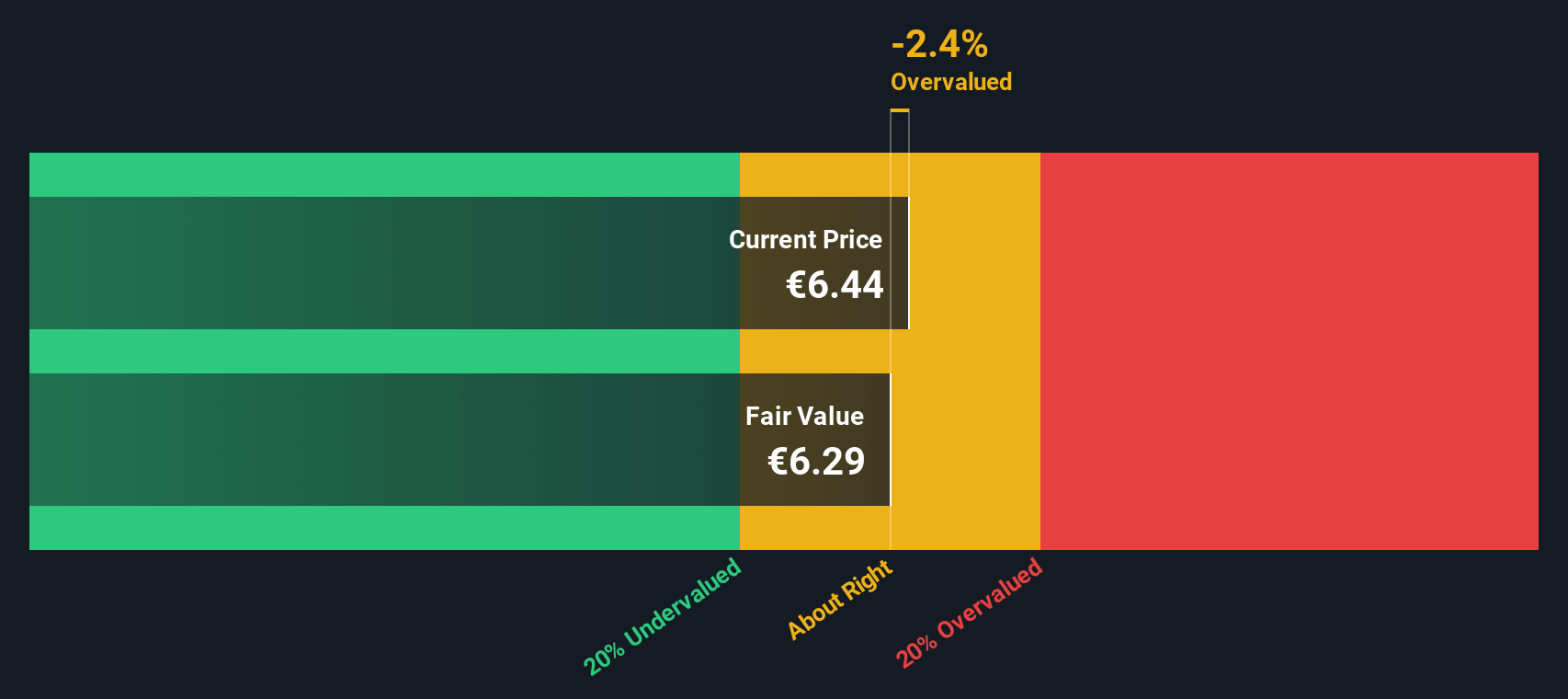

Result: Fair Value of €6.35 (ABOUT RIGHT)

See our latest analysis for Dalata Hotel Group.However, slower revenue growth and a premium valuation could quickly tilt sentiment if Dalata struggles to deliver on its earnings expectations.

Find out about the key risks to this Dalata Hotel Group narrative.Another View: DCF Model Adds More To The Story

While the market focuses on how Dalata compares to the industry, our DCF model provides a different perspective. It suggests Dalata is undervalued, prompting debate about which method offers a more accurate picture. Which direction will the market take next?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dalata Hotel Group Narrative

If you see things differently or prefer a hands-on approach to research, you can craft your own perspective in just a few minutes by using Do it your way.

A great starting point for your Dalata Hotel Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Set yourself apart by finding high-potential stocks others might overlook with our expert-curated screeners below.

- Supercharge your portfolio with companies focused on artificial intelligence breakthroughs by tracking AI penny stocks.

- Boost your income strategy and uncover steady earners through stocks offering dividend stocks with yields > 3%.

- Capitalize on market mispricing by spotting shares with strong fundamentals that are currently undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ISE:DHG

Dalata Hotel Group

Owns, leases, and manages hotels under the Maldron Hotels and Clayton Hotels brand names in Dublin, Regional Ireland, the United Kingdom, and Continental Europe.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives