- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

How Glenveagh Properties' €50 Million Equity Raise Will Impact Investors (ISE:GVR)

Reviewed by Sasha Jovanovic

- Glenveagh Properties PLC recently completed a follow-on equity offering, raising €50.24 million by issuing 28,381,760 ordinary shares at €1.77 per share, after initially filing to offer 113,897,285 shares the previous day.

- This move increases the company’s outstanding share count, highlighting investor appetite for fresh capital and Glenveagh’s focus on funding future initiatives.

- We’ll explore how the significant capital raise and increased share supply may reshape Glenveagh's investment narrative going forward.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Glenveagh Properties' Investment Narrative?

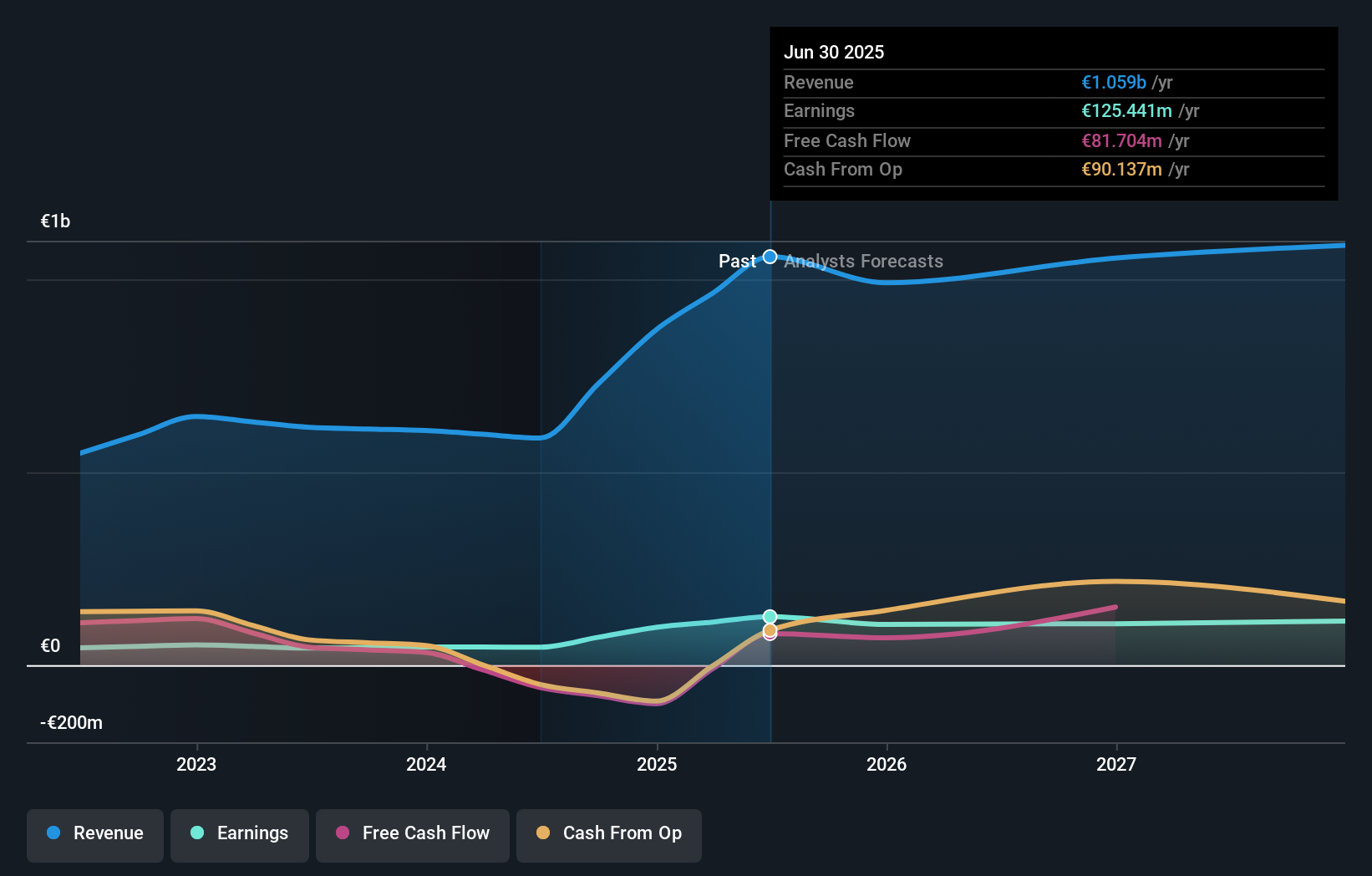

To be a Glenveagh Properties shareholder, you likely need to believe in the company's ability to convert strong operational momentum into value for investors, despite modest revenue growth forecasts and some anticipated earnings pressure over the next few years. The recent €50.24 million equity raise grows Glenveagh’s cash position, and its scale is modest relative to previous buybacks, so it is unlikely to materially shift short-term catalysts such as home delivery targets or annual profit expectations. However, it does slightly increase outstanding shares, which could temper per-share metrics in the near term. The capital injection may give Glenveagh more firepower to pursue new opportunities, though it doesn't alter the key risks: slower forecast earnings and revenue growth, leadership transitions, and sector competition remain at the forefront for investors to weigh.

But keep in mind, leadership changes could play a bigger role than many expect. Glenveagh Properties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Glenveagh Properties - why the stock might be worth over 5x more than the current price!

Build Your Own Glenveagh Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glenveagh Properties research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Glenveagh Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glenveagh Properties' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives