- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

Glenveagh Properties (ISE:GVR) Has Debt But No Earnings; Should You Worry?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Glenveagh Properties PLC (ISE:GVR) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Glenveagh Properties

What Is Glenveagh Properties's Debt?

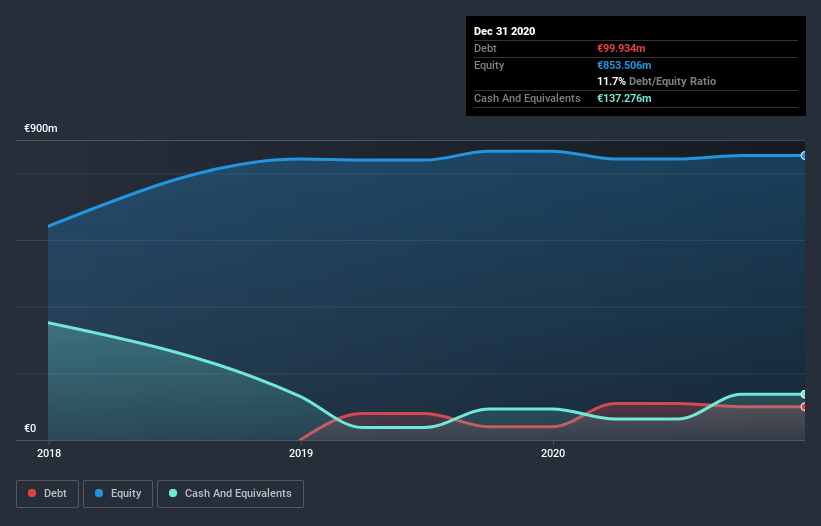

The image below, which you can click on for greater detail, shows that at December 2020 Glenveagh Properties had debt of €99.9m, up from €39.6m in one year. However, its balance sheet shows it holds €137.3m in cash, so it actually has €37.3m net cash.

How Strong Is Glenveagh Properties' Balance Sheet?

We can see from the most recent balance sheet that Glenveagh Properties had liabilities of €143.2m falling due within a year, and liabilities of €287.0k due beyond that. Offsetting this, it had €137.3m in cash and €3.95m in receivables that were due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to Glenveagh Properties' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the €738.9m company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Glenveagh Properties also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Glenveagh Properties can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Glenveagh Properties had a loss before interest and tax, and actually shrunk its revenue by 18%, to €232m. We would much prefer see growth.

So How Risky Is Glenveagh Properties?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Glenveagh Properties had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through €15m of cash and made a loss of €14m. Given it only has net cash of €37.3m, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Glenveagh Properties's profit, revenue, and operating cashflow have changed over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Glenveagh Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives