- Brazil

- /

- Metals and Mining

- /

- BOVESPA:BRAP3

Uncovering September 2024's Hidden Stock Gems

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, small-cap stocks have shown a promising performance despite still being below their previous peaks. This broad market rally, fueled by optimism and positive economic indicators, sets an intriguing stage for uncovering hidden stock gems in September 2024. In this favorable environment, identifying good stocks often involves looking for companies with strong fundamentals that can capitalize on current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 34.64% | 7.17% | 18.08% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Dutch-Bangla Bank | 67.06% | 7.20% | 10.24% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Bradespar (BOVESPA:BRAP3)

Simply Wall St Value Rating: ★★★★★★

Overview: Bradespar S.A. is a Brazilian mining company involved in the production of iron ore, pellets, and nickel through its interest in VALE, with a market cap of R$7.85 billion.

Operations: Bradespar generates revenue primarily through its interest in VALE, focusing on the production of iron ore, pellets, and nickel. The company has a market cap of R$7.85 billion.

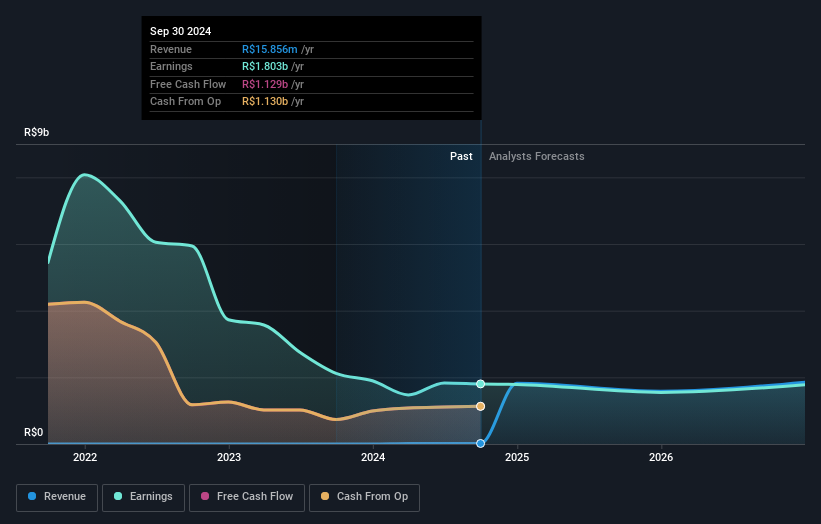

Bradespar, a company with no debt compared to its 2.3% debt-to-equity ratio five years ago, reported net income of BRL 535.46 million for Q2 2024, up from BRL 174.86 million the previous year. Despite a negative earnings growth of -33.5% over the past year and limited revenue (R$16M), it trades at a favorable P/E ratio of 4.1x against the BR market's 9.8x, indicating good relative value within its industry context.

Garudafood Putra Putri Jaya (IDX:GOOD)

Simply Wall St Value Rating: ★★★★★☆

Overview: PT Garudafood Putra Putri Jaya Tbk, along with its subsidiaries, operates in the manufacture and trade of food and beverages both in Indonesia and internationally, with a market cap of IDR15.27 billion.

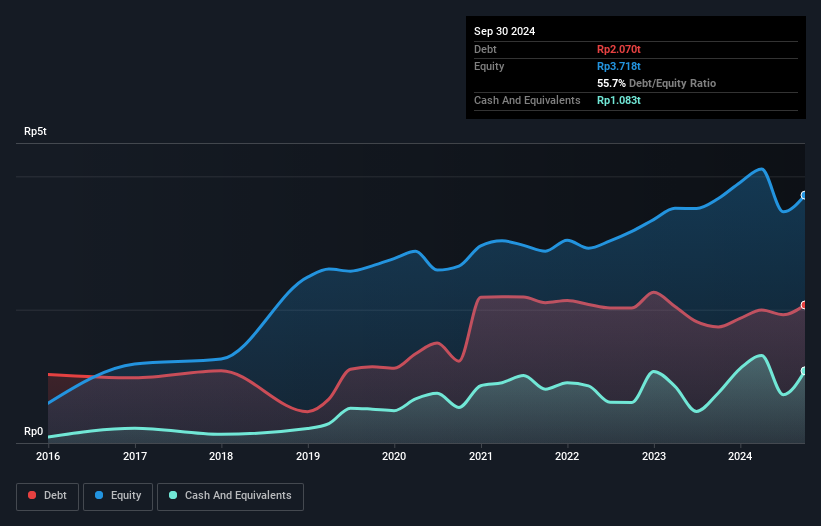

Operations: Garudafood generates revenue primarily from its packaged foods and beverages segments, with IDR9.59 billion and IDR1.44 billion respectively. The company’s net profit margin trends at 5%.

Garudafood Putra Putri Jaya has demonstrated robust financial health with a net debt to equity ratio of 34.6%, which is satisfactory. The company reported impressive earnings growth of 35.8% over the past year, outpacing the food industry’s -6.7%. Despite being removed from the S&P Global BMI Index recently, Garudafood's sales for H1 2024 reached IDR 5.71 trillion, up from IDR 5.23 trillion in H1 2023, and net income rose to IDR 258 billion from IDR 215 billion last year.

Migdal Insurance and Financial Holdings (TASE:MGDL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Migdal Insurance and Financial Holdings Ltd., together with its subsidiaries, provides insurance, pension, and financial services for private and corporate customers in Israel with a market cap of ₪5.14 billion.

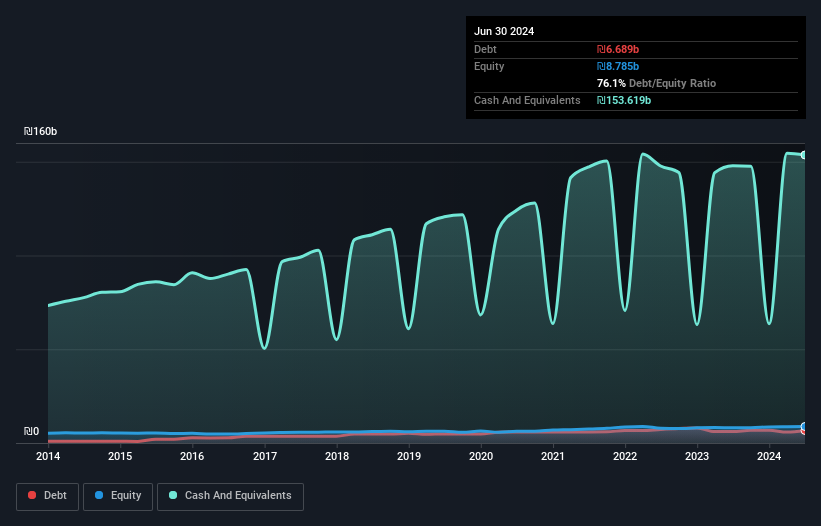

Operations: Migdal Insurance and Financial Holdings Ltd. generates revenue primarily from life insurance and long-term savings, contributing ₪22.79 billion, followed by health insurance at ₪2.26 billion, and automobile property insurance at ₪860.62 million. The company has a market cap of ₪5.14 billion and incurs costs across various segments impacting its net profit margin (%).

Migdal Insurance and Financial Holdings has demonstrated impressive earnings growth of 207.4% over the past year, significantly outpacing the insurance industry's 170%. The company's debt to equity ratio has improved from 77.1% to 76.1% over five years, indicating better financial health. Recent results show a strong turnaround with net income for Q2 at ILS 459.91 million compared to a loss of ILS 170.97 million last year, and basic earnings per share rising to ILS 0.43 from a loss of ILS 0.17 per share previously.

Next Steps

- Dive into all 4850 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bradespar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:BRAP3

Bradespar

Through its interest in VALE, operates as a mining company in the production of iron ore and pellets, and nickel in Brazil.

Flawless balance sheet, undervalued and pays a dividend.