Does Kulcs-Soft Számítástechnika Nyrt. (BUSE:KULCSSOFT) Have A Place In Your Dividend Stock Portfolio?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at Kulcs-Soft Számítástechnika Nyrt. (BUSE:KULCSSOFT) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

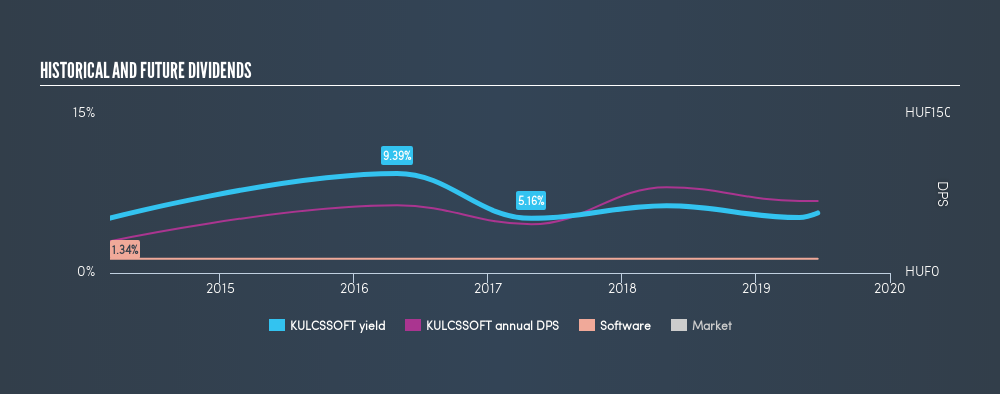

In this case, Kulcs-Soft Számítástechnika Nyrt likely looks attractive to dividend investors, given its 5.7% dividend yield and five-year payment history. It sure looks interesting on these metrics - but there's always more to the story . Some simple research can reduce the risk of buying Kulcs-Soft Számítástechnika Nyrt for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Kulcs-Soft Számítástechnika Nyrt paid out 103% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Kulcs-Soft Számítástechnika Nyrt paid out 106% of its free cash flow last year, which we think is concerning if cash flows do not improve. Cash is slightly more important than profit from a dividend perspective, but given Kulcs-Soft Számítástechnika Nyrt's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Remember, you can always get a snapshot of Kulcs-Soft Számítástechnika Nyrt's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the data, we can see that Kulcs-Soft Számítástechnika Nyrt has been paying a dividend for the past five years. During the past five-year period, the first annual payment was Ft30.00 in 2014, compared to Ft68.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 18% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Kulcs-Soft Számítástechnika Nyrt's earnings per share shrank slightly over the past year or so. We're not overly concerned about the drop in earnings per share in any given year, since there could be several reasons for this. Still, we generally prefer companies generating even modest growth. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Kulcs-Soft Számítástechnika Nyrt paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Earnings per share are down, and Kulcs-Soft Számítástechnika Nyrt's dividend has been cut at least once in the past, which is disappointing. Using these criteria, Kulcs-Soft Számítástechnika Nyrt looks quite suboptimal from a dividend investment perspective.

See if management have their own wealth at stake, by checking insider shareholdings in Kulcs-Soft Számítástechnika Nyrt stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BUSE:KULCSSOFT

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion