- Hungary

- /

- Real Estate

- /

- BUSE:GSPARK

Should You Be Adding Graphisoft Park SE Real Estate Development European (BUSE:GSPARK) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Graphisoft Park SE Real Estate Development European (BUSE:GSPARK). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Graphisoft Park SE Real Estate Development European

Graphisoft Park SE Real Estate Development European's Improving Profits

In the last three years Graphisoft Park SE Real Estate Development European's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Graphisoft Park SE Real Estate Development European has grown its trailing twelve month EPS from €1.72 to €1.81, in the last year. That's a modest gain of 5.4%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Graphisoft Park SE Real Estate Development European is growing revenues, and EBIT margins improved by 4.4 percentage points to 92%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

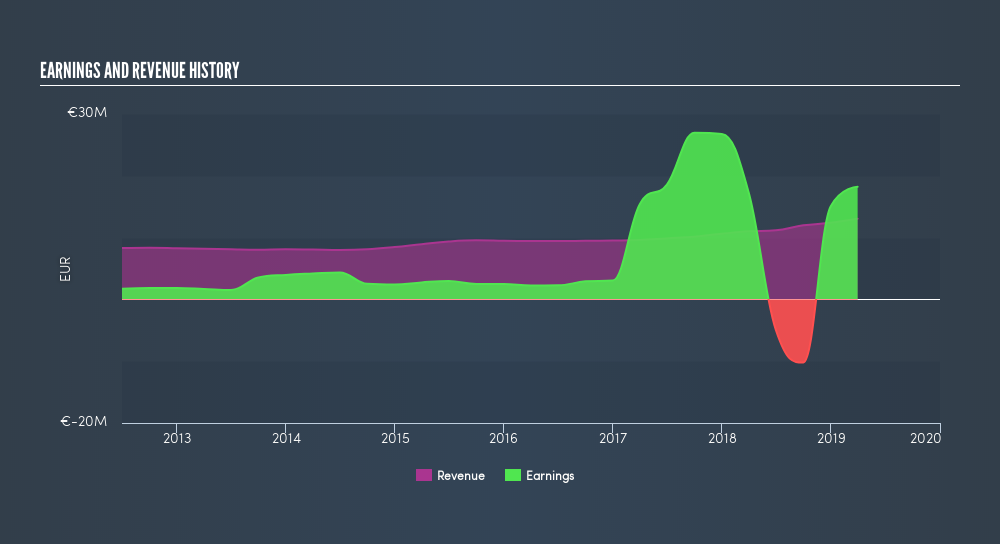

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Graphisoft Park SE Real Estate Development European is no giant, with a market capitalization of €36b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Graphisoft Park SE Real Estate Development European Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Graphisoft Park SE Real Estate Development European shares worth a considerable sum. Indeed, they hold €9.7b worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 27% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Graphisoft Park SE Real Estate Development European To Your Watchlist?

One positive for Graphisoft Park SE Real Estate Development European is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Of course, just because Graphisoft Park SE Real Estate Development European is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BUSE:GSPARK

Graphisoft Park SE Ingatlanfejleszto Európai Részvénytársaság

Engages in the real estate development and management activities in Hungary.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives