- Hungary

- /

- Real Estate

- /

- BUSE:GOPD

GOPD Nyilvánosan Muködo Részvénytársaság's (BUSE:GOPD) P/S Is Still On The Mark Following 96% Share Price Bounce

GOPD Nyilvánosan Muködo Részvénytársaság (BUSE:GOPD) shareholders would be excited to see that the share price has had a great month, posting a 96% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

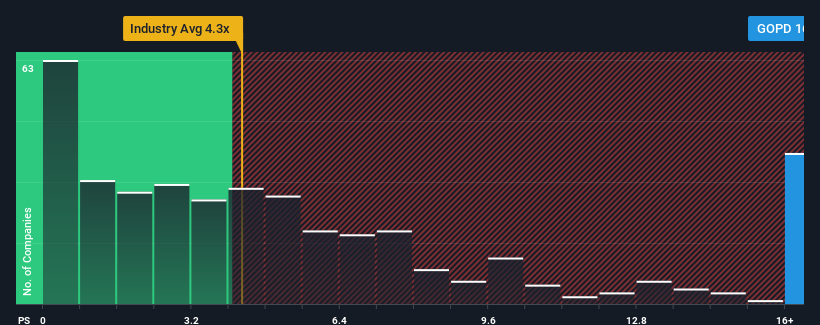

Following the firm bounce in price, given around half the companies in Hungary's Real Estate industry have price-to-sales ratios (or "P/S") below 3.9x, you may consider GOPD Nyilvánosan Muködo Részvénytársaság as a stock to avoid entirely with its 16.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for GOPD Nyilvánosan Muködo Részvénytársaság

How Has GOPD Nyilvánosan Muködo Részvénytársaság Performed Recently?

With revenue growth that's exceedingly strong of late, GOPD Nyilvánosan Muködo Részvénytársaság has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for GOPD Nyilvánosan Muködo Részvénytársaság, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like GOPD Nyilvánosan Muködo Részvénytársaság's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 78% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 4.5% shows it's a great look while it lasts.

In light of this, it's understandable that GOPD Nyilvánosan Muködo Részvénytársaság's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On GOPD Nyilvánosan Muködo Részvénytársaság's P/S

Shares in GOPD Nyilvánosan Muködo Részvénytársaság have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As detailed previously, the strength of GOPD Nyilvánosan Muködo Részvénytársaság's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

We don't want to rain on the parade too much, but we did also find 4 warning signs for GOPD Nyilvánosan Muködo Részvénytársaság (1 is potentially serious!) that you need to be mindful of.

If you're unsure about the strength of GOPD Nyilvánosan Muködo Részvénytársaság's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:GOPD

GOPD Nyilvánosan Muködo Részvénytársaság

Develops and sells real estate properties in Hungary.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives