Does Zwack Unicum Nyrt's (BUSE:ZWACK) Returns On Capital Reflect Well On The Business?

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. Having said that, after a brief look, Zwack Unicum Nyrt (BUSE:ZWACK) we aren't filled with optimism, but let's investigate further.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Zwack Unicum Nyrt:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

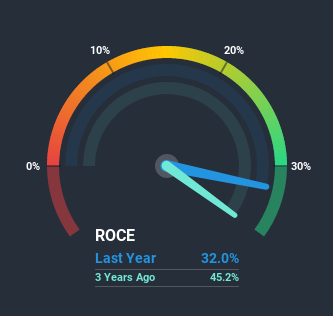

0.32 = Ft2.1b ÷ (Ft14b - Ft7.6b) (Based on the trailing twelve months to September 2020).

Thus, Zwack Unicum Nyrt has an ROCE of 32%. That's a fantastic return and not only that, it outpaces the average of 9.1% earned by companies in a similar industry.

See our latest analysis for Zwack Unicum Nyrt

Historical performance is a great place to start when researching a stock so above you can see the gauge for Zwack Unicum Nyrt's ROCE against it's prior returns. If you'd like to look at how Zwack Unicum Nyrt has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From Zwack Unicum Nyrt's ROCE Trend?

We are a bit worried about the trend of returns on capital at Zwack Unicum Nyrt. To be more specific, the ROCE was 42% five years ago, but since then it has dropped noticeably. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Zwack Unicum Nyrt to turn into a multi-bagger.

On a side note, Zwack Unicum Nyrt's current liabilities have increased over the last five years to 53% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.The Bottom Line On Zwack Unicum Nyrt's ROCE

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. In spite of that, the stock has delivered a 21% return to shareholders who held over the last five years. Regardless, we don't like the trends as they are and if they persist, we think you might find better investments elsewhere.

If you'd like to know about the risks facing Zwack Unicum Nyrt, we've discovered 1 warning sign that you should be aware of.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

If you decide to trade Zwack Unicum Nyrt, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zwack Unicum Nyrt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BUSE:ZWACK

Zwack Unicum Nyrt

Manufactures and sells alcoholic beverages in Hungary, Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives