- Hungary

- /

- Construction

- /

- BUSE:EPDUFERR

Market Might Still Lack Some Conviction On ÉPDUFERR Nyilvánosan Muködo Részvénytársaság (BUSE:EPDUFERR) Even After 49% Share Price Boost

ÉPDUFERR Nyilvánosan Muködo Részvénytársaság (BUSE:EPDUFERR) shareholders have had their patience rewarded with a 49% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 35%.

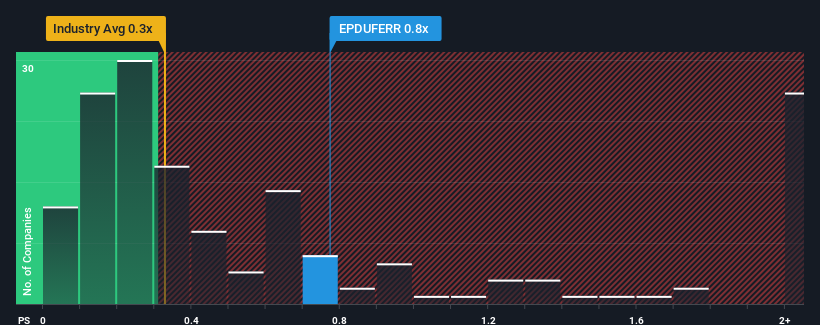

Although its price has surged higher, there still wouldn't be many who think ÉPDUFERR Nyilvánosan Muködo Részvénytársaság's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Hungary's Construction industry is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for ÉPDUFERR Nyilvánosan Muködo Részvénytársaság

How Has ÉPDUFERR Nyilvánosan Muködo Részvénytársaság Performed Recently?

For example, consider that ÉPDUFERR Nyilvánosan Muködo Részvénytársaság's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for ÉPDUFERR Nyilvánosan Muködo Részvénytársaság, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For ÉPDUFERR Nyilvánosan Muködo Részvénytársaság?

In order to justify its P/S ratio, ÉPDUFERR Nyilvánosan Muködo Részvénytársaság would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 5.1% decrease to the company's top line. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 3.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that ÉPDUFERR Nyilvánosan Muködo Részvénytársaság's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

ÉPDUFERR Nyilvánosan Muködo Részvénytársaság appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To our surprise, ÉPDUFERR Nyilvánosan Muködo Részvénytársaság revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for ÉPDUFERR Nyilvánosan Muködo Részvénytársaság that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ÉPDUFERR Nyilvánosan Muködo Részvénytársaság might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:EPDUFERR

ÉPDUFERR Nyilvánosan Muködo Részvénytársaság

Engages in the construction of residential and non-residential buildings in Hungary.

Slight with imperfect balance sheet.

Market Insights

Community Narratives