Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Luka Ploce d.d. (ZGSE:LKPC) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Luka Ploce d.d

What Is Luka Ploce d.d's Net Debt?

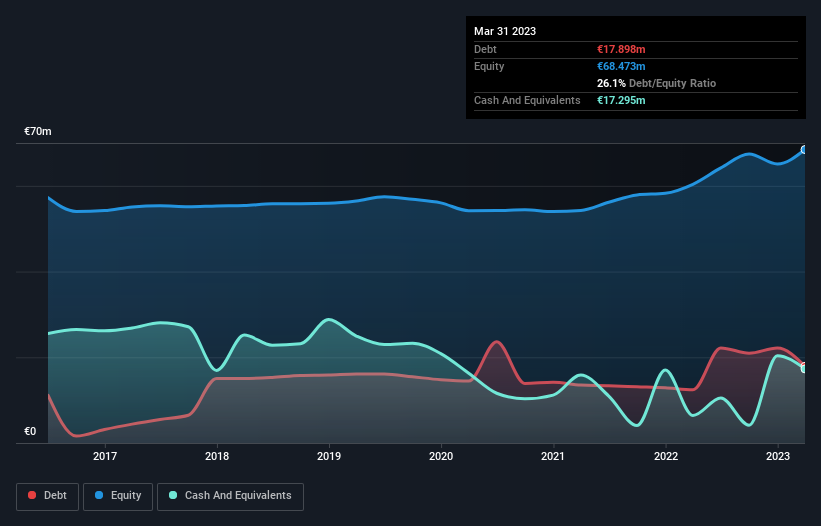

As you can see below, at the end of March 2023, Luka Ploce d.d had €17.9m of debt, up from €12.4m a year ago. Click the image for more detail. However, because it has a cash reserve of €17.3m, its net debt is less, at about €602.7k.

How Healthy Is Luka Ploce d.d's Balance Sheet?

The latest balance sheet data shows that Luka Ploce d.d had liabilities of €15.5m due within a year, and liabilities of €16.2m falling due after that. On the other hand, it had cash of €17.3m and €23.7m worth of receivables due within a year. So it actually has €9.30m more liquid assets than total liabilities.

This surplus suggests that Luka Ploce d.d is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Carrying virtually no net debt, Luka Ploce d.d has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Luka Ploce d.d has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.036 and EBIT of 22.6 times the interest expense. Indeed relative to its earnings its debt load seems light as a feather. On top of that, Luka Ploce d.d grew its EBIT by 100% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Luka Ploce d.d will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Luka Ploce d.d produced sturdy free cash flow equating to 69% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Luka Ploce d.d's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! We would also note that Infrastructure industry companies like Luka Ploce d.d commonly do use debt without problems. We think Luka Ploce d.d is no more beholden to its lenders, than the birds are to birdwatchers. For investing nerds like us its balance sheet is almost charming. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Luka Ploce d.d has 2 warning signs (and 1 which is significant) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:LKPC

Luka Ploce d.d

Provides port, warehousing, and wholesale and retail services in the Republic of Croatia.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives