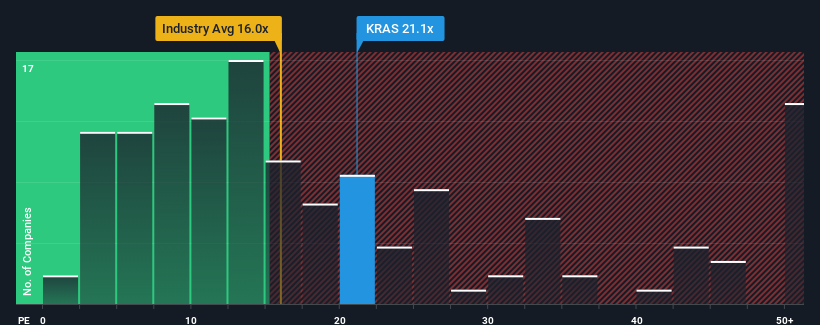

With a price-to-earnings (or "P/E") ratio of 21.1x Kras d.d. (ZGSE:KRAS) may be sending bearish signals at the moment, given that almost half of all companies in Croatia have P/E ratios under 15x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been quite advantageous for Kras d.d as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Kras d.d

Is There Enough Growth For Kras d.d?

Kras d.d's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 39%. The latest three year period has also seen an excellent 102% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 7.2% shows it's a great look while it lasts.

With this information, we can see why Kras d.d is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Kras d.d revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Kras d.d you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kras d.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:KRAS

Kras d.d

Engages in manufacture and sale of confectionery products in Croatia.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives