- Croatia

- /

- Oil and Gas

- /

- ZGSE:JNAF

Jadranski naftovod d.d (ZGSE:JNAF) Has Announced That It Will Be Increasing Its Dividend To €30.95

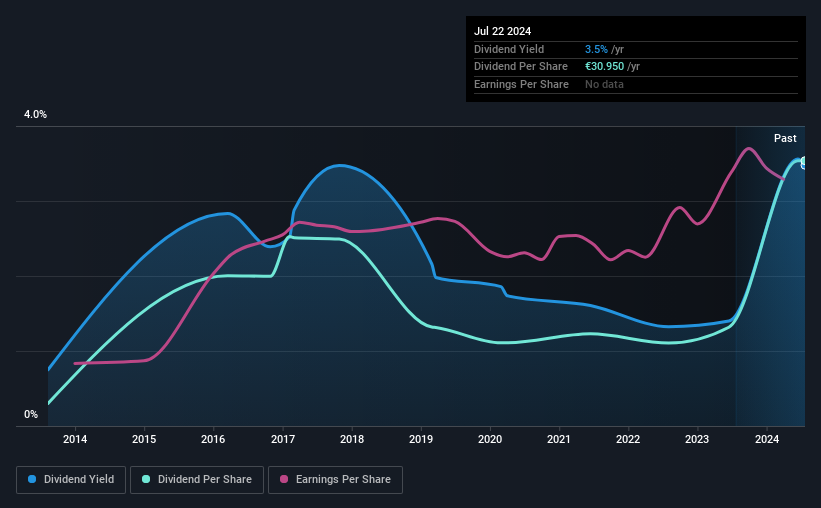

Jadranski naftovod d.d. (ZGSE:JNAF) will increase its dividend from last year's comparable payment on the 2nd of August to €30.95. Even though the dividend went up, the yield is still quite low at only 3.5%.

View our latest analysis for Jadranski naftovod d.d

Jadranski naftovod d.d's Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Based on the last payment, Jadranski naftovod d.d was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS could expand by 3.5% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 59% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was €2.64 in 2014, and the most recent fiscal year payment was €30.95. This works out to be a compound annual growth rate (CAGR) of approximately 28% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings per share has been crawling upwards at 3.5% per year. Growth of 3.5% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This could mean the dividend doesn't have the growth potential we look for going into the future.

Our Thoughts On Jadranski naftovod d.d's Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 2 warning signs for Jadranski naftovod d.d you should be aware of, and 1 of them is a bit unpleasant. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ZGSE:JNAF

Jadranski naftovod d.d

Engages in the transport and storage of crude oil and petroleum products in the Republic of Croatia and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.