- Croatia

- /

- Hospitality

- /

- ZGSE:LRH

Optimistic Investors Push Liburnia Riviera Hoteli d.d. (ZGSE:LRH) Shares Up 62% But Growth Is Lacking

Liburnia Riviera Hoteli d.d. (ZGSE:LRH) shareholders would be excited to see that the share price has had a great month, posting a 62% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

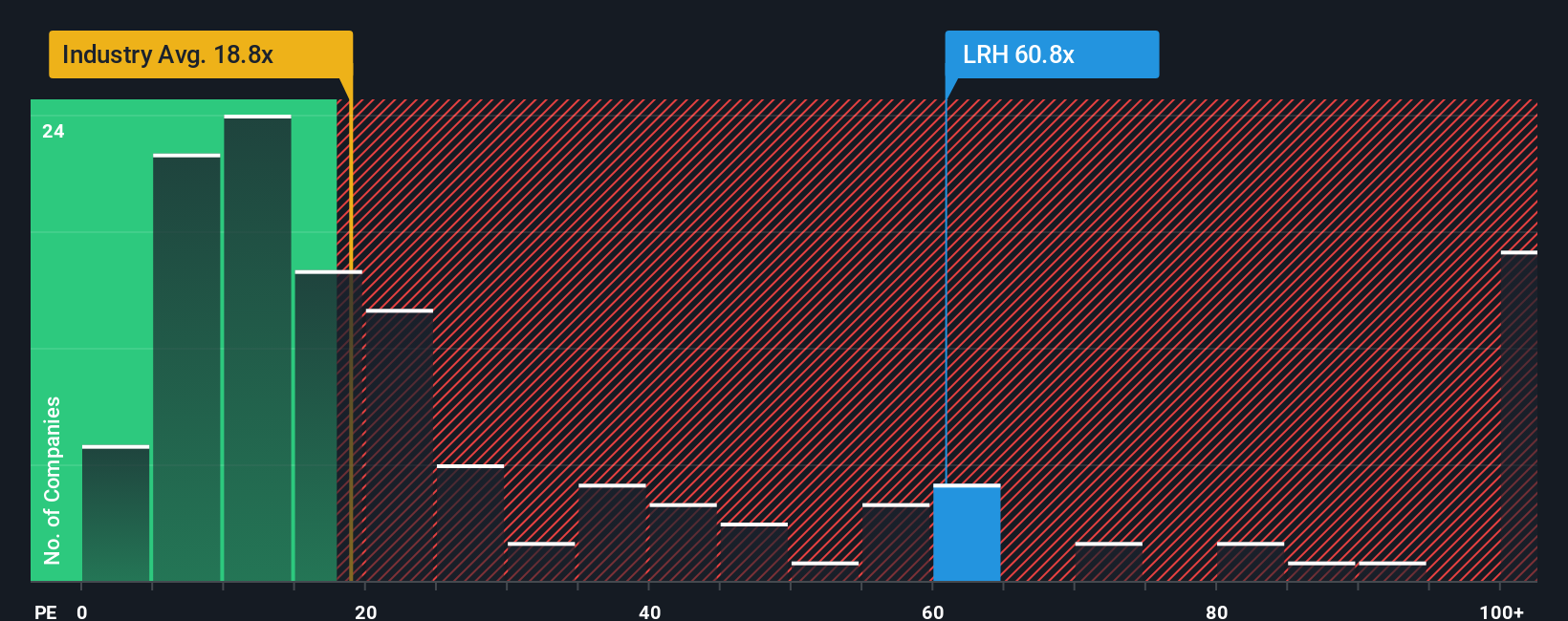

Since its price has surged higher, Liburnia Riviera Hoteli d.d may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 60.8x, since almost half of all companies in Croatia have P/E ratios under 15x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, Liburnia Riviera Hoteli d.d's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Liburnia Riviera Hoteli d.d

How Is Liburnia Riviera Hoteli d.d's Growth Trending?

Liburnia Riviera Hoteli d.d's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.9%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Liburnia Riviera Hoteli d.d is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Liburnia Riviera Hoteli d.d's P/E?

The strong share price surge has got Liburnia Riviera Hoteli d.d's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Liburnia Riviera Hoteli d.d currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Liburnia Riviera Hoteli d.d you should be aware of, and 2 of them are potentially serious.

Of course, you might also be able to find a better stock than Liburnia Riviera Hoteli d.d. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:LRH

Liburnia Riviera Hoteli d.d

Provides accommodation and hospitality services in Croatia, Germany, Austria, Italy, Hungary, Slovenia, Ukraine, Czech, other European countries, and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives