- Croatia

- /

- Hospitality

- /

- ZGSE:LRH

Liburnia Riviera Hoteli d.d.'s (ZGSE:LRH) Revenues Are Not Doing Enough For Some Investors

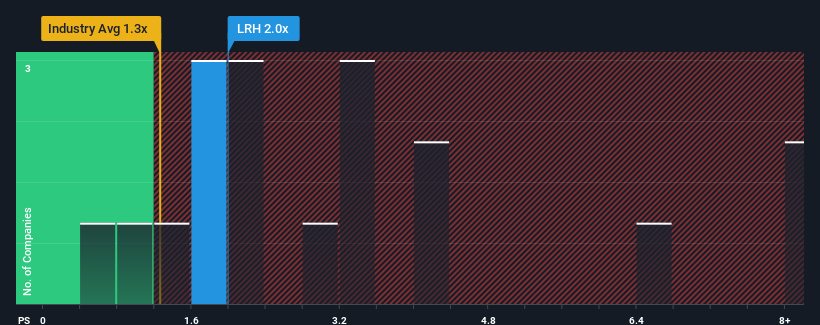

When you see that almost half of the companies in the Hospitality industry in Croatia have price-to-sales ratios (or "P/S") above 2.8x, Liburnia Riviera Hoteli d.d. (ZGSE:LRH) looks to be giving off some buy signals with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Liburnia Riviera Hoteli d.d

What Does Liburnia Riviera Hoteli d.d's P/S Mean For Shareholders?

Liburnia Riviera Hoteli d.d certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Liburnia Riviera Hoteli d.d will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Liburnia Riviera Hoteli d.d would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. The latest three year period has also seen a 18% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 82% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Liburnia Riviera Hoteli d.d is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Liburnia Riviera Hoteli d.d's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Liburnia Riviera Hoteli d.d revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Liburnia Riviera Hoteli d.d (1 doesn't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on Liburnia Riviera Hoteli d.d, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:LRH

Liburnia Riviera Hoteli d.d

Provides accommodation and hospitality services in Croatia, Germany, Austria, Italy, Hungary, Slovenia, Ukraine, Czech, other European countries, and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives