- Croatia

- /

- Hospitality

- /

- ZGSE:LRH

After Leaping 27% Liburnia Riviera Hoteli d.d. (ZGSE:LRH) Shares Are Not Flying Under The Radar

Liburnia Riviera Hoteli d.d. (ZGSE:LRH) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 97%.

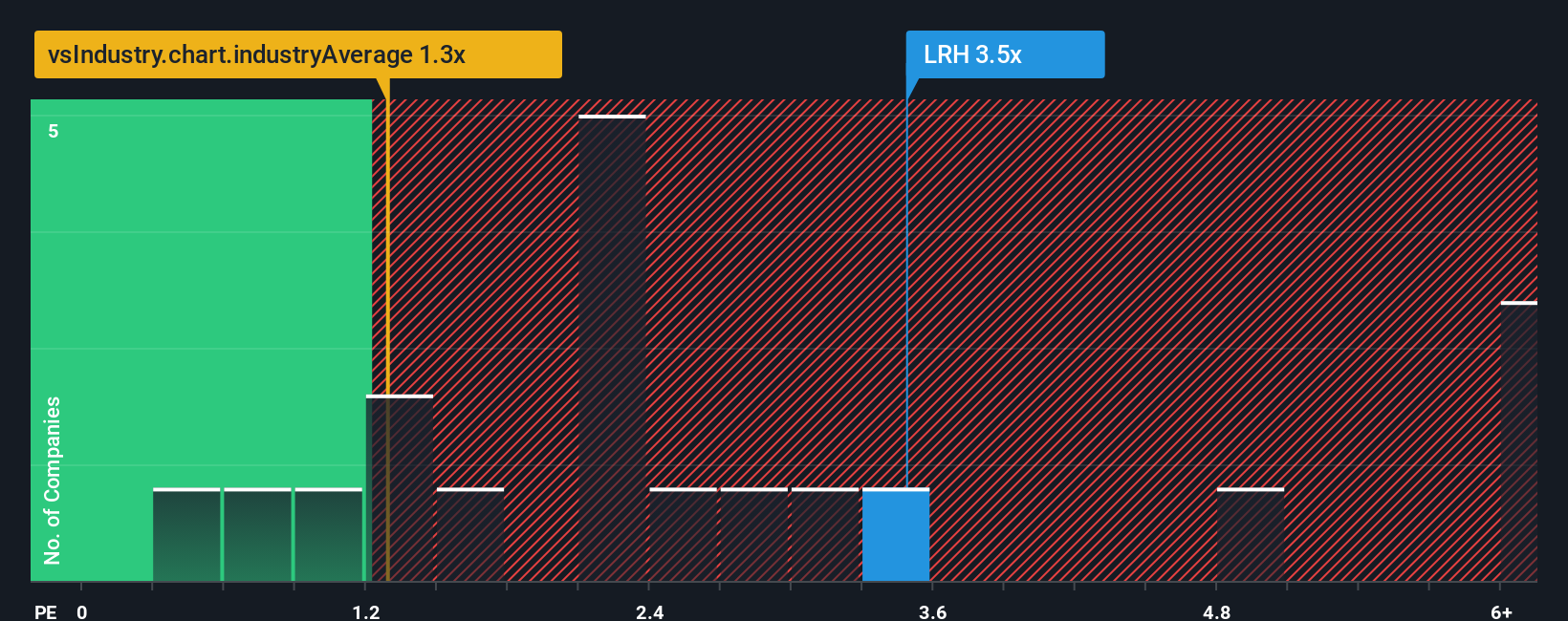

Since its price has surged higher, you could be forgiven for thinking Liburnia Riviera Hoteli d.d is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in Croatia's Hospitality industry have P/S ratios below 2.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Liburnia Riviera Hoteli d.d

What Does Liburnia Riviera Hoteli d.d's Recent Performance Look Like?

The recent revenue growth at Liburnia Riviera Hoteli d.d would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Liburnia Riviera Hoteli d.d will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

Liburnia Riviera Hoteli d.d's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.4%. This was backed up an excellent period prior to see revenue up by 95% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is only predicted to deliver 7.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Liburnia Riviera Hoteli d.d's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Liburnia Riviera Hoteli d.d's P/S Mean For Investors?

Liburnia Riviera Hoteli d.d shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Liburnia Riviera Hoteli d.d maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 2 warning signs for Liburnia Riviera Hoteli d.d (1 doesn't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:LRH

Liburnia Riviera Hoteli d.d

Provides accommodation and hospitality services in Croatia, Germany, Austria, Italy, Hungary, Slovenia, Ukraine, Czech, other European countries, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives