- Croatia

- /

- Construction

- /

- ZGSE:DLKV

These 4 Measures Indicate That Dalekovod d.d (ZGSE:DLKV) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Dalekovod d.d. (ZGSE:DLKV) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Dalekovod d.d

What Is Dalekovod d.d's Net Debt?

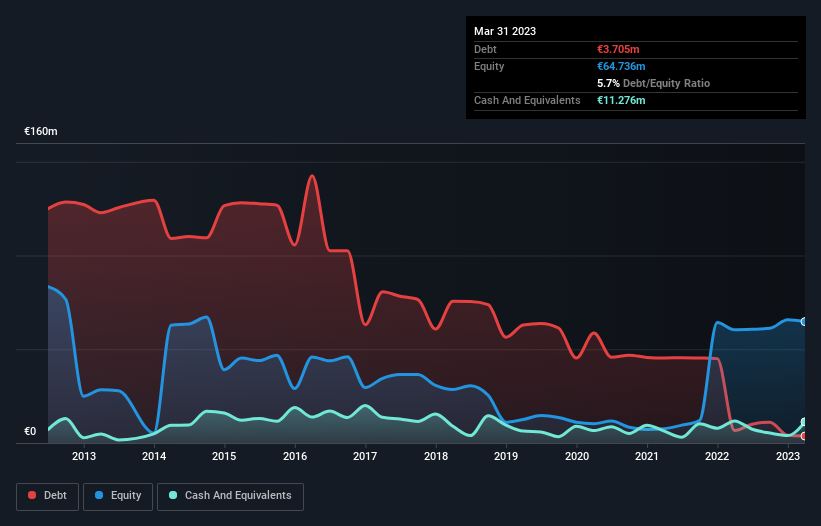

The image below, which you can click on for greater detail, shows that Dalekovod d.d had debt of €3.71m at the end of March 2023, a reduction from €6.63m over a year. But it also has €11.3m in cash to offset that, meaning it has €7.57m net cash.

A Look At Dalekovod d.d's Liabilities

According to the last reported balance sheet, Dalekovod d.d had liabilities of €52.9m due within 12 months, and liabilities of €8.72m due beyond 12 months. Offsetting this, it had €11.3m in cash and €61.1m in receivables that were due within 12 months. So it can boast €10.7m more liquid assets than total liabilities.

This surplus suggests that Dalekovod d.d has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Dalekovod d.d has more cash than debt is arguably a good indication that it can manage its debt safely.

Pleasingly, Dalekovod d.d is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 228% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Dalekovod d.d will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Dalekovod d.d has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Dalekovod d.d saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

While it is always sensible to investigate a company's debt, in this case Dalekovod d.d has €7.57m in net cash and a decent-looking balance sheet. And we liked the look of last year's 228% year-on-year EBIT growth. So we don't have any problem with Dalekovod d.d's use of debt. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Dalekovod d.d's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:DLKV

Dalekovod d.d

Engages in the design, engineering, production, construction, and installation of electric power facilities, facilities for road, railroad and mass transit, and telecommunication infrastructure in Croatia, Sweden, Norway, Slovenia, Germany, Ukraine, the United Kingdom, Northern Macedonia, Bosnia and Herzegovina, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026