Ðuro Ðakovic Grupa d.d. (ZGSE:DDJH) Stocks Shoot Up 39% But Its P/S Still Looks Reasonable

Despite an already strong run, Ðuro Ðakovic Grupa d.d. (ZGSE:DDJH) shares have been powering on, with a gain of 39% in the last thirty days. The annual gain comes to 174% following the latest surge, making investors sit up and take notice.

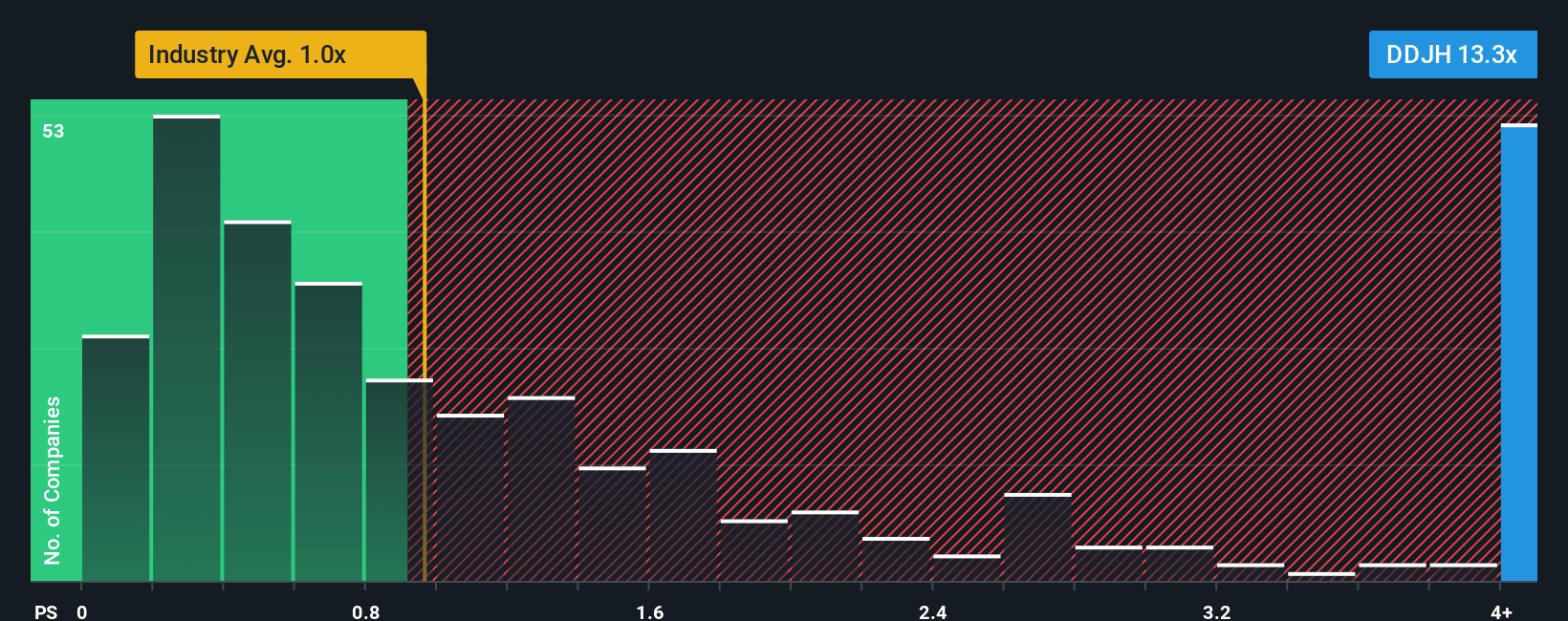

Since its price has surged higher, when almost half of the companies in Croatia's Machinery industry have price-to-sales ratios (or "P/S") below 1x, you may consider Ðuro Ðakovic Grupa d.d as a stock not worth researching with its 13.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Ðuro Ðakovic Grupa d.d

What Does Ðuro Ðakovic Grupa d.d's P/S Mean For Shareholders?

Ðuro Ðakovic Grupa d.d certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Ðuro Ðakovic Grupa d.d, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ðuro Ðakovic Grupa d.d's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 177% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.3% shows it's noticeably more attractive.

With this information, we can see why Ðuro Ðakovic Grupa d.d is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

The strong share price surge has lead to Ðuro Ðakovic Grupa d.d's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ðuro Ðakovic Grupa d.d maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ðuro Ðakovic Grupa d.d you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:DDJH

Ðuro Ðakovic Grupa d.d

Engages in defense, transport, industry, and energy businesses in Croatia and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives