- Croatia

- /

- Auto Components

- /

- ZGSE:ADPL

AD Plastik d.d.'s (ZGSE:ADPL) Shares Leap 27% Yet They're Still Not Telling The Full Story

AD Plastik d.d. (ZGSE:ADPL) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

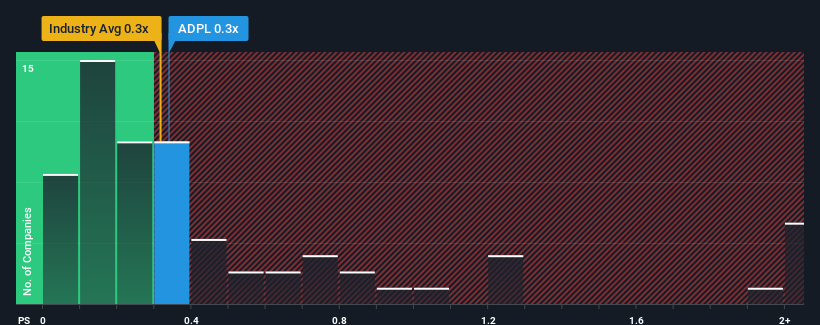

Although its price has surged higher, it's still not a stretch to say that AD Plastik d.d's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Auto Components industry in Croatia, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for AD Plastik d.d

What Does AD Plastik d.d's Recent Performance Look Like?

Recent times have been pleasing for AD Plastik d.d as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on AD Plastik d.d will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AD Plastik d.d.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like AD Plastik d.d's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. Still, revenue has fallen 11% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 6.3% over the next year. With the industry only predicted to deliver 3.2%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that AD Plastik d.d is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

AD Plastik d.d appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, AD Plastik d.d's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for AD Plastik d.d you should be aware of, and 2 of them are significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:ADPL

AD Plastik d.d

Develops, produces, and sells interior and exterior automotive components in Slovenia, Romania, Russia, France, Hungary, Italy, the United Kingdom, Germany, Spain, Serbia, Czech Republic, Vietnam, Slovakia, Croatia, Poland, the United States, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives