- Hong Kong

- /

- Renewable Energy

- /

- SEHK:987

Did Changing Sentiment Drive China Renewable Energy Investment's Share Price Down A Worrying 52%?

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in China Renewable Energy Investment Limited (HKG:987), since the last five years saw the share price fall 52%.

Check out our latest analysis for China Renewable Energy Investment

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

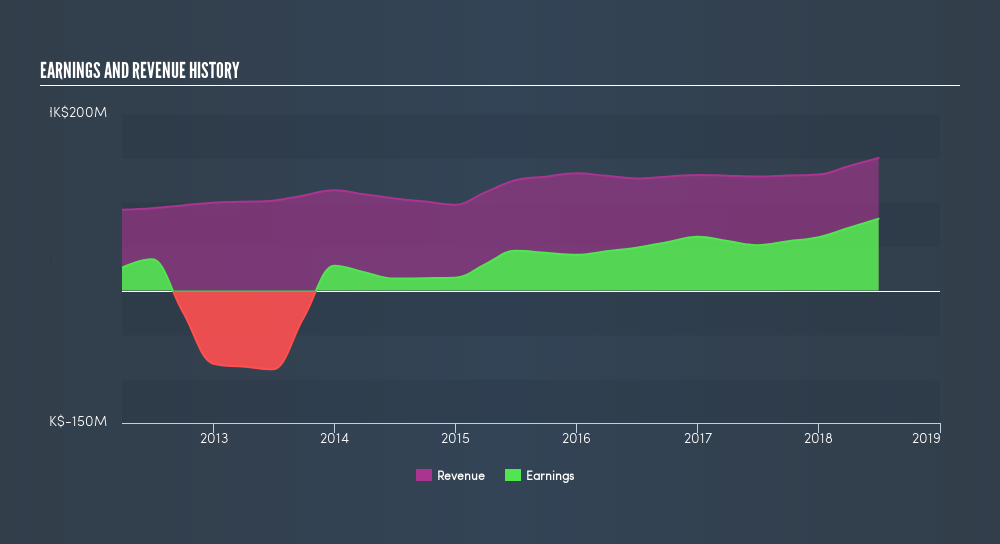

During five years of share price growth, China Renewable Energy Investment moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 6.6% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for China Renewable Energy Investment the TSR over the last 5 years was -49%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that China Renewable Energy Investment shareholders have received a total shareholder return of 7.2% over the last year. That's including the dividend. Notably the five-year annualised TSR loss of 13% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of China Renewable Energy Investment by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:987

China Renewable Energy Investment

An investment holding company, engages in the renewable energy business in the People’s Republic of China and Hong Kong.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives