- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1184

SEHK Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets and deepening trade tensions, Hong Kong's market dynamics offer a unique landscape for investors eyeing dividend stocks in July 2024. In such an environment, selecting stocks with consistent dividend payouts can provide an anchor of stability and potential passive income.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Construction Bank (SEHK:939) | 7.83% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.38% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.72% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 9.54% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.11% | ★★★★★☆ |

| Shougang Fushan Resources Group (SEHK:639) | 10.00% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.26% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.33% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.32% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.04% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top SEHK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

S.A.S. Dragon Holdings (SEHK:1184)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S.A.S. Dragon Holdings Limited operates as an investment holding company, specializing in the distribution of electronic components and semiconductor products across regions including Hong Kong, Mainland China, Taiwan, the USA, Vietnam, Singapore, and Macao with a market cap of approximately HK$2.40 billion.

Operations: S.A.S. Dragon Holdings Limited generates revenue primarily through the distribution of electronic components and semiconductor products, amounting to HK$22.37 billion.

Dividend Yield: 9.1%

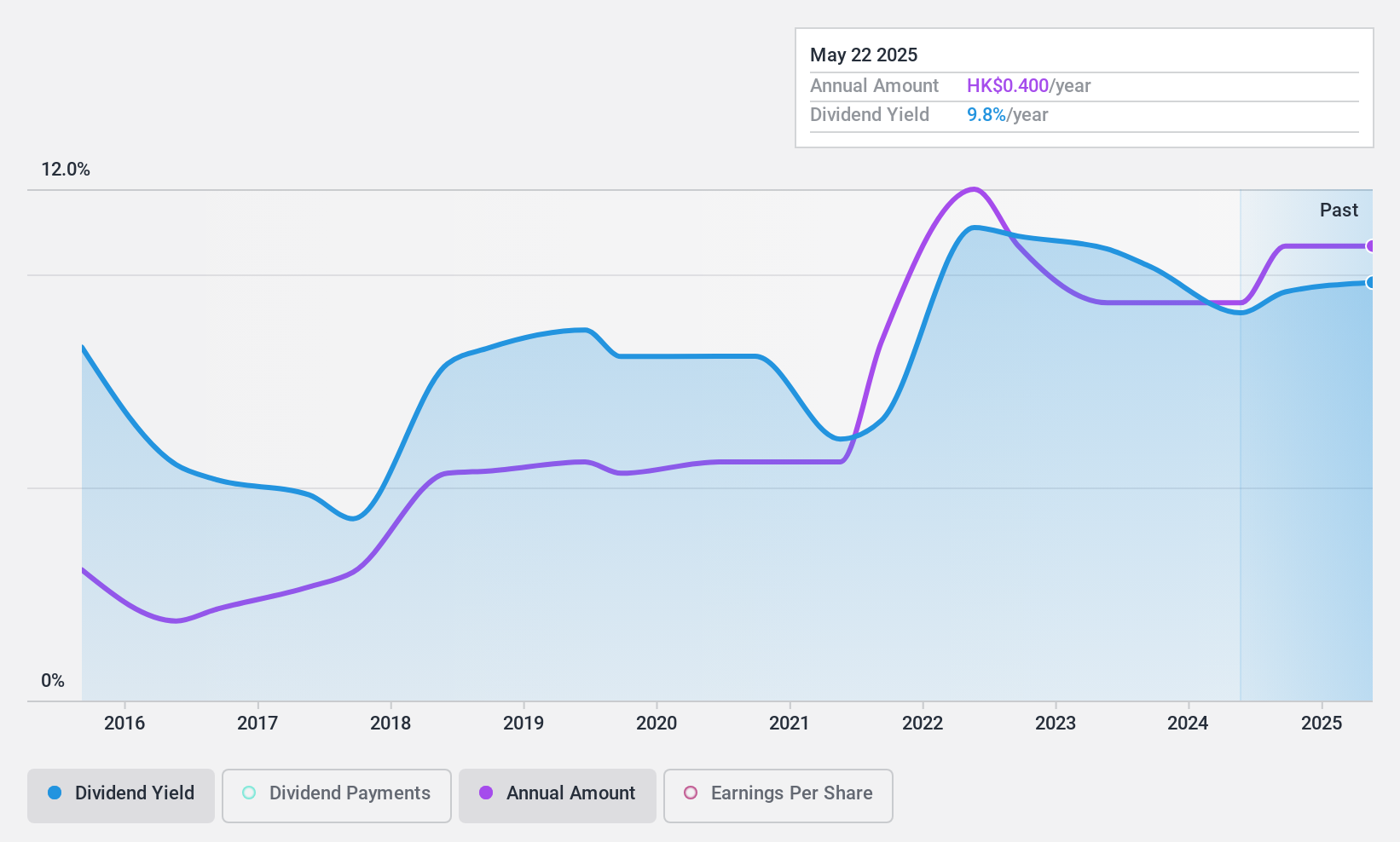

S.A.S. Dragon Holdings, with a dividend yield of 9.11%, ranks in the top 25% of Hong Kong dividend payers. The company's dividends appear sustainable, backed by a payout ratio of 54.2% and a cash payout ratio of just 21.2%. Despite this strong coverage, the firm has experienced volatility in its dividend payments over the past decade, indicating some level of unpredictability in returns to shareholders. On May 22, 2024, it declared a final dividend of HK$0.25 per share for the year ended December 31, 2023.

- Navigate through the intricacies of S.A.S. Dragon Holdings with our comprehensive dividend report here.

- The valuation report we've compiled suggests that S.A.S. Dragon Holdings' current price could be quite moderate.

Best Pacific International Holdings (SEHK:2111)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Best Pacific International Holdings Limited operates in the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace, with a market capitalization of approximately HK$2.34 billion.

Operations: Best Pacific International Holdings Limited generates revenue primarily through two segments: HK$834.34 million from the manufacturing and trading of elastic webbing, and HK$3.37 billion from the manufacturing and trading of elastic fabric and lace.

Dividend Yield: 7.4%

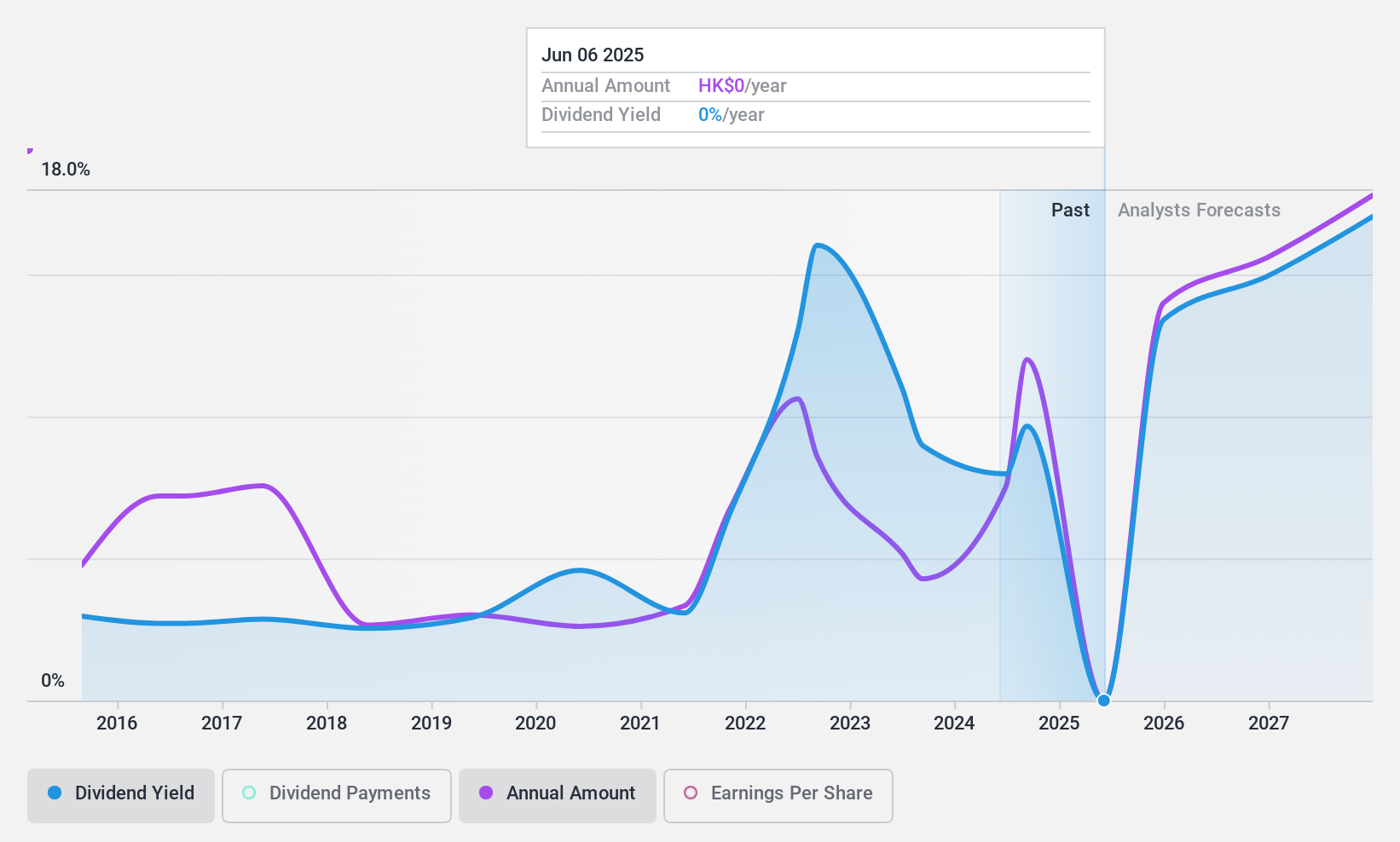

Best Pacific International Holdings recently projected a significant profit increase to HK$260 million for HY 2024, nearly doubling from HK$138.6 million in HY 2023, indicating improved financial health. Despite this growth, the company's dividend yield remains modest at 7.41%, lower than the top Hong Kong dividend payers. The dividends are well-covered by earnings and cash flows, with a payout ratio of 50% and a cash payout ratio of 23.9%. However, its dividend history shows instability over the past decade, which could concern consistent income seekers.

- Get an in-depth perspective on Best Pacific International Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report Best Pacific International Holdings implies its share price may be lower than expected.

Tianjin Development Holdings (SEHK:882)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianjin Development Holdings Limited operates in the People's Republic of China, primarily supplying water, heat, thermal power, and electricity to various customers in the Tianjin Economic and Technological Development Area, with a market capitalization of approximately HK$1.99 billion.

Operations: Tianjin Development Holdings Limited generates revenue primarily from its utilities segment (HK$1.60 billion), pharmaceuticals (HK$1.44 billion), followed by hotel operations (HK$130.38 million) and electrical and mechanical services (HK$166.77 million).

Dividend Yield: 6.6%

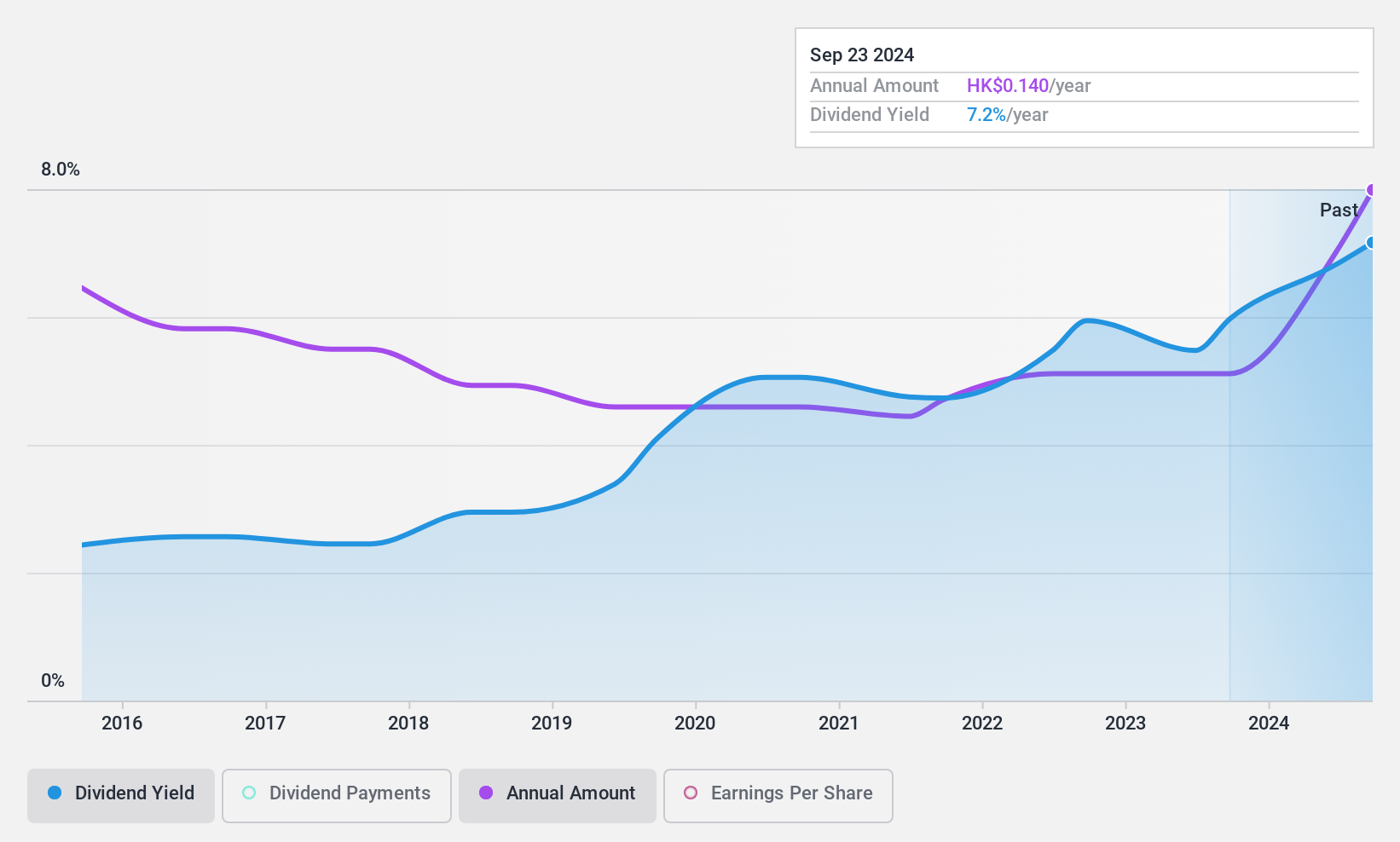

Tianjin Development Holdings recently declared an increased dividend of 8.80 Hong Kong cents per share, reflecting a commitment to shareholder returns despite challenges in covering these payments with earnings and free cash flows. Over the past year, earnings surged by 77.5%, yet the company's dividend yield of 6.59% trails behind top Hong Kong payers. The adoption of new Articles of Association could signal strategic shifts aiming to enhance governance and potentially financial stability.

- Unlock comprehensive insights into our analysis of Tianjin Development Holdings stock in this dividend report.

- In light of our recent valuation report, it seems possible that Tianjin Development Holdings is trading behind its estimated value.

Key Takeaways

- Investigate our full lineup of 89 Top SEHK Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1184

S.A.S. Dragon Holdings

An investment holding company, provides electronic supply chain services in Hong Kong, Mainland China, Taiwan, the United States, Vietnam, Singapore, Macao, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives