- Hong Kong

- /

- Renewable Energy

- /

- SEHK:836

China Resources Power Holdings Company Limited's (HKG:836) Shares Not Telling The Full Story

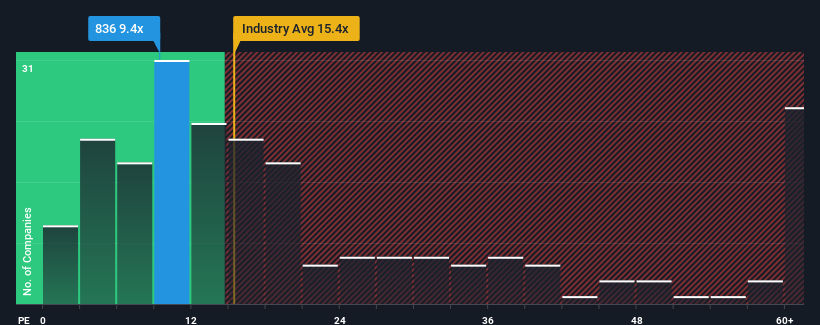

It's not a stretch to say that China Resources Power Holdings Company Limited's (HKG:836) price-to-earnings (or "P/E") ratio of 9.4x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, China Resources Power Holdings has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for China Resources Power Holdings

How Is China Resources Power Holdings' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like China Resources Power Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 56% last year. The latest three year period has also seen an excellent 45% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 20% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 15% per annum, which is noticeably less attractive.

With this information, we find it interesting that China Resources Power Holdings is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From China Resources Power Holdings' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that China Resources Power Holdings currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with China Resources Power Holdings (including 1 which is potentially serious).

Of course, you might also be able to find a better stock than China Resources Power Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:836

China Resources Power Holdings

An investment holding company, invests in, develops, operates, and manages power plants and coal mines in the People’s Republic of China.

Undervalued with solid track record.

Market Insights

Community Narratives